The Market Pullback Has Been Worse Than It Looks

How we're adjusting our approach in light of it.

The Market Pullback Has Been Worse Than It Looks

And why the AI + Reindustrialization + Energy themes—and now biotech—still point to major opportunities on the other side.

The headline indices have barely flinched during this pullback, which makes the selling pressure underneath them easy to underestimate. As of Friday’s close, the Dow was only 4.18% off its highs. The S&P 500 was down 4.61%. Even the Nasdaq—home to the most momentum-heavy names—was “only” off 6.55%.

But that doesn’t tell the real story.

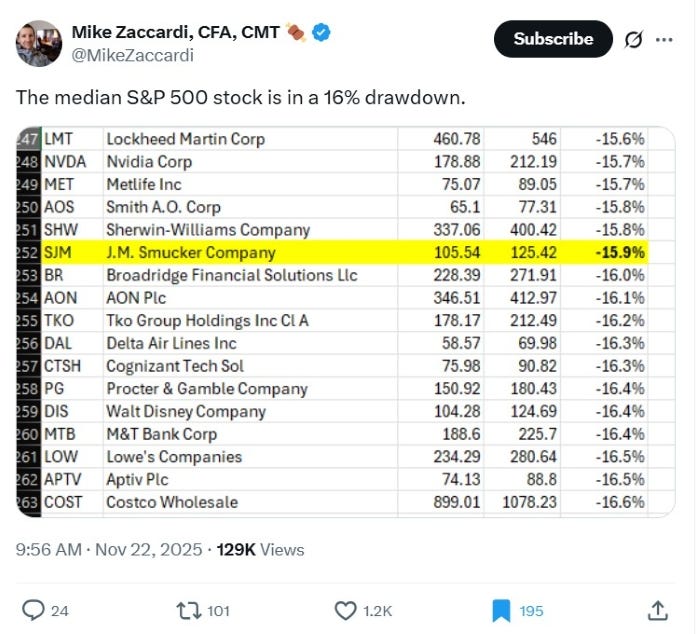

The median S&P 500 stock is down almost 16% from its recent high, as Mike Zaccardi, CFA, CMT points out here.

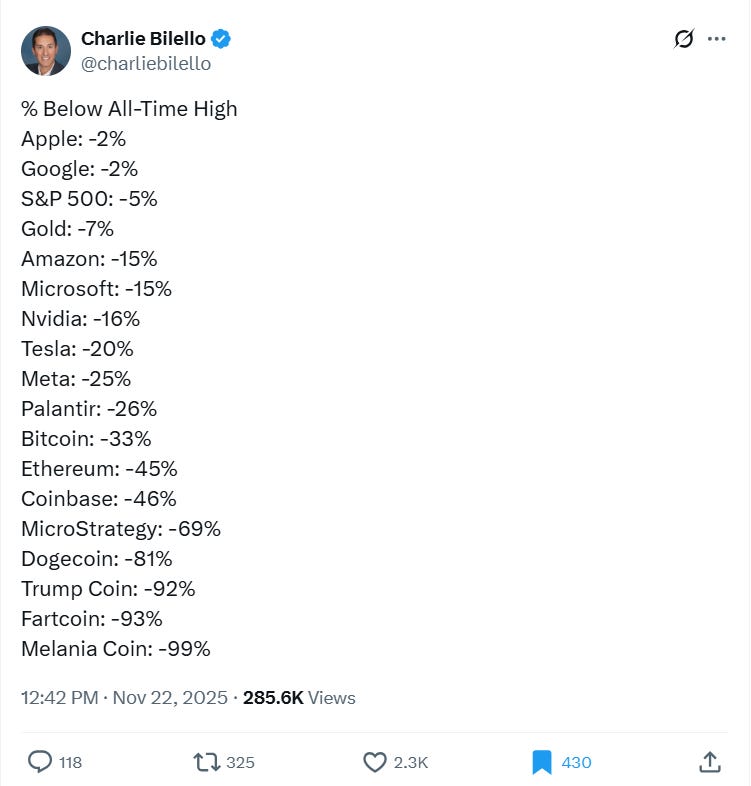

And some of the hottest names from earlier this year have been hit far harder: Palantir is down 26%, and Coinbase is down 46%, as Charlie Bilello noted here.

