Gold’s Spike Isn’t a “Weimar Moment”

The unique combo of factors that led to Weimar-era hyperinflation doesn't exist now.

Gold’s Spike Isn’t A “Weimar Moment”

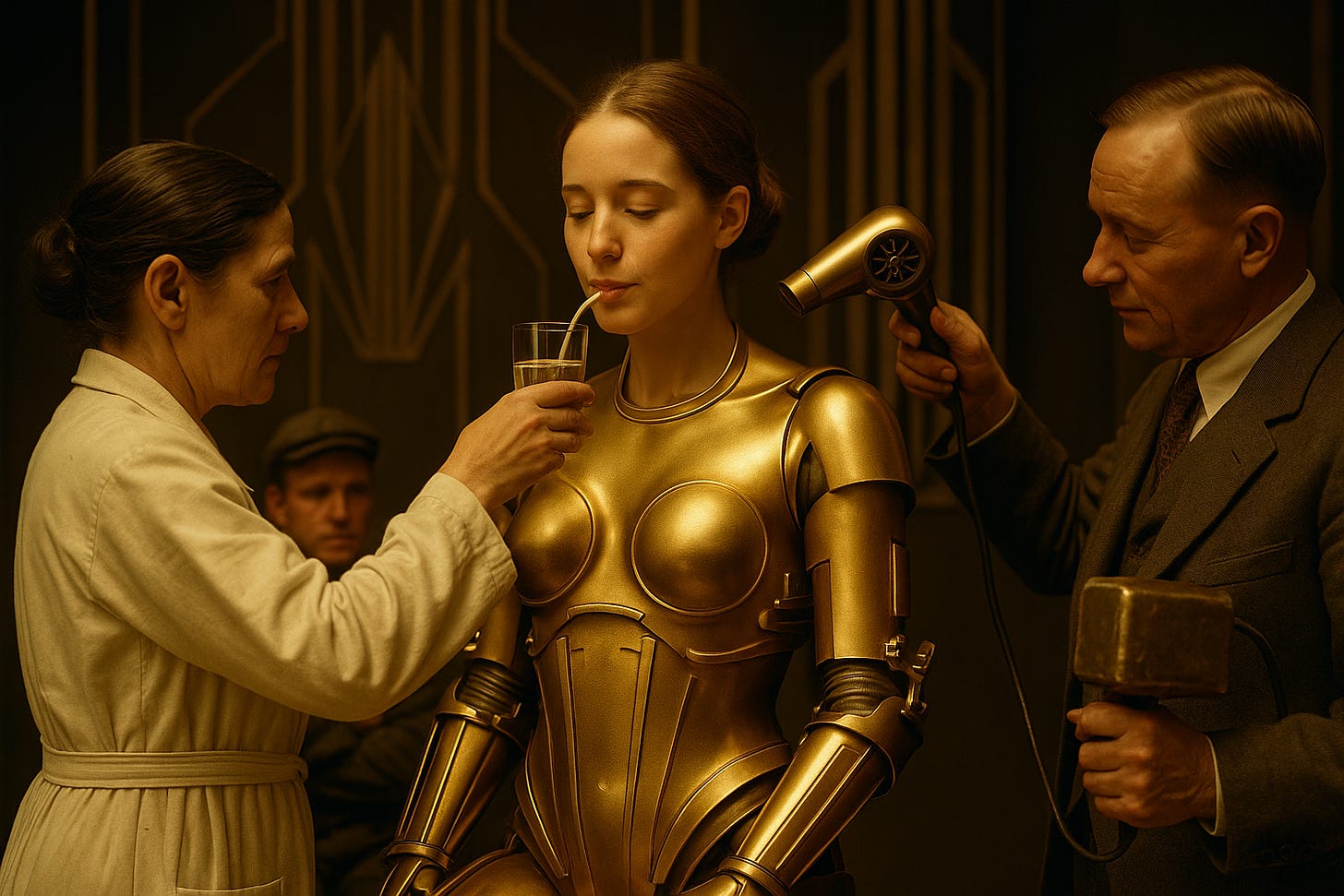

Some observers see gold ripping higher and rush to shout “Weimar!” That analogy sounds dramatic, but it’s wrong. The Weimar hyperinflation wasn’t just about “money printer go brrr.” It was about money creation colliding with a collapse in real output.

