Trade Alert: Top Names + Chartmill

Bullish bets on one of our top ten names plus two stocks from our Chartmill screens.

Back To The Well

We’re putting on three new longs today.

1) From last night’s Top Names

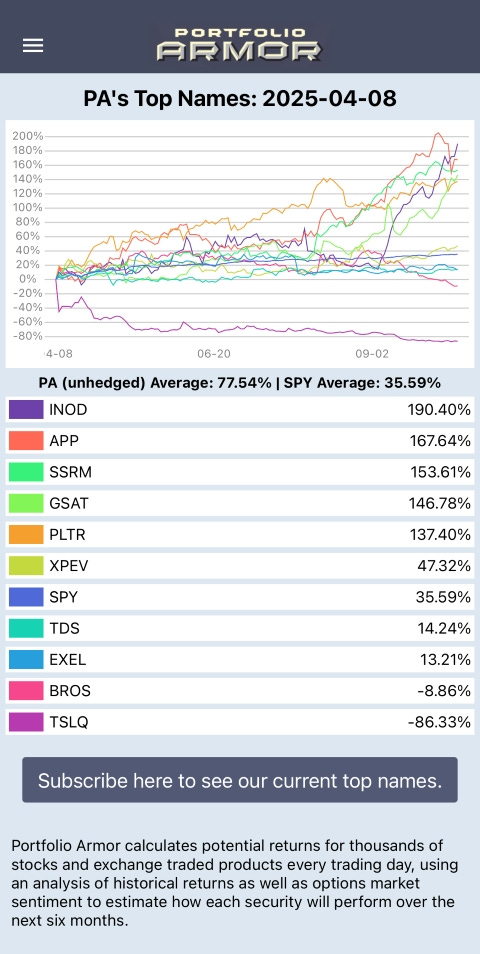

One name surfaced on our system’s Top Ten screen. That list has been our best hunting ground for asymmetric setups, and we’re leaning into it again here. You can see the 6-month performance of our Top Names from April 8th below.

Options are rich into a nearby catalyst, so we’re harvesting near-term IV while keeping uncapped upside on the long-dated piece.

2) Gold exposure

A second name from our screening stack offers gold beta with strong fundamentals and technicals per Chartmill’s data. It’s a clean way to express a “lower real yields / risk-off” impulse without owning bullion outright. We’re structuring it to harvest elevated IV and leave uncapped upside into 2026.

3) Reindustrialization play

The third name sits squarely in the reindustrialization lane—benefiting from reshoring, HVAC/refrigeration demand, and broader electrification. Chartmill flags solid profitability, growth, and technical strength. Here too we’re financing the long call by selling nearer-dated premium; risk stays defined while we keep meaningful upside.

Structure notes (all three)

We’re selling near-term premium to reduce cost and lower breakevens, then letting decay pay us.

Two of the trades use uncapped call exposure; the third is a defined-risk variant around a catalyst window.

As always, we set GTC (Good ‘Till Canceled) exit orders are set on day one so we don’t have to babysit these trades and early winners cash out automatically, leaving runners for our uncapped trades.

Full details, including tickers, strikes, expirations, limit prices, and GTC exit orders for all three trades are below the paywall, as usual.

Today’s Top Names Trade

The stock is TechnipFMC (FTI 0.00%↑), and our trade is a combo consisting of these three legs:

Buying the $42 strike calls expiring on April 17th, 2026,

Selling the $38 strike puts expiring on November 21st, 2025, and

Buying the $36 strike puts expiring on November 21st, 2025,

For a net debit of $1.80. The max gain on 2 contracts is uncapped, the max loss is $760, and the break even is with FTI at $37.79. This trade filled at $1.70.

Today’s Gold Trade

The stock is Harmony Gold ( HMY 0.00%↑ ), and our trade is a combo consisting of these three legs:

Buying the $22 strike calls expiring on May 15th, 2026,

Selling the $20 strike puts expiring on October 17th, 2025, and

Buying the $18 strike puts expiring on October 17th, 2025,

For a net debit of $1.05. The max gain on 2 contracts is uncapped, the max loss is $610, and the break even is with HMY at $18.92. This trade filled at $0.95.

Today’s Reindustrialization Trade

The stock is Mueller Industries (MLI 0.00%↑), and our trade is a combo expiring on November 21st, consisting of these four legs:

Buying the $100 strike call,

Selling the $110 strike call,

Selling the $100 strike put, and

Buying the $95 strike put,

For a net debit of $1.60. The max gain on 1 contract is $840, the max loss is $660, and the break even is with MLI at $101.60. This trade filled at $1.45.

Exiting These Trades

My plan:

FTI Calls (leg 1): Open a GTC order to sell half of the contracts at $5, and aim to be out of all of them before expiration at the best price we can get. Entered a GTC limit order to exit the second half of the calls at $9.50 on 11/11/2025.

FTI Put Spread (legs 2 & 3): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

HMY Calls (leg 1): Open a GTC order to sell half the contracts at $4, and aim to be out of all of them before expiration at the best price we can get.

HMY Put Spread (legs 2 & 3): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

MLI Call Spread (legs 1 & 2): Open a GTC order to exit at a net credit of $8, and lower that price, if necessary, as we approach expiration.

MLI Put Spread (legs 3 & 4): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

Out of the MLI put spread today at $0.20.

Out of the FTI put spread today at a net debit of $0.20.