In other words: while the indices look calm, the market beneath them has already experienced a meaningful correction.

That’s the environment we’re actually trading in.

The Core Macro Themes Are Intact: AI, Reindustrialization, Energy

The irony is that the underlying story powering this market hasn’t broken at all. Last week, Nvidia (NVDA), Dycom Industries (DY), and Powell Industries (POWL) all reported strong results—beating expectations on both top and bottom lines.

These companies sit directly in the crosscurrents of the same forces that have driven this bull market for two years:

Massive AI build-out

Reindustrialization and infrastructure upgrades

Surging demand for power generation and grid capacity

Enormous data centers are being built everywhere—sucking up land, electricity, concrete, copper, switchgear, cables, transformers, and semiconductors. The suppliers feeding this build-out remain in an uptrend fundamentally, even if their stock prices have sagged with the broader pullback.

Of the four core themes I laid out over the summer (link)—Reindustrialization, Embodied AI, Energy, and Crypto—the first three are still very much alive.

Crypto is the only one that looks structurally broken for now. Its last major catalyst was the reelection of crypto-friendly President Trump last year, and it hasn’t found a new spark since.

In practice, biotech has replaced crypto as a core theme for me. More real innovation is happening there now, and investors have started to notice. Two examples that Portfolio Armor subscribers and I hold open positions in—Nurix Therapeutics (NRIX) and Personalis (PSNL)—were both up about 30% last week.

Innovation is happening. Capital is flowing. That’s where attention should be.

Updating Our Trade Selection Rules for This Environment

Last week I tightened our trade-entry process to avoid catching falling knives.

After seeing last week’s market action, I’m making two refinements.

