The Death Of Index Investing

After the passing of one of its most respected advocates, an alternative approach to consider.

One rational voice is dumb. Over his grave

the household of Impulse mourns one dearly loved:

sad is Eros, builder of cities,

and weeping anarchic Aphrodite.— W.H. Auden, “In Memory of Sigmund Freud”

The Death Of Index Investing

When Jonathan Clements passed away on Sunday, personal finance lost one of its most influential voices. Clements, a longtime Wall Street Journal columnist and the founder of Humble Dollar, spent his career championing index funds. In his own words in his final, posthumously published post, he spent years “pounding away at the virtues of index funds.”

He wasn’t alone. Nearly every major personal finance columnist and author of his generation echoed that refrain: put your money in index funds, and keep costs low. Their nod to risk management was usually a suggestion to diversify away from equities to some extent, e.g., putting 60% of your investable assets in equity index funds and 40% in bond index funds, something along those lines.

For decades, this advice worked well enough. But the last few years have shown that there’s a better way.

A More Flexible Alternative

Back in July, I published a post called Rough Seas, Smooth Ride, where I walked through an extremely conservative example of our hedged portfolio method: one hedged against a greater-than-4% decline over six months.

The method let investors set exactly how much downside they were willing to risk—and in that case, the trade-off for minimizing downside was modest but competitive returns.

But what if you’re willing to risk more?

The March 20th Portfolio

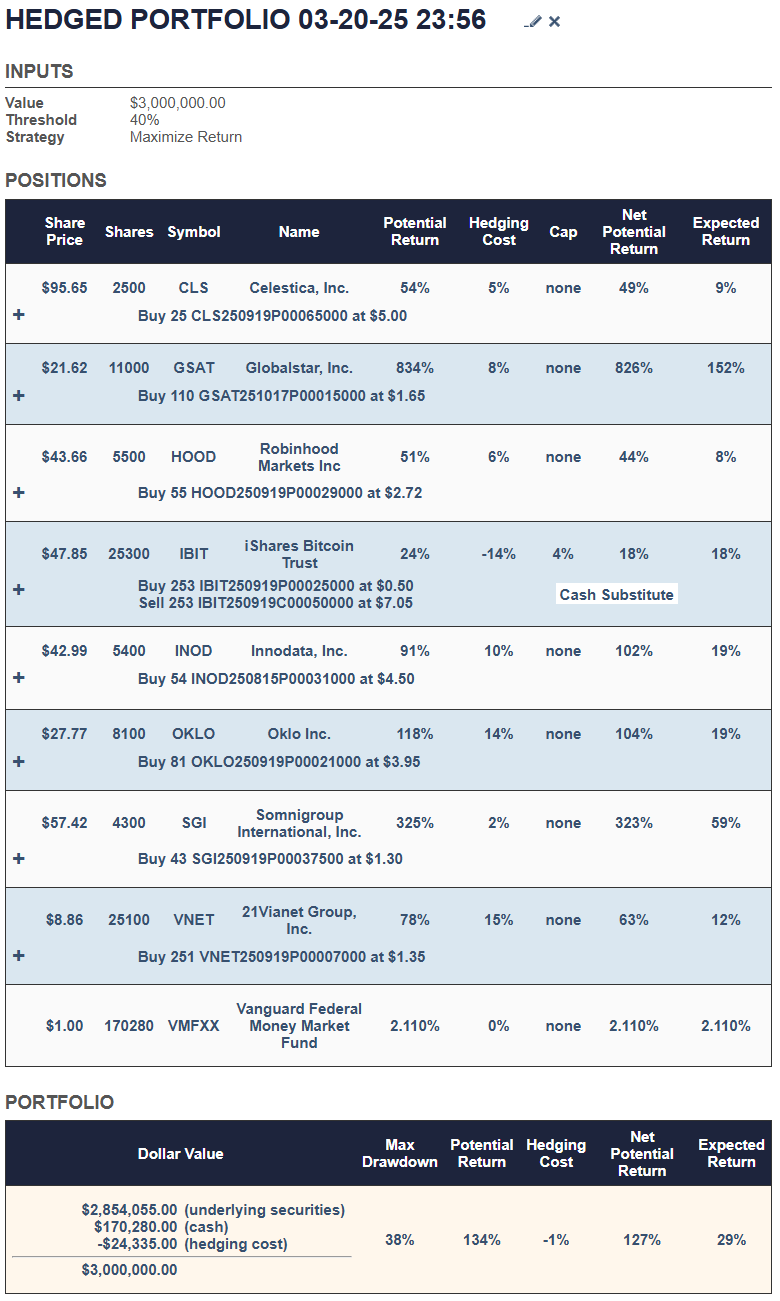

Here’s what happened with a portfolio constructed on March 20th, 2025, hedged against a greater-than-40% decline.

