Trade Alert: Why We're Passing On Last Night's Top Name

But trading three others (plus one name from our Multibaggers list).

Passing On Last Night’s #1 Name

While Portfolio Armor’s Top Ten names continue to deliver exceptional performance, occasionally we pass on one that doesn’t fit our criteria at the moment.

The #1 ranked name in our system last night was Intellia Therapeutics (NTLA 0.00%↑). It’s not the first time NTLA has appeared in our Top Ten—we opened a risk-reversal on it back in July which we exited for a profit in September:

Risk-reversal on Intellia Therapeutics (NTLA -2.34%↓). Entered at a net debit of $1.27 on 7/18/2025; exited at a net credit of $5.64 on 9/23/2025. Profit: 344%1

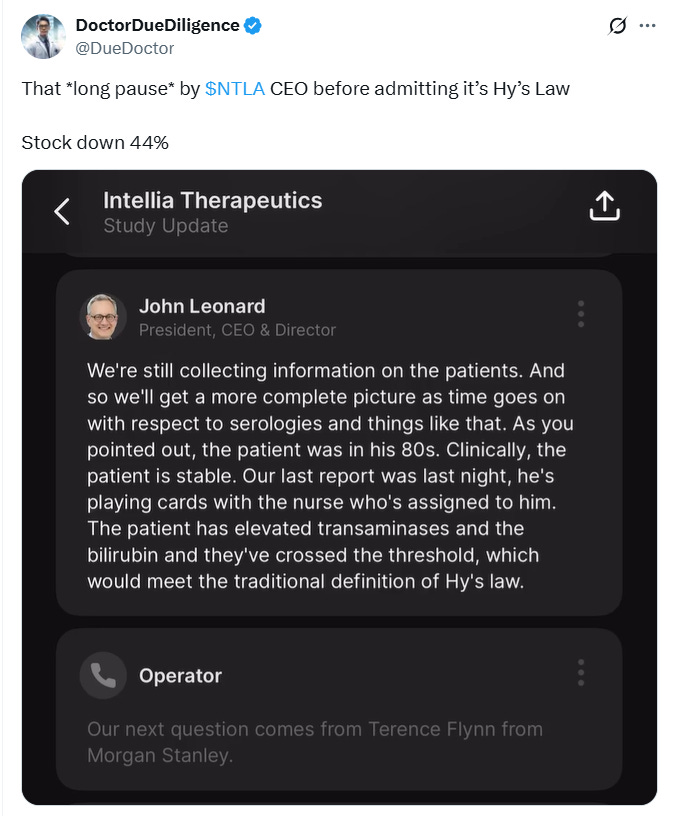

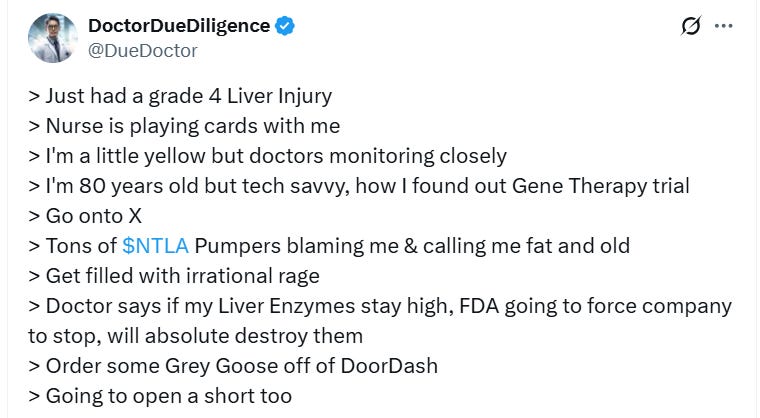

But on Monday, NTLA plunged after the FDA placed a clinical hold on its in vivo gene-editing trial following a serious liver-injury event in one of the early-dose patients.

Several biotech accounts we track in our Market Watchers feed have since put NTLA in the “too-hard” pile, and we agree there are cleaner opportunities in biotech right now (although it’s possible that six months from now we’ll look back and see Portfolio Armor’s algorithm was right about NTLA back in October when the experts were wrong).

That said, we’re trading three other Top Names from last night’s list—along with one Multibagger idea—using our Harvest IV / Defined Risk framework: using short-dated, high implied volatility to help finance longer-dated upside exposure.

Full details for all four are below.