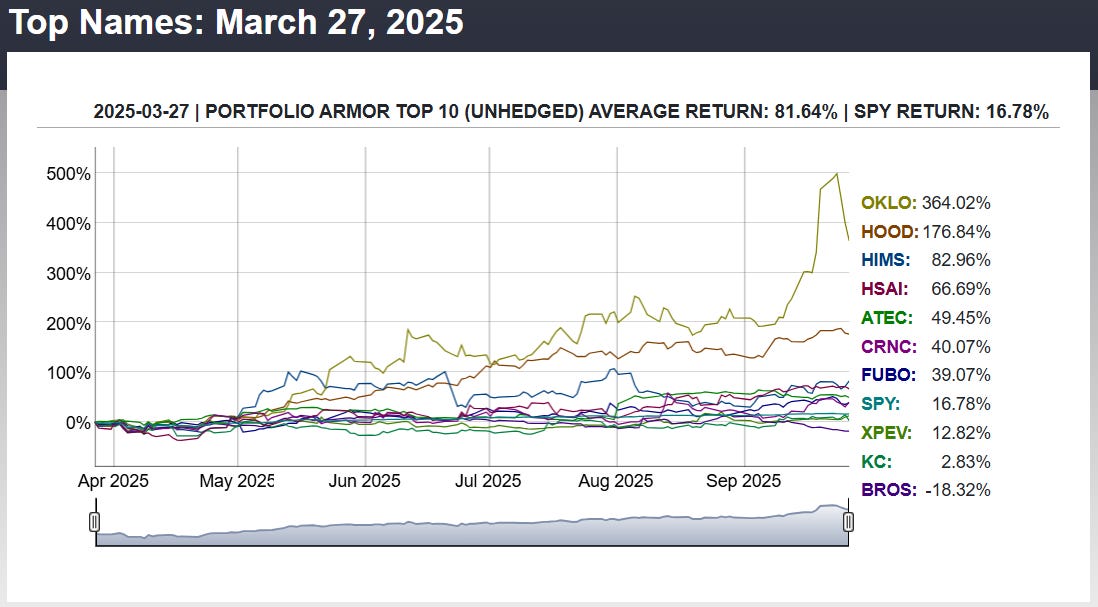

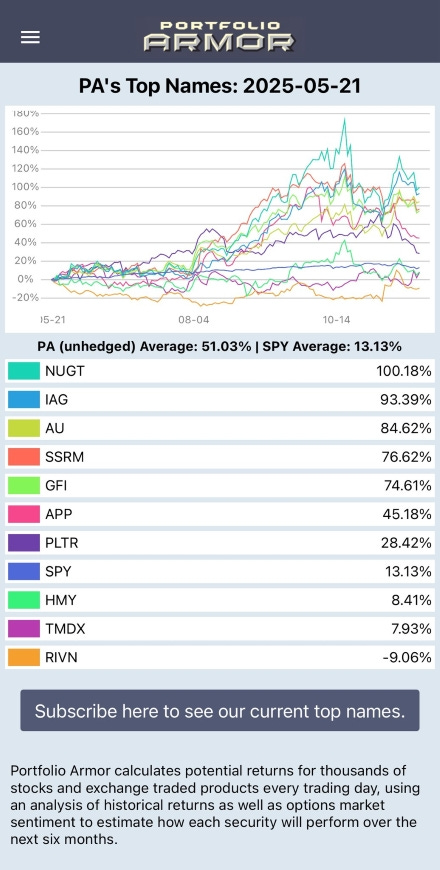

First, new Portfolio Armor Top Ten Names remain automatic green lights. The track record justifies that stance. Since I launched the Portfolio Armor Substack three years ago, across roughly 125 rolling six-month periods, our weekly top ten lists have averaged +19.90% over the next six months versus +10.06% for SPY.

That strength continued last week: the May 21st cohort just finished its six-month run at +51.03%, compared to +13.13% for SPY.

The Top Names engine is still working.

Where we need more caution now is with Top Names we already own that reappear in the Top Ten. A short-term pullback can increase a stock’s chances of making the list, since historically, names that were down over the past week and month have outperformed over the next six months. But in this market, some of those pullbacks have turned into mini free-falls.

So when an existing holding reappears in the Top Ten, it’s no longer an automatic green light. We want:

RSI (Relative Strength Index) over 30 (and rising, if under 40), and

A Chartmill Set-Up rating of 5 or higher (a measure of price consolidation)

This applies not only to Portfolio Armor names but also to the ideas we source from my Market Watchers list on X and from the Multibaggers list drawn from it of traders with documented triple-digit gains this year.

It’s fine to buy beaten-down names, but not ones that look like they’re going to keep getting beaten down.

One further adjustment:

We’re keeping the RSI ≥ 30 requirement, but dropping the requirement for a “cross up” through 30. Some stocks have pulled back without crashing, and it makes sense to stay open to those setups. The nuance is that rising RSI still matters most when RSI is below ~40; above that, a stable RSI is usually fine as long as the setup is strong.

Finally, two tactical points to manage risk as we add bullish options positions:

Use call expirations ~6 months out to increase our odds of surviving the correction.

Use “temporal diversification”—don’t reuse the same expiration dates on follow-on trades in the same name. This way, one bad expiration window doesn’t hit both positions at once.

What This Pullback Really Means

Momentum names cracking while the AI + Reindustrialization + Energy demand themes continue rolling forward is the sort of dislocation that consistently produces outsized opportunities.

This is exactly what happened during last spring’s bear phase. Our March 27th Top Names cohort—picked right in the teeth of that drawdown—went on to deliver exceptional six-month performance.

The current environment sets up similarly: strong fundamentals, weak price action, and a selection engine that has historically thrived on temporary dislocations.

If this correction continues a bit longer, it’s likely to give us some of the best setups we’ll see heading into 2026.