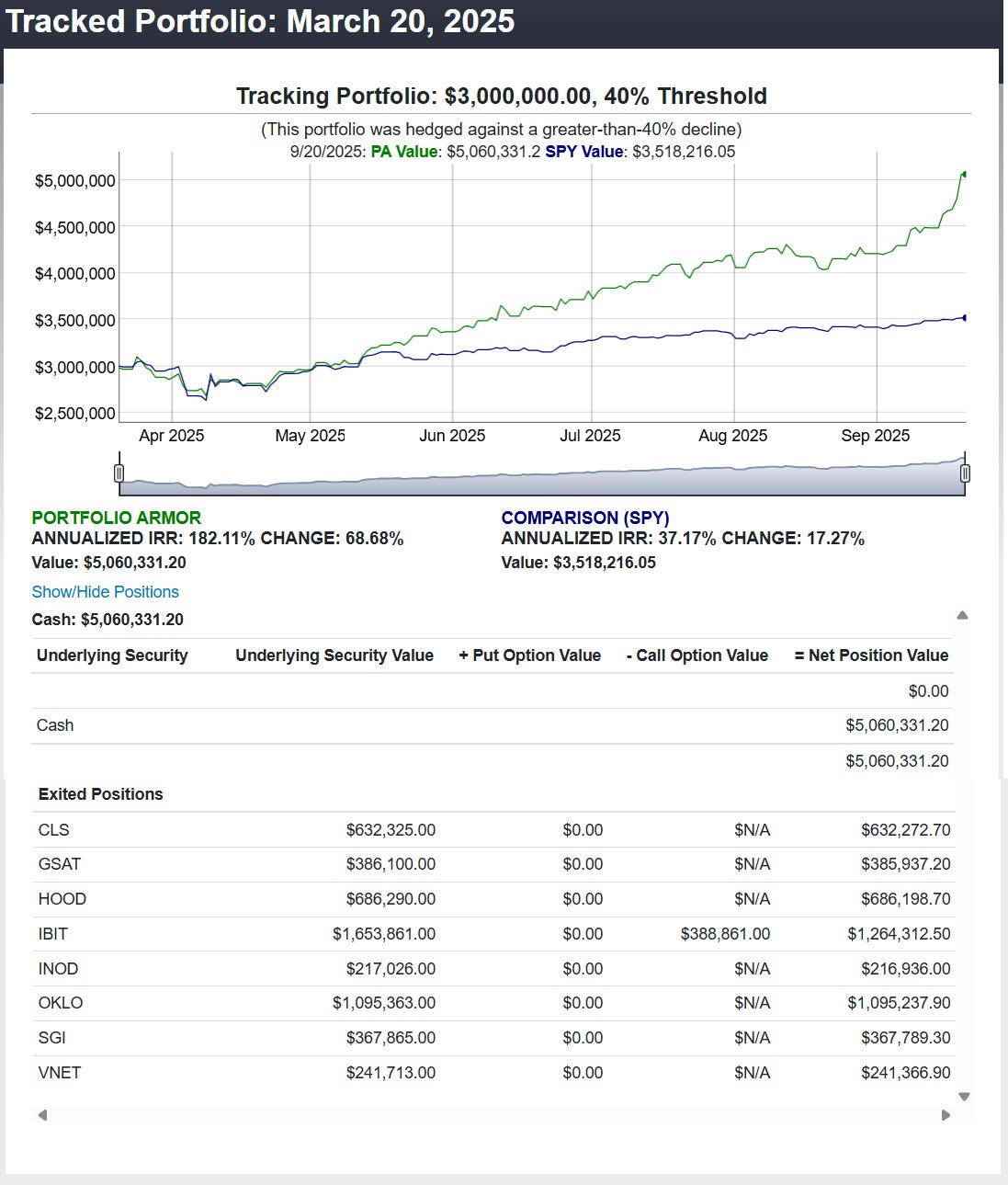

Six months later, here were the results:

This portfolio’s value grew from $3 million to just over $5 million—an astounding +68.68% gain in six months, nearly quadrupling the market’s performance over the same period. You can see an interactive version of the chart above here.

Not An Anomaly

It would be tempting to dismiss this as a fluke. But since we updated our security-selection process in the summer of 2022, the story has been consistent.

Every cohort of hedged portfolios set with decline thresholds of 20% or more—whether hedged against >20%, >25%, >30%, or >40% drops—has beaten the market on average. You can see the full record here: Portfolio Armor Performance.

In other words, while this particular >40% decline portfolio looks spectacular, it’s part of a broader pattern.

A Changing of the Guard

This brings us back to Jonathan Clements. He spent a career advocating index funds, and many of his peers did the same. But as the great physicist Max Planck once wrote,

“A new scientific truth does not triumph by convincing its opponents… but rather because its opponents eventually die, and a new generation grows up that is familiar with it.”

Index investing was the “new scientific truth” of its time. But the evidence from the last few years suggests the hedged portfolio method is something better: a way to set risk precisely and, on average, earn superior returns—without abandoning discipline.

Perhaps, as a new generation of investors and writers takes up the mantle, they’ll move beyond repeating the same case for index funds readers have read for decades and consider a method that is more adaptable, more resilient, and, as the data increasingly shows, more effective.

A Note on Portfolio Armor

Both the Portfolio Armor website and this Substack are built on the same foundation: our security selection method. On the website, that method powers the hedged portfolio construction tool, which uses it to populate hedged portfolios tailored to a given risk tolerance. Here on Substack, we use the same top-ranked names as a source of trade ideas, applying them through more aggressive options structures and strategies. Different approaches, same engine.