Rough Seas, Smooth Ride

How Portfolio Armor's hedged portfolio method handles choppy markets.

The Benefits Of Being Boring

Most of the time, I’d rather swing for the fences—LEAPS on a moonshot biotech are a lot more fun to talk about than a meticulously hedged, drawdown-capped portfolio. But a lot of investors sleep better owning something engineered not to blow up. And when markets whip around, the “boring” approach can quietly shine.

One of our hedged portfolios just finished its six‑month run this week. It was built on January 24th for an investor who told us, in effect: “I’ve got $3 million. I don’t want to risk losing more than 4% over the next six months. Do the best you can within that constraint.”

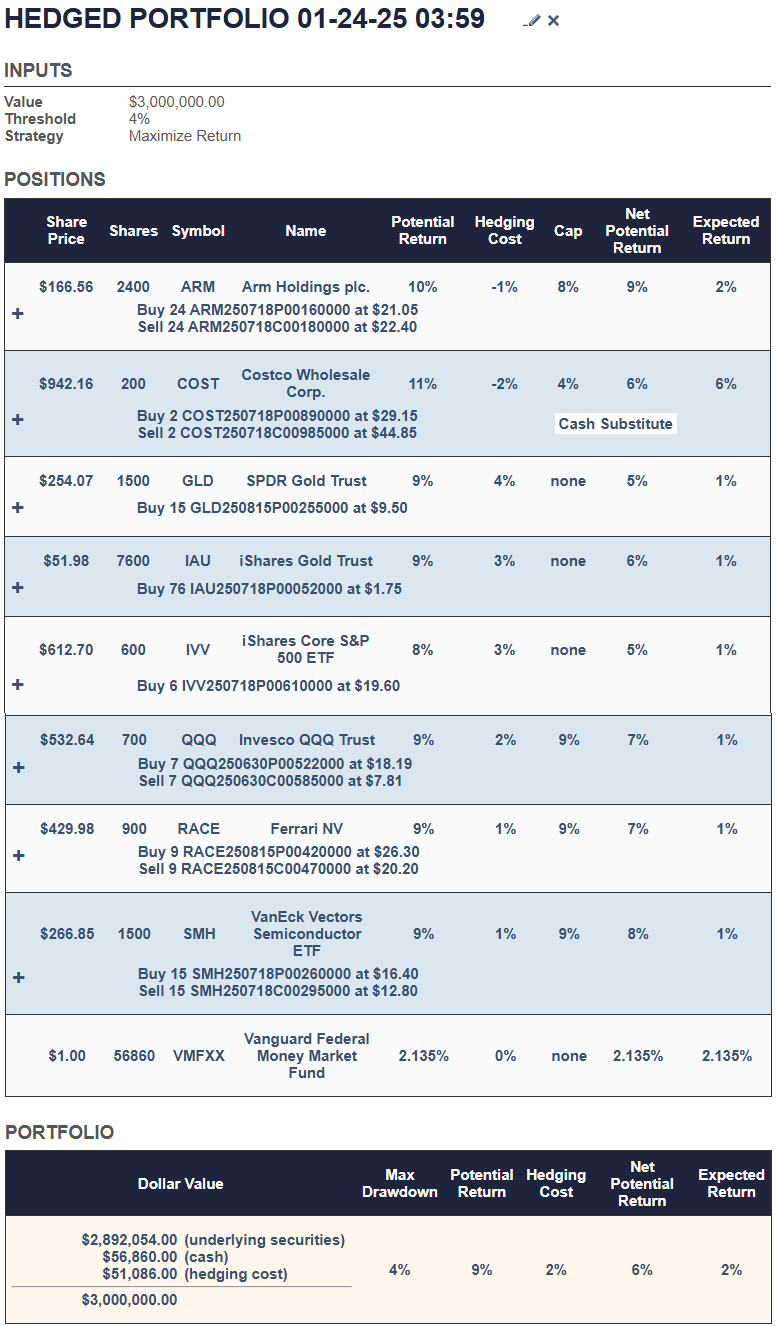

Below is the snapshot of what the algorithm produced that day.

The Core Idea

Portfolio Armor’s hedged portfolio method answers three questions simultaneously:

What should I own right now?

We start with our top names—securities the system estimates will outperform over the next six months.How do I make sure I don’t lose more than X%?

We hedge each position so that, in aggregate, the portfolio’s maximum drawdown is limited to your chosen threshold.How do I do #2 without killing my upside?

The tool searches billions of combinations of securities and hedges to minimize total hedging cost while keeping as much potential return as possible.

The result is a portfolio of stocks/ETFs paired with optimal puts or collars, plus a cash or cash‑equivalent sleeve—constructed to cap downside and preserve upside, then left alone for six months.

How The Tool Builds One

Here’s the workflow under the hood:

Inputs:

• Portfolio size (minimum $30,000).