A Final Note for Risk-Averse Investors

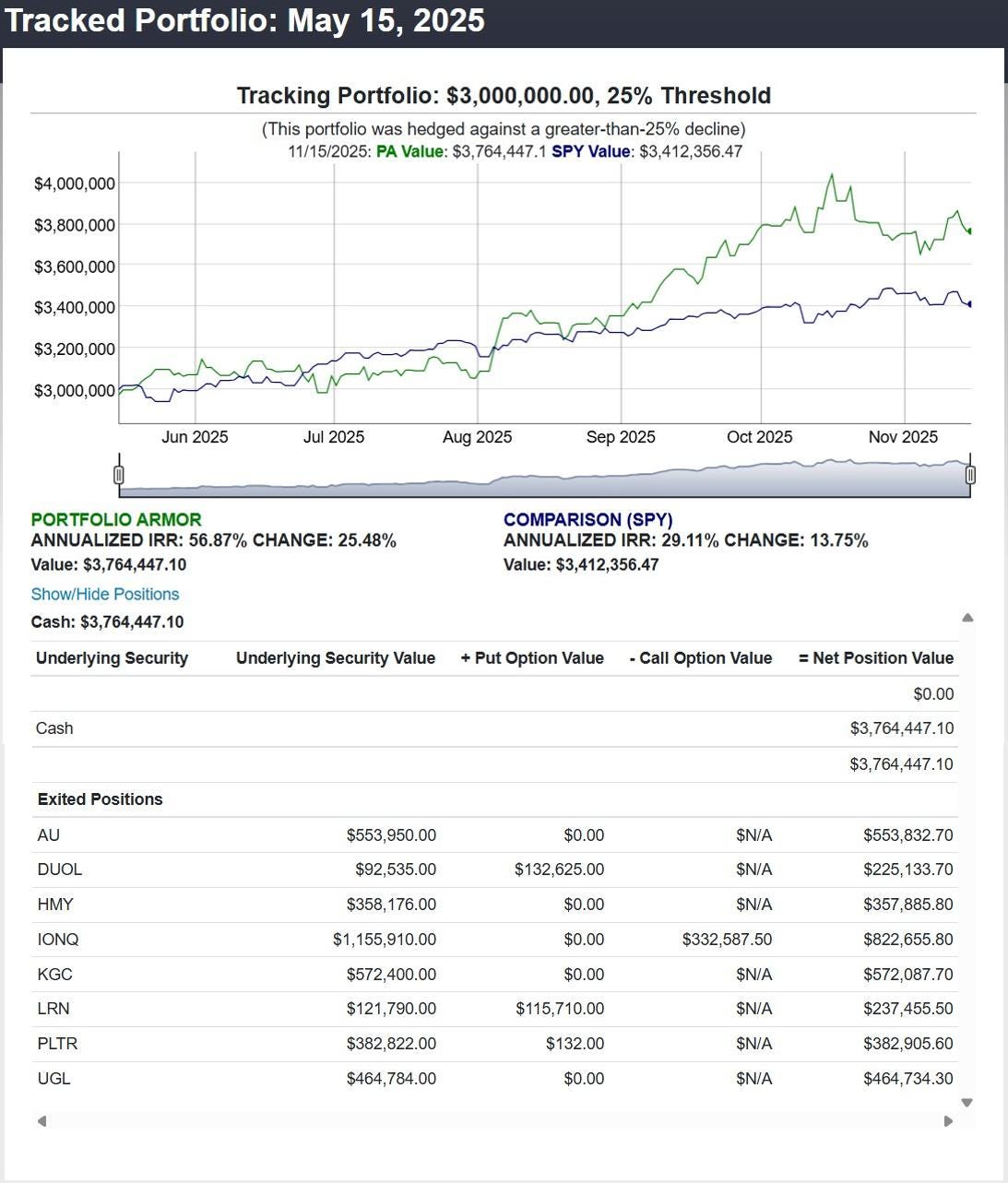

For investors who want upside exposure without riding out every market storm, remember that the Hedged Portfolio Method remains available through Portfolio Armor’s hedged-portfolio construction tool. As I wrote back in September, it’s objectively a better approach than indexing.

It’s a systematic approach to building portfolios with built-in protection—and the most recent hedged portfolios to complete their six-month runs have delivered strong results, even during a volatile period. Below is one example.

If you want equity upside but can’t stomach full-market drawdowns, the hedged approach remains a compelling alternative.