Exits, 11/14/2025

How we did during a brutal week.

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Product.

None

Options

Put spread on CoreWeave (CRWV). Entered at a $1.85 credit as part of a 4-leg combo on 11/4/2025; effectively exited at a $7.05 debit on 11/13/2025 via assignment of the $118 put, sale of the assigned shares at $81.40, and sale of the $113 put at $27.70.

Loss: 141% of max risk *(~381% of premium collected).1

Put spread on Astera Labs (ALAB). Entered at a net credit of $4.47 as part of a 4-leg combo on 09/24/2025; effectively exited at a net debit of $11.18 on 11/14/2025 via assignment of the $230 put, sale of the assigned shares at $147, and sale of the $220 put at $71.82. Loss: 121% of max risk (150% of premium collected).2

Put spread on Oklo (OKLO). Entered at a net credit of $1.91 as part of a 4-leg combo on 10/24/2025; effectively exited at a net debit of $5.00 on 11/14/2025 via expiration at max loss.

Loss: 100% of max risk (~162% of premium collected).

Put spread on Nebius (NBIS). Entered at a net credit of $2.63 as part of a 4-leg combo on 11/4/2025; exited at a net debit of $5.00 on 11/14/2025. Loss: 100% of max risk (~90% of premium collected).

Put spread on Sezzle (SEZL). Entered at a net credit of $1.56 as part of a 4-leg combo on 8/14/2025; effectively exited at a net debit of $4.90 on 11/14/2025 via assignment of the $90 put, sale of the assigned shares at $53.10, and sale of the $85 put at $32.

Loss: 97% of max risk (214% of premium collected).

Put spread on Oklo (OKLO). Entered at a net credit of $1.01 as part of a 4-leg combo on 11/6/2025; exited at a net debit of $4.60 on 11/14/2025.

Loss: 90% of max risk (~355% of premium collected).

Put spread on Clearpoint Neuro (CLPT). Entered at a net credit of $0.98 credit as part of a 4-leg combo on 10/3/2025; effectively exited at a $4.43 debit on 11/13/2025 via assignment of the $30 put, sale of the assigned shares at $16.22, and sale of the $25 put at $9.35.

Loss: 86% of max risk (~352% of premium collected).

Put spread on Axon Enterprise (AXON). Entered at a net credit of $4.48 as part of a 4-leg combo on 9/10/2025; effectively exited at a net debit of $8.50 on 11/14/2025 via assignment of the $730 put, sale of the assigned shares at $562.50, and sale of the $720 put at $159.

Loss: 73% of max risk (~90% of premium collected).

Put spread on Sea (SE). Entered at a net credit of $1.49 as part of a 4-leg combo on 10/14/2025; effectively exited at a net debit of $3.86 on 11/14/2025 via assignment of the $180 put, sale of the assigned shares at $139.14, and sale of the $175 put at $37.

Loss: 68% of max risk (159% of premium collected).

Put spread on Sibanye Stillwater (SBSW).

Entered at a net credit of $0.27 as part of a 3-leg combo on 10/20/2025; exited at a net debit of $0.15 on 11/10/2025.

Profit: 44% on premium collected (~7% on max risk).Put spread on ZIM Integrated Shipping (ZIM).

Entered at a net credit of $0.53 as part of a 3-leg combo on 09/22/2025; exited at a net debit of $0.20 on 11/13/2025.Profit: 62% on premium collected (~22% on max risk).

Put spread on CorMedix (CRMD).

Entered at a net credit of $0.62 as part of a 3-leg combo on 11/07/2025; exited at a net debit of $0.20 on 11/12/2025.

Profit: 68% on premium collected (~30% on max risk).Put spread on Ondas Holdings (ONDS). Entered at a net credit of $0.53 as part of a 3-leg combo on 10/24/2025; exited at a net debit of $0.15 on 11/14/2025.

Profit: 72% on premium collected (~39% on max risk).

Calls on SkyWater Technology (SKYT).

Bought for $4, as part of a 3-leg combo on 10/31/2025; sold (half) at $6.50 on 11/10/2025.

Profit: 63% (~53% on max risk).Put spread on Argan (AGX). Entered at a $1.87 net credit as part of a 4-leg combo on 9/11/2025; exited at a $0.20 net debit on 11/13/2025.

Profit: 89% on premium collected (~53% of max risk).

Put spread on Lemonade (LMND).

Entered at a net credit of $2.96 as part of a 4-leg combo on 8/22/2025; exited at a net debit of $0.25 on 11/12/2025.Profit: 92% on premium collected (~133% on max risk).

Put spread on Halozyme Therapeutics (HALO). Entered at a $6.40 credit on 5/13/2025; exited at a $0.30 debit on 11/13/2025.

Profit: 95% on premium collected (~169% of max risk).

Calls on TechnipFMC (FTI).

Bought for $2.57, as part of a 3-leg combo on 10/9/2025; sold (half) at $5 on 11/10/2025.Profit: 95% (~53% on max risk).

3-leg combo on Treehouse Foods (THS 0.87%↑).

Entered at a net debit of $0.96 on 9/29/2025; exited the put spread at a net debit of $0.20 on 11/10/2025; exited the calls at $3.40 on 11/11/2025.