• Max drawdown you’re willing to risk (e.g., 4%, 6%, 9%).

• Objective: “Maximize return” (default).Candidate Selection:

• Pull that day’s top names from Portfolio Armor’s daily ranking (based on historical returns, option market sentiment, and our own net potential return calculation).

• If your account size is small, we filter out high-dollar names so you can own round lots (100-share blocks) and hedge cost-effectively.Optimization:

• For each candidate, the algorithm evaluates the cost/benefit of hedging with optimal puts or with optimal collars (puts + short calls).

• It then solves a knapsack-like optimization problem: which mix of positions and hedges meets your drawdown constraint at the lowest aggregate cost, while maximizing expected return.Cash Substitute (how the system soaks up leftover cash):

• First, the algorithm splits the portfolio into equal tranches (seven here).

• It allocates most of those tranches to round lots of names hedgeable against your chosen threshold (in this case, >4%), drawn from the broader list beyond the daily top ten.

• Rounding down to whole lots leaves a cash pile. To minimize idle cash and hedging cost, the system allocates as much of that remainder as possible to a “cash substitute”—a security from a separate list that, when tightly collared (cap = 1% or current money‑market yield, whichever is higher; floor = your threshold), produces the largest net credit.

• In this portfolio, COST filled that role.

• Whatever still can’t be absorbed goes to a money market fund (we use VMFXX simply because its 7‑day yield is easy to pull).When To Exit:

• Hold the securities for roughly six months—until shortly before their hedges expire (the nearest expirations can be five to seven months out), or until a covered call is exercised and your shares are called away—whichever comes first.

• Otherwise, no tinkering. When you hit that exit point, rerun the process with current data and constraints.

January 24 Portfolio: Anatomy At A Glance

Inputs

Portfolio value: $3,000,000

Max drawdown: 4%

Strategy: Maximize Return

Positions & Hedges (examples from the screenshot):

ARM 0.00%↑ , GLD 0.00%↑, IAU 0.00%↑, IVV 0.00%↑, QQQ 0.00%↑, RACE 0.00%↑, SMH 0.00%↑, and a tightly collared COST 0.00%↑ position serving as the cash substitute; a small leftover sat in VMFXX.

Each equity/ETF was paired with either optimal puts or a collar—whichever delivered the best return/risk trade-off.

Total hedging cost: about 2% of the portfolio (paid up front).

Net potential return (after hedging): ~6% over six months.

Expected return (our conservative estimate): ~2%.

In other words: we constrained the downside to 4%, gave up a couple percent to protection, and still kept respectable upside in a jittery market.

So…Did It Work?

Short answer: Yes.

Click the chart link to see day-by-day results, but final day paints the full picture:

The portfolio stayed within its 4% risk budget, finished with a gain, and even outperformed SPY over the period (not something you should expect every time—especially in roaring bull markets with a 4% cap—but nice when it happens).

That’s the point—the ceiling may not dazzle, but the floor actually holds.

If you’re managing serious money for yourself (or clients) and want a rules-based way to cap drawdowns without going to cash or buying a blunt instrument like an index put, this approach earns its keep.

Track Record (4% Max-Drawdown Portfolios Since 2022)

Portfolios constructed with a 4% decline threshold have averaged 3.11% over six months (~6% annualized) since 2022. You can see the full list of results here.

Why “Boring” Can Be Powerful

Path matters. Two portfolios can end at the same value, but the one that never scared you out of it is the one you finished holding.

Volatility drag is real. Frequent big drawdowns mean you need larger rebounds just to break even. Smooth the ride, and compounding gets easier.

Discipline beats guessing. A repeatable process runs whether you feel bullish or nervous.

Think of this as your portfolio’s shock absorbers. You can still enjoy the drive—but the potholes don’t wreck your suspension.

Getting Started

Decide how much you want to allocate.

Decide how much pain you can tolerate over six months.

Let the tool do the heavy lifting.

You’ll get a printable report showing every position, the exact options to buy/sell, the projected max drawdown, and the expected/ potential returns. You can then enter the trades in your brokerage account (or have your advisor/RIA do it).

Final Thoughts

I built this because the standard “60/40 and pray” approach stopped making sense in a world where both stocks and bonds can tank together. Hedged portfolios give you a different knob to turn: risk, not just allocation.

Yes, I still like to roll the dice on asymmetric bets. But for the capital you absolutely don’t want to lose—or for clients who value sleep more than sizzle—being boring is a feature, not a bug.

If you want help setting one up, or want to talk through custom constraints (different time frames, tighter/wider drawdown limits), just reach out.

Manage risk like it’s your job (because it is—whether it’s your own capital or your clients’).

• Access the hedged portfolio tool: https://portfolioarmor.com/join-now

• Paid Portfolio Armor Substack subscribers: contact me for a discount code.

• Custom constraints or integration questions? Let’s talk.

Test: https://www.zerohedge.com/news/2025-07-28/rape-europa