Exits, 2/20/2026

How we did on the trades we exited this week.

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options

3-leg combo on Sportradar Group (SRAD 0.00%↑). Entered at a net debit of $1.30 on 9/19/2025; the November 21st, 2025 $27.50–$25 put spread was assigned and exercised at expiration on 11/21/2025 for the full $2.50 width; sold the February 20th, 2026 $32.50 calls for $0.01 on 2/20/2026. Loss: 100% of max risk (292% of premium outlay). Signal: PA Top Names.

4-leg combo on Power Solutions International (PSIX 0.00%↑). Entered at a net debit of $0.45 on 10/31/2025; the November 21st, 2025 $80–$75 put spread was assigned/exercised on 11/21/2025; the February 20th, 2026 $110–$120 call spread expired worthless on 2/20/2026. Loss: 100% of max risk (-1211% on premium outlay). Signal: Market Watchers.

Put spread on iShares Ethereum Trust (ETHA 0.00%↑). Entered at a net credit of $1.24 as part of a 3-leg combo on 1/14/2026; assigned and exercised on 2/20/2026. Loss: 100% of max risk (223% of premium collected). Signal: Me, ChatGPT.

Put spread on MP Materials (MP 0.00%↑). Entered at a net credit of $2.02 as part of a 4-leg hybrid combo on 1/29/2026; exited at a net debit of $4.75 on 2/19/2026. Loss: 92% of max risk (135% of premium collected). Signal: Market Watchers.

Put spread on Iris Energy (IREN 0.00%↑). Entered at a net credit of $2.32 as part of a 4-leg hybrid combo on 11/13/2025; exited at a net debit of $4.76 on 2/19/2026. Loss: 91% of max risk (105% of premium collected). Signal: PA Top Names.

4-leg combo on Nebius (NBIS 0.00%↑). Entered at a net debit of $2.45 on 12/3/2025; exited the $90–$95 put spread at a net debit of $0.20 on 2/19/2026; exited the $115–$135 call spread at a net credit of $0.25 on 2/19/2026. Loss: 32% of max risk (98% on premium outlay). Signal: PA Top Names.

4-leg combo on Zoetis (ZTS 0.00%↑). Entered at a net debit of $1.50 on 12/26/2025; exited the February 20th, 2026 $120–$115 put spread at a net debit of $0.20 on 2/13/2026; exited the February 20th, 2026 $130–$140 call spread at a net credit of $0.40 on 2/19/2026. Loss: 19% of max risk (87% of premium outlay). Signal: Multibaggers.

Put spread on Symbotic (SYM 0.00%↑). Entered at a net credit of $2.10 as part of a 4-leg hybrid combo on 12/5/2025; exited at a net debit of $1.74 on 2/20/2026. Profit: 17% on premium collected (return on max risk: 12%). Signal: Top Names.

4-leg hybrid combo on Alamos Gold (AGI 0.00%↑). Entered at a net debit of $3.10 on 2/3/2026; exited the $38–$33 put spread at a net debit of $0.20 on 2/10/2026; exited the Sep ’26–Feb ’26 $41 call calendar at a net credit of $4.60 on 2/20/2026. Profit: 42% on premium outlay (return on max risk: 16%). Signal: PA Top Names.

Calls on Bit Digital (BTBT 0.00%↑). Entered at $0.61 per call as part of a risk-reversal on 8/28/2025; sold half at $1.80 on 10/20/2025; second half expired worthless on 2/20/2026. Profit: 48% on premium outlay. Signal: PA Top Names.

Bearish call spread on Cognizant Technology Solutions (CTSH 0.00%↑). Entered at a net credit of $0.77 as part of a 4-leg combo on 9/22/2025; exited at a net debit of $0.20 on 2/19/2026. Profit: 74% on premium collected (return on max risk: 13%). Signal: Me, ChatGPT.

Put spread on Compass Pathways (CMPS 0.00%↑). Entered at a net credit of $0.87 as part of a 3-leg combo on 1/28/2026; exited at a net debit of $0.20 on 2/18/2026. Profit: 77% on premium collected (return on max risk: 59%). Signal: Multibaggers.

Put spread on Fortuna Silver Mines (FSM 0.00%↑). Entered at a net credit of $0.86 as part of a 3-leg combo on 12/30/2025; exited at a net debit of $0.20 on 2/20/2026. Profit: 77% on premium collected (return on max risk: 40%). Signal: PA Top Names.

Put spread on SandRidge Energy (SD 0.00%↑). Entered at a net credit of $1.65 as part of a 3-leg combo on 12/18/2025; exited at a net debit of $0.20 on 2/19/2026. Profit: 88% on premium collected (return on max risk: 171%). Signal: Chartmill.

Short call on D-Wave Quantum (QBTS 0.00%↑). Sold to open for a net credit of $2.55 as part of a 4-leg hybrid combo on 1/12/2026; bought to close for $0.20 on 2/20/2026. Profit: 92% on premium collected. Signal: PA Top Names.