Profit: 233% on premium collected (~64% on max risk).4-leg combo on Mueller Industries (MLI).

Entered at a net debit of $1.45 on 10/9/2025; exited the put spread at a net debit of $0.20 on 11/10/2025, and exited the call spread at a net credit of $8.00 on 11/12/2025.

Profit: 438% (~438% on max risk).

This loss exceeded the theoretical max risk because I sold the long $113 put first while CRWV was still trading above $84, and only afterward sold the assigned shares—by which time the stock had dropped several dollars. That brief window of being unintentionally long the stock pushed the realized loss past the vertical’s defined max risk. Going forward, when a short put in a deep in-the-money floor is assigned near expiration, the cleaner approach is to eliminate that path risk by exercising the long put.

This loss also ended up exceeding the theoretical max risk, but for a different reason. In this case I did sell the assigned shares first and then closed the long $220 put, but by trading out of the floor in separate legs rather than exercising the long put, I was still exposed to path risk in the option’s price. With a deep in-the-money floor close to expiration, the more robust approach—one I plan to use going forward—is to exercise the long put after assignment. That locks in the defined max loss of the vertical spread and removes the risk that stock or option price movements between legs push the realized loss beyond max risk.

Comments

Stocks or Exchange Traded Product.

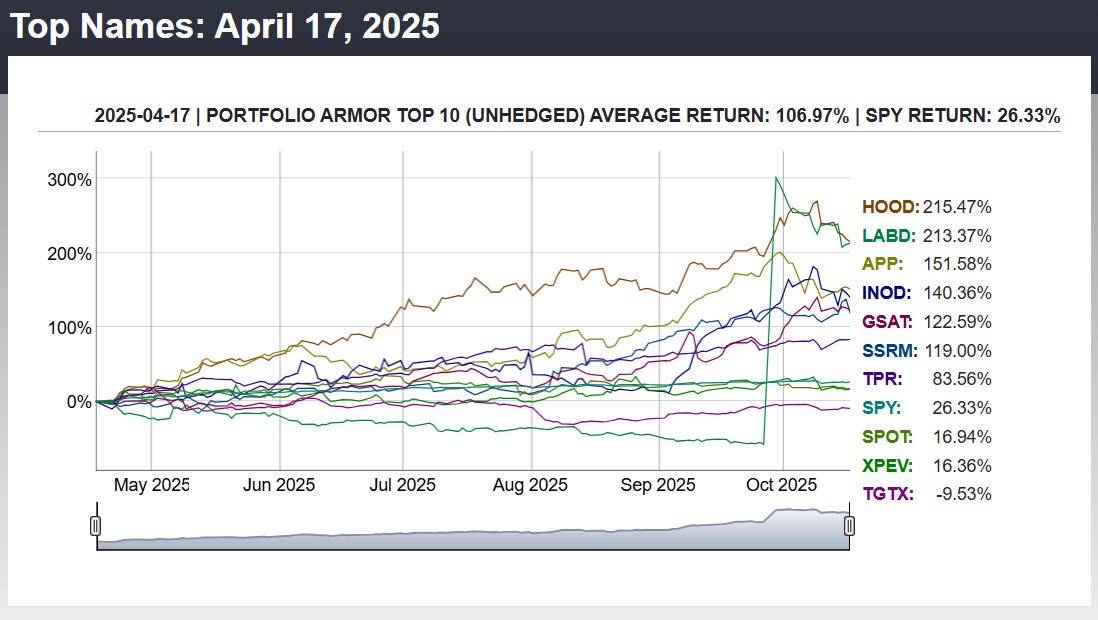

No exits this week, as I haven’t followed our basic strategy (formerly known as our core strategy) of buying shares of PA top names in a while, but have been placing options trades on them instead. Nevertheless, our top names have continued their strong performance, as you can see in last night’s update.

Options

This was one of the roughest weeks we’ve seen in months, with momentum names selling off far more sharply than the indices. I had considered using the Portfolio Armor iPhone app to hedge broad market risk with optimal QQQ puts ahead of November’s cluster of expirations, but even that probably wouldn’t have helped much—this pullback wasn’t led by the index. It was led by the very momentum names that had been driving the tape higher, and those sold off disproportionately hard.

On the positive side, half of our exits this week were still profitable, despite the backdrop. And the sharp pullback gave us entries into a slate of attractive new names at far better prices than we usually get. Historically, when stocks appear in Portfolio Armor’s Top Names during a correction—especially the more violent ones—they can produce equally violent rebounds once the selling pressure exhausts itself.

We structured the new trades with tenors reaching well into next year, giving the call legs time to benefit even if the current correction lingers. And we have a major catalyst on deck: Nvidia reports earnings next week. If NVDA confirms that the AI buildout is still in full swing—and especially if it guides confidently for 2026—that should go a long way toward stabilizing sentiment. A strong report would be a tailwind not just for AI names but also for the broader ecosystem feeding them: energy, materials, REIT-like power infrastructure, picks-and-shovels names, and industrial suppliers.

So while the tape was unforgiving this week, the overall playbook hasn’t changed: defined risk, financed upside, and asymmetric positioning into high-quality themes with catalysts ahead. If history is any guide (see the performance of our system’s top ten names selected during last spring’s correction over the subsequent six months below), weeks like this one are often where some of the best trades begin.