Top Names, 11/13/2025

Updating our top names performance and presenting this week's top ten names.

A Market Comment

In light of this week’s market action, you may find this post of interest, if you missed it:

Our basic strategy (formerly known as our core strategy) to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of ~20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top names in options trades, such as this one we exited this week:

Calls on TechnipFMC (FTI).

Bought for $2.57, as part of a 3-leg combo on 10/9/2025; sold (half) at $5 on 11/10/2025. Profit: 95% (~53% on max risk).

A Top Names Performance Update

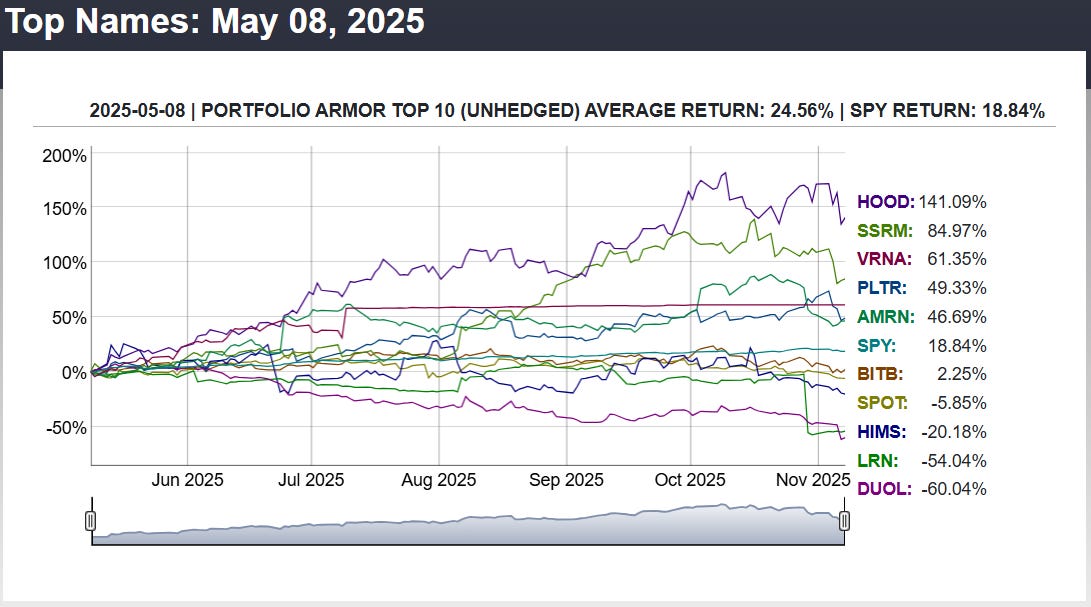

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from 5/8/2025.

Over the next 6 months, our top ten names from May 8th returned +24.56%, versus +18.84% for the SPDR S&P 500 Trust ETF (SPY 0.23%↑).

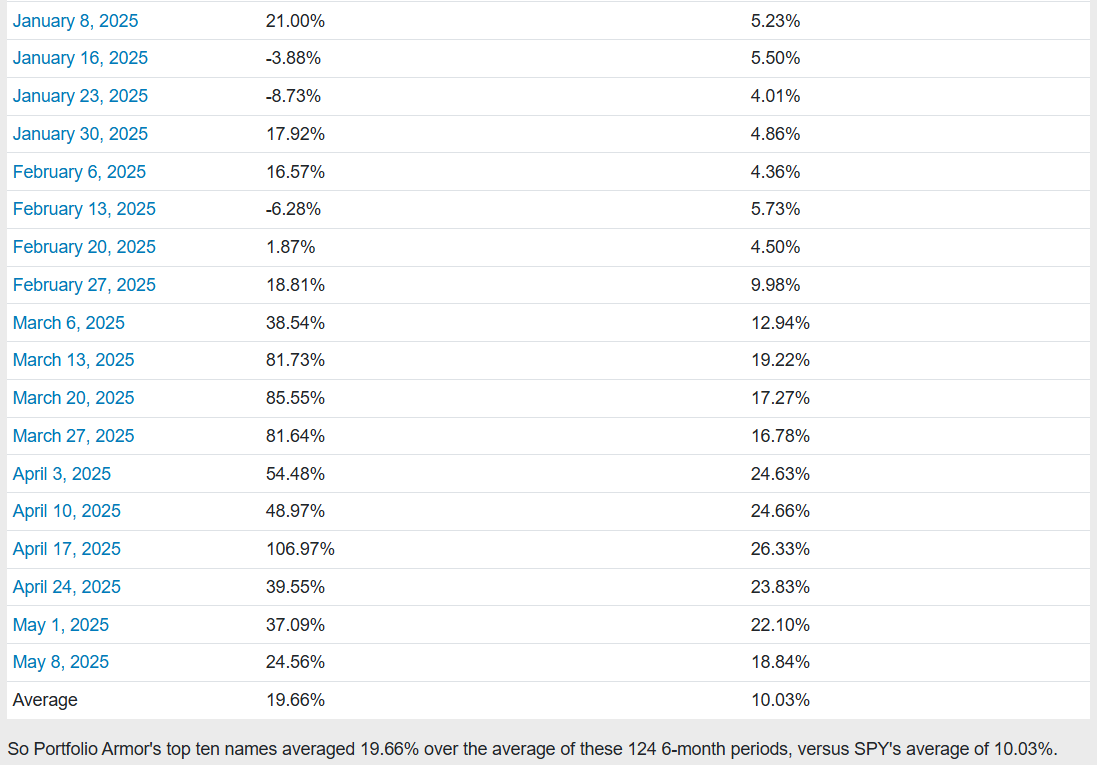

So far, we have 6-month returns for 124 weekly top names cohorts since we started this Substack at the end of December, 2022.

[Skipping ahead so this post doesn’t exceed email length—you can see the top names returns for every week here]

And as you can see above, our top names have averaged returns of 19.66% over the next six months, versus SPY’s average of 10.03%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.