Trade Alert: Top Names + Earnings

Bullish bets on two of our top names, one of which is reporting earnings this week.

Two New Bullish Trades From Monday’s Top Ten

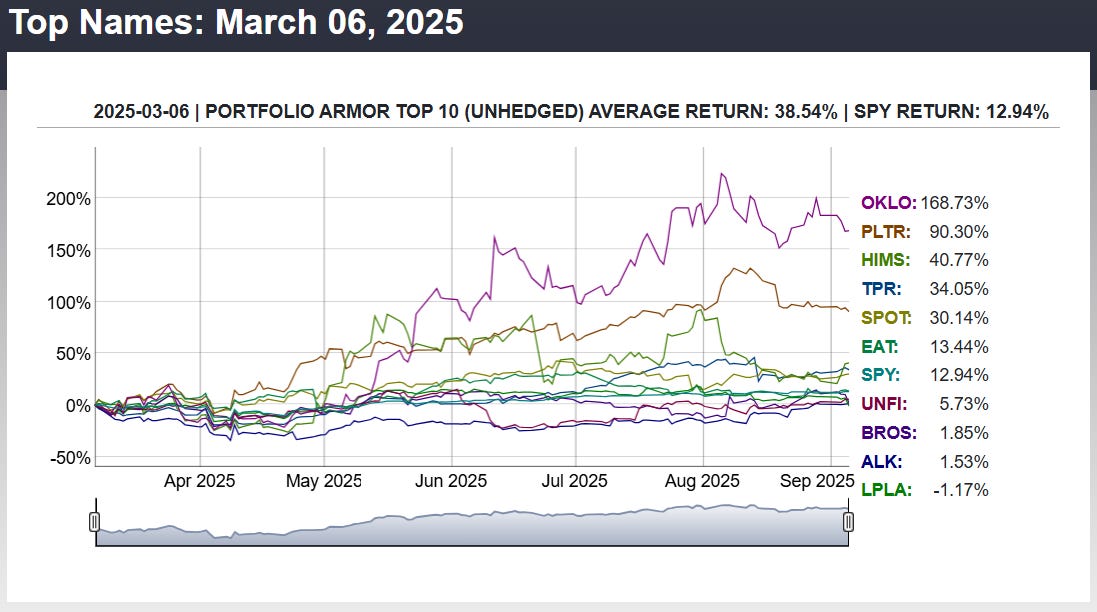

We’re opening two risk-defined bullish options positions today in names that appeared in Portfolio Armor’s Top 10 last night. If you’re new here, our Top Names list has a strong long-term record; you can see the historical results here: How Our Top Names Have Performed. And you can see how our most recent Top Names cohort to finish its 6-month run has done below.

Why these two?

Both align with our ongoing macro themes—Reindustrialization, Embodied AI, and Energy/Infrastructure—that we outlined here:

One benefits from the build-out of advanced, real-world autonomy; the other is levered to next-gen compute that enables those systems. In short: they’re not meme punts; they’re tied to durable trends we’ve been tracking all year.

How we’re structuring the trades

Options are expensive in both names right now, so we’re using our trusty four-leg combo to harvest elevated implied volatility and lower our net cost and break-evens: This keeps risk defined and gives us a better probability of profit than naked calls when IV is high.

Full details including exact strikes, expirations, entry prices, break-evens, max P&L, and the GTC exit orders for both trades are below.

Today’s First Top Names Trade

The stock is AeroVironment (AVAV 0.00%↑), and our trade is a combo expiring on September 12th (the company is scheduled to release earnings after the close today), consisting of these four legs:

Buying the $240 strike call,

Selling the $250 strike call,

Selling the $230 strike put, and

Buying the $227.50 strike put,

For a net debit of $1.85. The max gain on 1 contract is $815, the max loss is $435, and the break even is with AVAV at $241.85. This trade filled at $1.85.

Today’s Second Top Names Trade

The stock is IonQ (IONQ 0.00%↑), and our trade is a combo expiring on November 21st, consisting of these four legs:

Buying the $42 strike call,

Selling the $50 strike call,

Selling the $38 strike put, and

Buying the $34 strike put,

For a net debit of $0.88. The max gain on 1 contract is $712, the max loss is $488, and the break even is with IONQ at $42.88. This trade hasn’t filled yet.

Exiting These Trades

My plan (assuming the IONQ trade fills as well):

AVAV Call Spread (legs 1 & 2): Open a GTC order to exit at a net credit of $8, and lower that price, if necessary, as we approach expiration.

AVAV Put Spread (legs 3 & 4): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

IONQ Call Spread (legs 1 & 2): Open a GTC order to exit at a net credit of $6.40, and lower that price, if necessary, as we approach expiration.

IONQ Put Spread (legs 3 & 4): Open a GTC order to exit at a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

AVAV missed on earnings, but beat on revenues, and had a bit of a roller coaster afterhours, trading between $216 and $244.50, before ending up at $240. Steady as she goes for now on our exit strategy; I'll recheck the Friday ATM straddle tomorrow and see if it makes sense to adjust our GTC orders.

Check that $9.03