Put spread on Rambus (RMBS 0.00%↑). Entered at a net credit of $2.70 as part of a 4-leg combo on 1/7/2026; exited at a net debit of $0.20 on 2/18/2026. Profit: 93% on premium collected (return on max risk: 109%). Signal: PA Top Names.

Put spread on Fabrinet (FN 0.00%↑). Entered at a net credit of $3.99 as part of a 4-leg combo on 1/26/2026; exited at a net debit of $0.20 on 2/18/2026. Profit: 95% on premium collected (return on max risk: 63%). Signal: PA Top Names

Put spread on Advanced Micro Devices (AMD 0.00%↑). Entered at a net credit of $4.01 as part of a 4-leg combo on 12/12/2025; exited at a net debit of $0.20 on 2/20/2026. Profit: 95% on premium collected (return on max risk: 385%).

4-leg hybrid combo on Corning (GLW 0.00%↑). Entered at a net debit of $3.35 on 11/17/2025; exited the $70–$75 put spread at a net debit of $0.20 on 1/23/2026; exited the call calendar (long Jun 18th, 2026 $90 calls / short Feb 20th, 2026 $95 calls) at a net credit of $8.20 on 2/19/2026. Profit: 139% (return on max risk: 56%). Signal: PA Top Names.

4-leg hybrid combo on AXT, Inc. (AXTI 0.00%↑). Entered at a net debit of $2.85 on 1/27/2026; exited the $12.50–$17.50 put spread for a net debit of $0.20 on 2/13/2026; exited the call calendar (long Aug 21st, 2026 $22.50 calls / short Feb 20th, 2026 $22.50 calls) for a net credit of $7.40 on 2/20/2026. Profit: 153% (return on max risk: 54%). Signal: PA Top Names.

Comments

Stocks or Exchange Traded Products

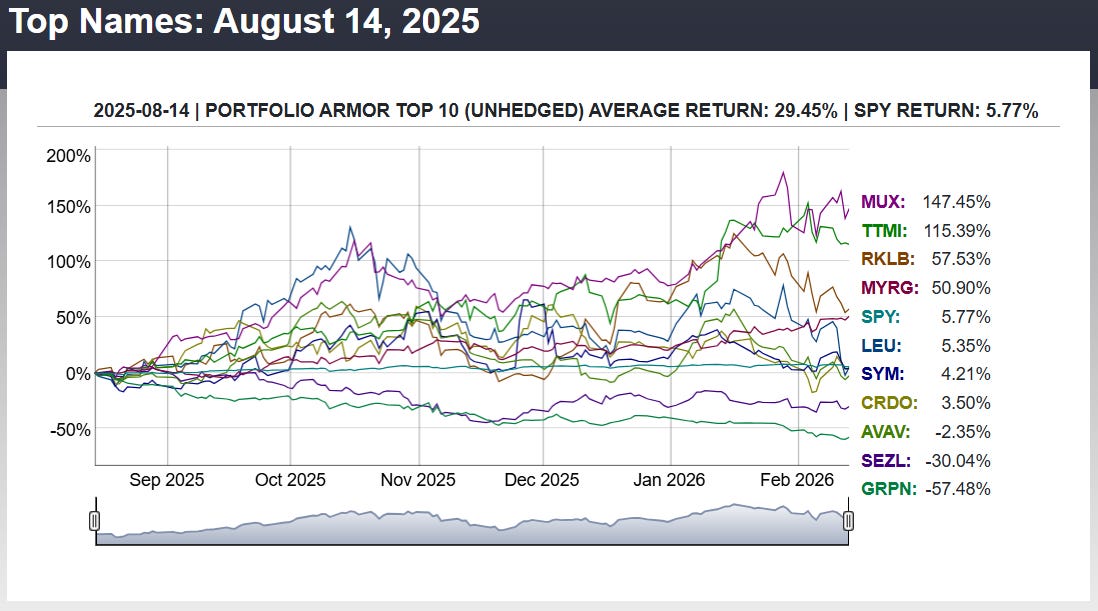

No exits this week, as I haven’t been doing our basic strategy, which involves buying stocks and ETFs, and have been focusing on options instead. Nevertheless, the performance of our system’s top names have nearly doubled that of the SPDR S&P 500 Trust (SPY 1.32%↑) since I started this Substack. Here’s the performance of our last weekly Top Names cohort to finish its 6-month run:

You can find the performance of all 138 weekly Top Names cohorts that have finished their 6-month runs here.

Options

Today was the big options expiration date for February, and OpEx days tend to be where our losing trades collect (because we often exit winners before expiration), so for nearly two thirds of our exits this week to be profitable is pretty impressive. The current market volatility works in our favor, given the way we structure trades.

One difference in this week’s Exits post: I’ve added the signal that prompted me to enter the trade. I had been including that on the spreadsheet linked above, but going forward, I’ll include it in these exits posts too.

Solid week: we’re on the right track. We’ll look to keep the momentum going next week.