Trade Alert: Another Crack At Quantum

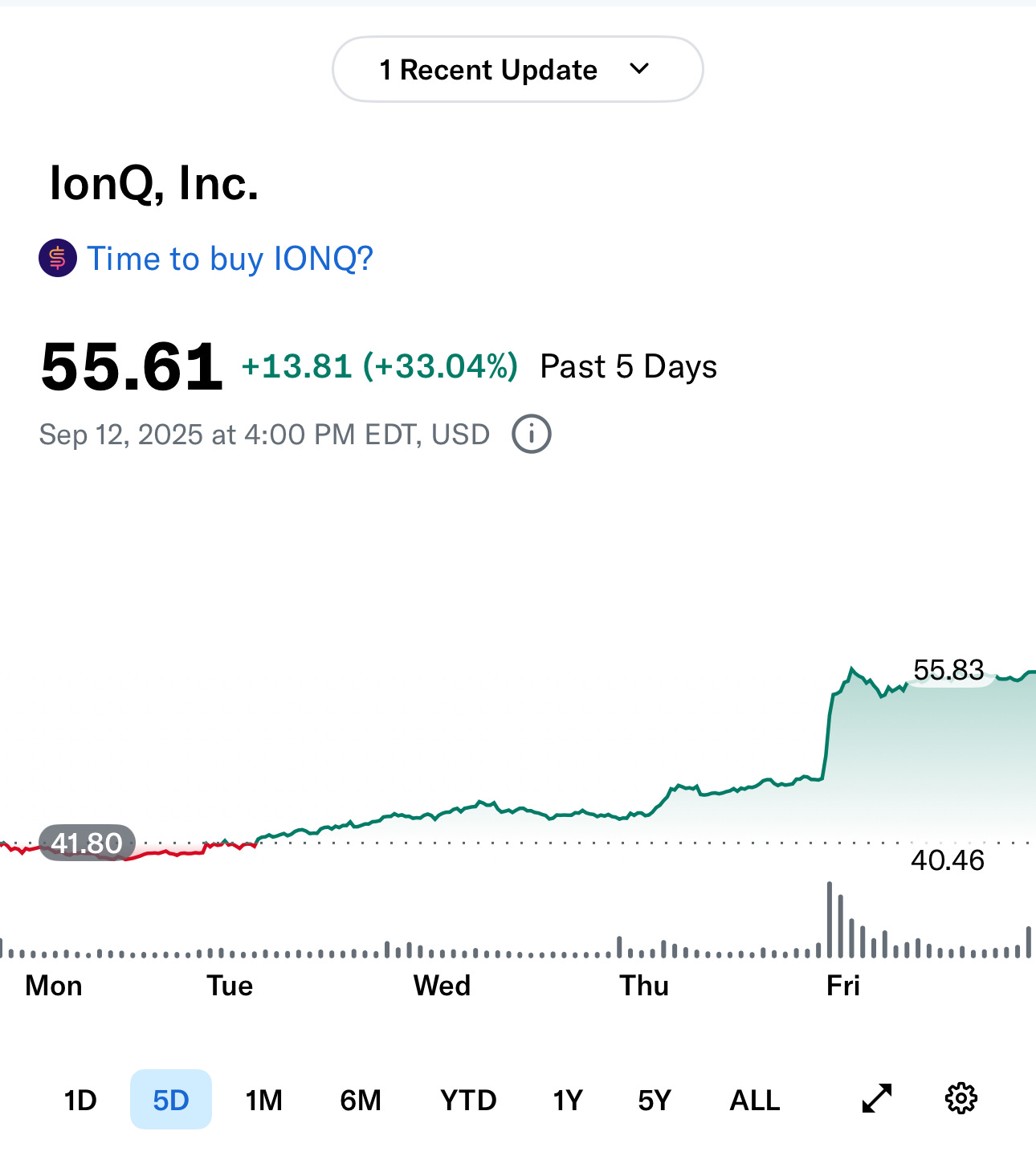

The previous quantum name to hit our top ten was up 33% last week.

Riding the Quantum Ripple

Last Monday, we tried to put on a trade in a quantum computing name that had landed in our Top Names list the prior Friday—IonQ (IONQ 0.00%↑). Our order never filled, and by the end of the week the stock had sprinted +33%.

That kind of move isn’t unusual for our Top Names (longtime readers have seen this movie before); it’s why we scan that list every evening.

With that in mind, another quantum stock appeared in Friday’s Top Names, and we’re putting a trade on it today.

Plus A Second Top Name

In addition, we’re adding a position in one more Top Name from Friday’s list that lines up neatly with our core themes (re-industrialization and embodied AI.

How we’re structuring these (high level):

Same “harvest IV, define risk” template we’ve been using recently.

We go far enough out to catch likely catalysts and let realized vol do the heavy lifting, and we pre-set exits.

As usual, we’ll keep costs and break-evens in check by working mid-prices and avoiding greedy targets.

Details on strikes, expirations, and exits are in the paid section. For free readers, the takeaway is simple: we’re leaning into quantum strength, and adding a Top Name aligned with our core themes.

Today’s First Top Names Trade

The stock is D-Wave Quantum (QBTS 0.00%↑), and our trade is a combo expiring on January 16th, 2026, consisting of these four legs:

Buying the $18 strike call,

Selling the $25 strike call,

Selling the $18 strike put, and

Buying the $12 strike put,

For a net credit of $0.95. The max gain on 1 contract is $795, the max loss is $505, and the break even is with QBTS at $17.05. This trade filled at $1.

Today’s Second Top Names Trade

The stock is Unity Software (U 0.00%↑), and our trade is a combo expiring on November 21st, consisting of these four legs:

Buying the $48 strike call,

Selling the $60 strike call,

Selling the $42 strike put, and,

Buying the $38 strike put,

For a net debit of $1.25. The max gain on 1 contract is $10.75, the max loss is $525, and the break even is with U at $49.25. This trade filled at $1.20.

Exiting These Trades

My plan:

QBTS Call Spread (legs 1 & 2): Open a GTC order to exit at a net credit of $5.60, and lower that price, if necessary, as we approach expiration.

QBTS Put Spread (legs 3 & 4): Open a GTC order to exit at net debit of $0.20, and raise that price, if necessary, as we approach expiration.

U Call Spread (legs 1 & 2): Open a GTC order to exit at a net credit of $8, and lower that price, if necessary, as we approach expiration.

U Put Spread (legs 3 & 4): Open a GTC order to exit at a net debit of $0.20, and lower that price, if necessary, as we approach expiration.

U filled at 1.32 debit; QTBS open at $1 credit Mid currently at .74 credit

Out of the U put spread today at a net debit of $3.10.