Trade Alert: Pharma Panic

Bullish options trades on a midcap plummeting today, and one on a moonshot.

The Pharma Panic Yesterday That Wasn’t…

After President Trump announced on Sunday that he’d be signing an executive order on drug pricing on Monday, I expected pharma stocks to open in the red. But the relief rally from the 90-day truce in the U.S.-China tariff war lifted even pharma names.

…But Was Today

At least in one name, the “Company A”, I had written this stock before today:

Company A

This is a biotech stock with the following ratings via Chartmill (these are all on a 0-10 scale, except for the Piotroski F-Score, which is on a 0-9 scale, with 9 being the best).

Overall technical: 10

Overall fundamental: 8

Profitability: 8

Health: 8

Growth: 8

Valuation: 9

F-Score: 9

This stock beat on top and bottom lines when it reported its earnings this month.

How I’m playing it

Bull‑put credit spread: Taking advantage of expensive puts to collect a net credit which we'll get to keep if the stock doesn't fall further over the next few months.

Equity kicker: Allocate part of that credit to Jan 2026 OTM calls. Theta from the spread finances the lottery ticket.

That company dropped 25% today, on a downgrade based on some potentially negative regulatory news, but that looks like an overreaction. The options strategies I mentioned above still make sense here, just at lower strikes.

Company B – The Diabetes Moonshot

This one is a pure speculative bet—but with asymmetric payoff.

Catalyst

First‑in‑human trial just made its debut participant insulin‑independent after 30 years of Type‑1 Diabetes. Not only doesn't he need to take insulin, but he doesn't need to take any immunosuppressant drugs either. No safety issues so far. We bought shares of this one when the initial news came out early this year, but the company just mentioned that this individual has gone a few more months with no reported issues.

Risk

Biology can always surprise.

FDA hurdles, capital raises if share price pops.

How I’m playing it.

Unlike earlier this year, this name now has options traded on it. I’m buying January 2027 calls on it.

Details on both names and trades are below.

And if you'd rather limit your risk here, you can download the Portfolio Armor app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

Company A Trade #1

The company is Halozone Therapeutics (HALO 0.00%↑), and before we get to our trades, here’s ChatGPT o3’s summary of today’s negative news and drop:

What happened today?

Magnitude of the move: HALO opened at $57.91 and quickly fell to the high‑$40s, a ~ 25 % intraday draw‑down. ChartMill

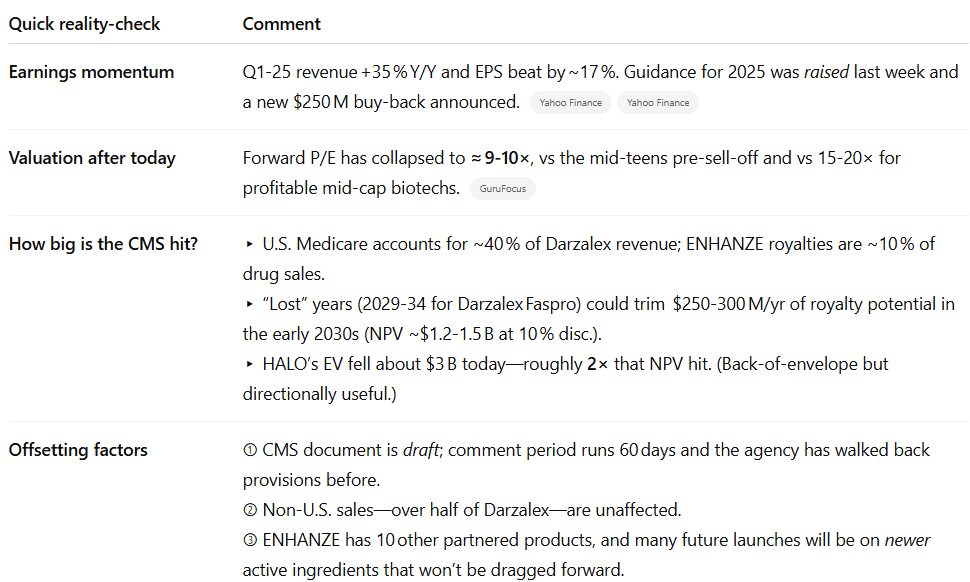

Catalyst: CMS’s draft Inflation Reduction Act (IRA) guidance says that pricing negotiations for a drug/device combination that uses Halozyme’s hyaluronidase (ENHANZE®) will begin 13 years after the original IV drug wins approval, not 13 years after the sub‑cutaneous combo is approved. That potentially chops 3‑7 years off the high‑royalty runway for products such as J&J’s Darzalex Faspro and Roche’s Phesgo. Investors.comTipRanks

Street reaction: Leerink Partners cut HALO to Underperform and lowered its PT to $47 on the CMS news. Other desk notes flagged the same risk. Investing.com

Is the market over‑penalizing HALO?

Bottom line

The CMS proposal introduces a real (and hard‑to‑model) headwind, so some multiple compression is warranted.

Yet the $3 B vaporized today likely over‑discounts the plausible royalty shortfall, especially given: (a) CMS could soften the rule; (b) the rest of HALO’s portfolio/guidance is intact; (c) the stock now trades at a single‑digit forward P/E with a buy‑back in place.

With that in mind, our trade is a vertical spread expiring on December 19th, buying the $50 strike puts and selling the $60 strike puts, for a net credit of $6.40. The max gain on 1 contract is $640, the max loss is $360, and the break even is with HALO at $53.60. This trade filled at $6.40.

Company A Trade #2

Buying the $65 strike calls on HALO expiring on December 19th, for $2.40. The max gain on 2 contracts is uncapped, the max loss is $480, and the break even is with HALO at $67.40. This trade filled at $2.40.

Company B Trade

The company is Sana Biotechnology (SANA 0.00%↑), and our trade is buying the $2 strike calls expiring on January 15th, 2027, for $0.90. The max gain on 4 contracts is uncapped, the max loss is $360, and the break-even is with SANA at $2.90. This trade filled at $0.89.

Exiting These Trades

HALO put spread: A GTC order to exit at a net debit of $0.30, raising that price, if necessary, as we approach expiration.

HALO calls: A GTC order to sell half of the calls at $5 and aim to sell all before expiration.

SANA calls: A GTC order to sell half the calls at $3, and aim to sell all before expiration.

Out of the HALO put spread today at a net debit of $0.30.

Out of one of the HALO calls at $5.80, for a gain of 142%.