Trade Alert: Top Names + UNH

Bullish options bets on two of our recent top names, plus a trade on the beaten-down insurer.

Trading Our Interlocked Macro Trends

Over the weekend, I wrote about the four interlocked macro trends I’ve been focused on, reindustrialization, embodied AI, energy, and crypto.

Today we have bullish bets on two recent top names that deal with the first three macro trends:

An advanced nuclear micro‑reactor developer—a pure play on the massive power demand AI build‑outs will require.

A server / database‑infrastructure supplier riding the same wave from the compute side.

In addition, we have a couple of trades on a beaten-down health insurer, UnitedHealth Group (UNH 0.00%↑).

Is UNH Near A Bottom?

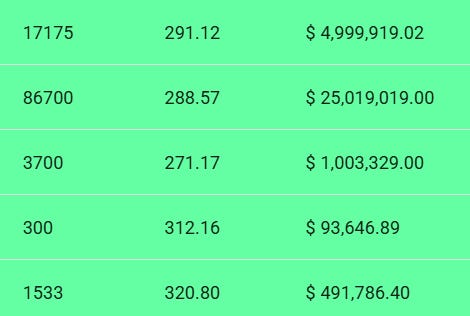

Shares of United Health are down nearly 44% year-to-date, but a couple of datapoints suggest it may be near a bottom. There was a big flush in May, on heavy volume, after its CEO stepped down and news broke of a DoJ probe of the company for potential Medicare fraud.

At about the same time, several insiders made large, open market purchases of UNH shares.

Four of those five purchases were made at prices higher than the stock is trading at now.

So we have a pair of trades on UNH today that will collectively break even if the stock manages to close above $285 after it reports earnings next week, and two bullish bets on our nuclear + AI names.

Details below.

Today’s UNH Trades

The stock of course is UnitedHealth Group (UNH 0.00%↑), and we have two trades on it, both expiring on August 1st:

Buying the $300 strike call and selling the $310 strike call, for a net debit of $2.25. The max gain on 1 contract is $775, the max loss is $225, and the break even is with UNH at $302.25. This trade filled at $2.23.

Buying the $282.50 strike puts and selling the $285 strike puts, for a net credit of $1.25. The max gain on 2 contracts is $2.50, the max loss is $2.50, and the break even is with UNH at $283.75. This trade filled at $1.30.

Today’s First Top Names Trade

The stock is Oklo (OKLO 0.00%↑), and our trade is a vertical spread expiring on January 16th, buying the $75 strike call and selling the $100 strike call, for a net debit of $5. The max gain on 1 contract is $2,000, the max loss is $500, and the break even is with OKLO at $80. This trade filled at $5.

Today’s Second Top Names Trade

The stock is Super Micro Computer (SMCI 0.00%↑), and our trade is a diagonal spread, buying the $55 strike calls expiring on October 17th, and selling the $60 strike calls expiring on August 22nd, for a net debit of $3.20. The max gain is uncapped, the max loss is $350, and the break even is with SMCI at $49.48. This trade filled at $3.20.

Exiting These Trades

UNH call spread: I opened a GTC order to exit at a net credit of $9.75, and I will lower that price, if necessary, as we approach expiration.

UNH put spread: I opened a GTC order to exit at a net debit of $0.20, and I will raise that price, if necessary, as we approach expiration.

OKLO: I opened a GTC order to exit at a net credit of $24, and I will lower that price, if necessary, as we approach expiration.

SMCI: I opened a GTC order to exit the diagonal at a net credit of $7. If that doesn’t fill before the short call expires on August 22nd, then we can revisit our exit price on the long call.

Nevermind, a Diag spread

Out of the OKLO call spread today at $20, for a gain of 300%.