Top Names, 12/18/2025

Updating our top names performance and presenting this week's top ten names.

Our Basic Strategy

Our basic strategy to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of ~20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position—there are no options involved in this strategy.

Another Use For Our Top Names

We also use our top names in options trades, such as this Micron earnings trade we entered earlier this week:

(Semiconductors / AI Infrastructure)

The stock is Micron Technology (MU -2.10%↓), and our trade is a combo consisting of these four legs:

Buying the $245 strike call expiring on December 26th, 2025,

Selling the $255 strike call expiring on December 26th, 2025,

Selling the $225 strike put expiring on December 19th, 2025,

Buying the $220 strike put expiring on December 19th, 2025,

For a max net debit of $1.90. The max gain on 1 contract is $810, the max loss is $690, and the break-even is with MU at $227.36.

This trade filled at $1.70.

Micron closed at $248.55 today, after its blowout earnings after yesterday’s close.

A Top Names Performance Update

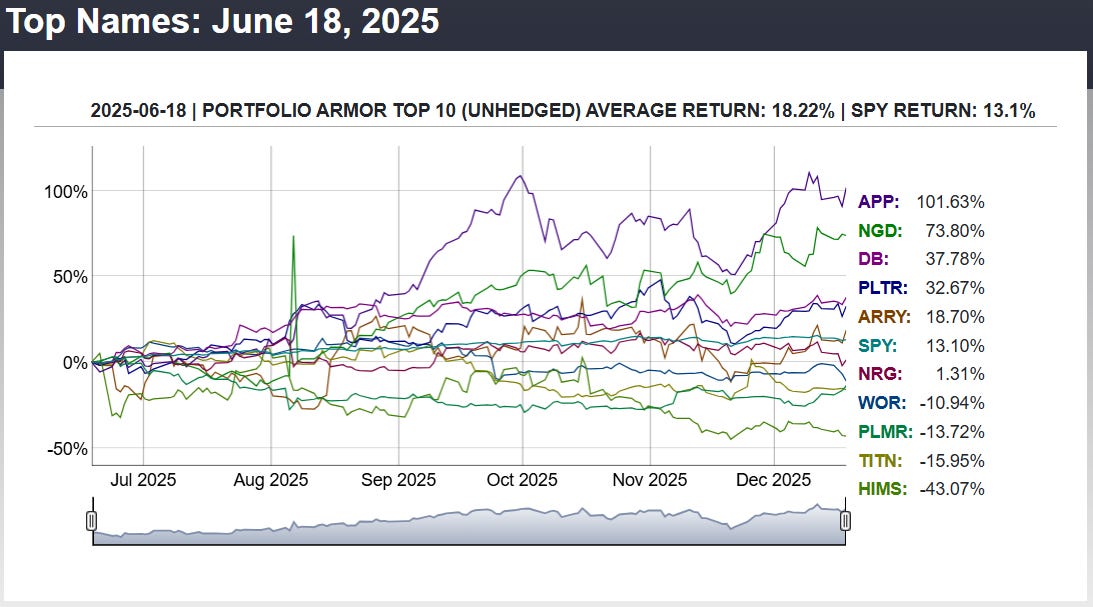

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from 6/18/2025.

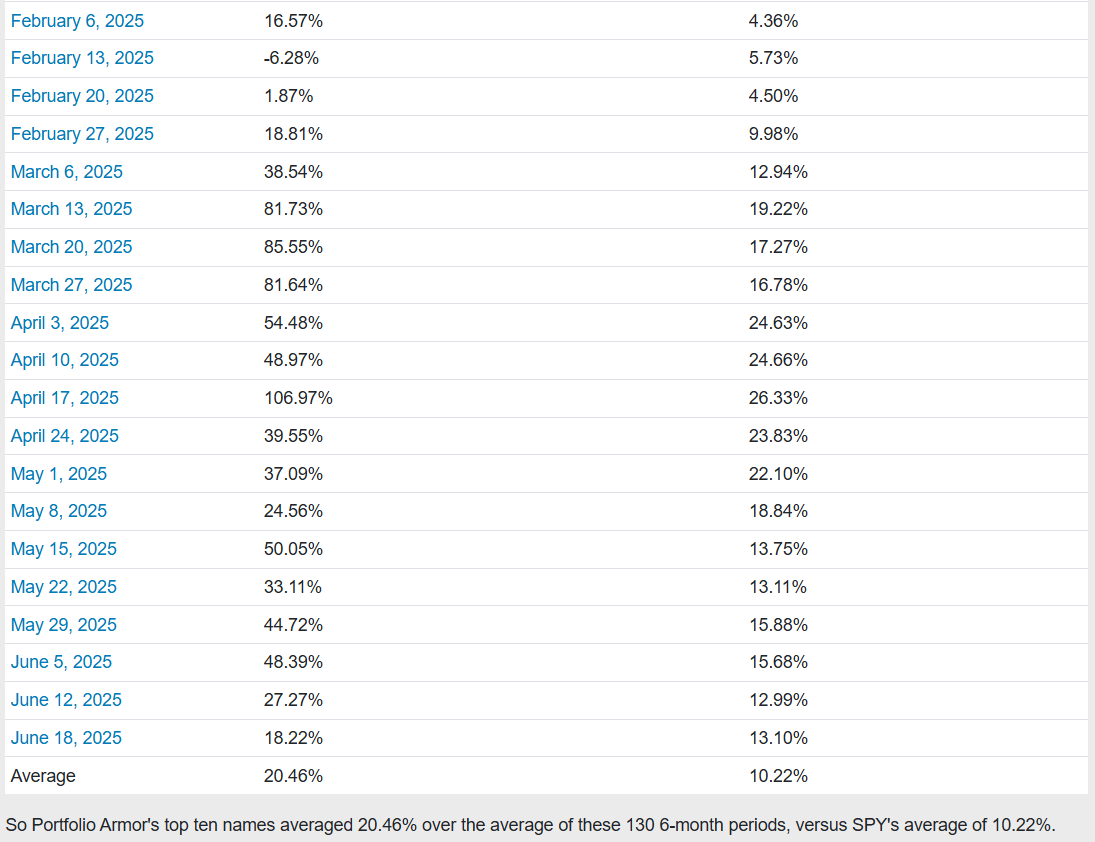

So far, we have 6-month returns for 130 weekly top names cohorts since we started this Substack at the end of December, 2022.

[Skipping ahead so this post doesn’t exceed email length—you can see the top names returns for every week here]

And as you can see above, our top names have averaged returns of 20.46% over the next six months, versus SPY’s average of 10.22%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close. An interesting coincidence here—#5 was one of the two names we placed trades on today, after seeing a report Wednesday that its CEO had just bought another 1.1 million shares in the open market.