What Made Weimar Unique

Industrial shutdown: After France and Belgium occupied the Ruhr in 1923 to enforce reparations, Germany answered with passive (and some not-so-passive) resistance. Factories and mines in the country’s industrial heartland stopped producing. The state paid idled workers anyway.

Fiscal + monetary spiral: With tax receipts plunging and expenses soaring, Berlin leaned on the Reichsbank to print to cover payrolls and deficits. That stoked a classic fiscal-dominance loop.

Collapse in “stuff,” explosion in “marks”: Too many marks chased not enough goods. Velocity spiked as people spent wages immediately before prices changed again.

Breakdown, then reset: Only with the end of resistance, spending cuts, and the Rentenmark stabilization (plus new collateral and tax reforms) did prices re-anchor.

Key point: The hyperinflation wasn’t just printing; it was printing into a supply shock + state-funded idle industry. That’s a very specific cocktail.

Why Today Is Nothing Like Weimar

No systemic shutdown of industry. Whatever our cyclical or policy debates, we are not paying millions not to produce while the industrial base sits idle under foreign occupation. American workers aren’t sabotaging our industrial heartland, and no foreign troops are killing them.

Functioning tax + bond markets. Governments are funding themselves primarily through debt at market rates; fiscal stress is real, but it isn’t a Weimar-style collapse in revenue with payrolls for idle factories.

Anchored (if noisy) inflation expectations. We’ve had post-pandemic inflation and policy mistakes, but the institutional framework (independent central banks, inflation-linked markets, liquid FX) bears little resemblance to 1923 Germany.

So Why Is Gold Spiking Now?

Think real rates, official flows, and uncertainty, not Weimar.

Real yields > the dollar. Gold tracks real interest rates more than it tracks DXY. If markets price easier policy (or lower term premium) faster than inflation expectations fall, real yields slip, and gold catches a bid, even with a firm dollar.

Official-sector and Emerging Markets buying. Central banks and sovereign buyers add gold for reserve diversification and sanction-resilience, not because of short-term FX moves. These flows can be price-insensitive and break the classic USD/gold inverse.

Physical tightness outside the West. Premiums in Asia and steady bar/coin demand can tug global prices higher even when Western ETFs are flat. The market is segmented; paper flows don’t tell the whole story.

Policy and geopolitics = uncertainty premium. A high-profile summit, policy shake-ups, or administrative shock (e.g., federal workforce RIFs during a shutdown) can be deflationary at the margin and bullish for gold at the same time, because they increase governance uncertainty.

Positioning + short covering. If systematic funds and options desks were underweight or short gamma, a nudge lower in real yields or a headline shock can force chasing higher.

Oil isn’t the boss of gold. Lower crude can cool breakevens, but if the move is about supply relief while real rates dip and uncertainty rises, gold can still climb.

Bottom line: Today’s price action reflects macro hedging and reserve dynamics, not a replay of a 1923 industrial strike financed by a printing press.

Answers To Common Pushbacks

“But balance sheets are huge” Size isn’t destiny. Weimar printed into a production stop; we printed into a supply-chain shock and then normalized. Different mechanism, different outcomes.

“Gold up means inflation spiral.” Sometimes; often it means lower real yields or higher tail-risk hedging. Gold rallies through deflation scares too.

“Dollar’s strong, so gold shouldn’t rise.” That correlation breaks when real rates and official buying dominate.

How We’re Playing It

We want upside with defined risk and discipline on exits.

Core exposure: We hold call positions in gold miner Harmony Gold (HMY 0.00%↑ ) and gold doré producer SSR Mining (SSRM 0.00%↑). We mentioned both of these back in September, but re-entered HMY with longer tenors last week. We’ve already de-risked by taking profits on parts of each and kept runners for further upside.

Management: Our standard GTC exits remain in place: buy back any financing put spreads near $0.20, scale long calls per plan (e.g., take half around +200% on uncapped calls).

What would change our stance: A sharp rise in real yields without offsetting uncertainty, or evidence that official-sector demand is ebbing meaningfully.

If you’re following along, the high-level takeaway is simple: gold can rip for reasons that have nothing to do with Weimar. This move looks driven by real-rate dynamics, sovereign demand, and policy uncertainty, not a collapse in industrial production. We’re positioned accordingly, with risk defined and exits pre-set.