Trade Alert: Sun of China

A bullish bet on one of our top ten names, a Chinese solar company.

Sun Of China

“Sun of China” is the name of a short story by the great Chinese science fiction author, Liu Cixin. In it, a migrant worker from rural China goes from Beijing window washer to cleaning a giant solar mirror in orbit. That—and today’s stock being a Chinese solar name—was the inspiration for the image above.

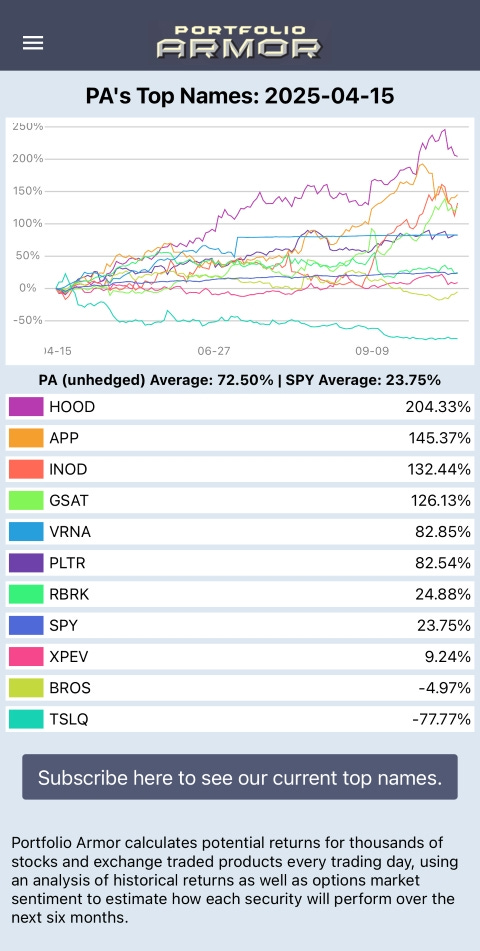

Today’s stock also showed up in Portfolio Armor’s Top Names last night. Regular readers know we often start from that list when building trades, because its track record has been so strong. You can see the running results since we started this Substack in 2022 on our performance page here, and you can see the performance of our most recent top names cohort to finish its 6-month run below.

For this one, we’re sticking with our playbook: uncapped upside into next year, financed by a small, near-term bull put spread. The goal is simple—harvest elevated implied volatility on the floor to lower our net cost and push the break-even down, while keeping the upside open if we get a squeeze or policy-driven pop.

As usual, we’ll set our GTC exit orders as soon as we get our entry fills, so we won’t have to baby sit this trade, and we’ll increase the chances of it cashing out automatically if we’re in the money sufficiently—as happened with multiple trades so far this week:

Options

Put spread on CEMEX (CX 2.86%↑). Entered at a net credit of $0.45 as part of a 4-leg combo on 10/7/2025; exited at a debit of $0.20 on 10/14/2025. Profit: 56%.

Put spread on Harmony Gold (HMY 3.75%↑). Entered at a net credit of $1.17, as part of a 3-leg combo on 10/9/2025; exited at a net debit of $0.20 on 10/15/2025. Profit: 83%.

Calls on AirSculpt Technologies (AIRS 2.85%↑). Bought for $2.08, as part of a risk-reversal on 8/14/2025; sold (half) for $4 on 10/15/2025. Profit: 92%.

Calls on Vishay Precision Group (VPG 3.52%↑). Bought for $2.64 as part of a 3-leg combo on 8/13/2025; sold (half) for $6.50 on 10/15/2025. Profit: 146%.

Call spread on D-Wave Quantum (QBTS -9.56%↓). Entered at a net debit of $1.72, as part of a 4-leg combo on 9/15/2025; exited at a net credit of $5.60 on 10/15/2025. Profit: 226%.

Calls on Evolv Technologies Holdings (EVLV 4.33%↑). Bought for $0.76 on 6/17/2025; sold for $2.80 on 10/14/2025. Profit: 268%.

Call spread on Oklo (OKLO 9.20%↑). Entered at a net debit of $5 on 7/22/2025; exited at a net credit of $20 on 10/13/2025. Profit: 300%.

4-leg combo on AST SpaceMobile (ASTS 5.04%↑). Entered at a net debit of $2.70 on 8/27/2025; exited the call spread at a net credit of $12 on 10/8/2025; exited the put spread at a net debit of $0.20 on 10/13/2025. Profit: 337%.

Call on Energy Fuels, Inc. (UUUU 0.66%↑). Bought for $1.85 as part of a risk-reversal with a floor on 8/12/2025; sold (second half) for $14.30 on 10/13/2025. Profit: 673%.

Risk-reversal on Ouster (OUST -3.13%↓). Entered at a net debit of $0.73 on 6/25/2025; sold half of the calls for $10 and bought-to-close all of the puts for $0.91 on 8/14/2025; sold the other half of the calls for $14.50 on 10/15/2025. Profit: 1,454%.

On premium outlay; return on max risk = 45%.

On premium outlay; return on max risk = 117%.

On premium outlay; return on max risk = 160%.

On premium outlay; return on max risk (if OUST had gone to $0 before expiration) = 51%.

Full details for paid subscribers below.

Today’s Top Names Trade

The stock is Daqo New Energy (DQ 0.00%↑), and our trade is a combo consisting of these three legs:

Buying the $32 strike calls expiring on April 17th, 2026,

Selling the $27 strike puts expiring on October 31st, 2025, and

Buying the $22 strike puts expiring on October 31st, 2025,

For a net debit of $3.10. The max gain on 2 contracts is uncapped, the max loss is $1,620, and the break even is with DQ at $26.33. This trade filled at $2.85.

Exiting This Trade

My plan:

DQ Calls (leg 1): Open a GTC order to sell half of the calls at $10, and plan to sell all for the best price we can get before expiration.

DQ Put Spread (legs 2 & 3): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

Out of the DQ put spread today at a net debit of $0.20.