Satellite Mind

Anatomy of a successful options trade on AST Spacemobile.

Step One: Find A Promising Stock

We did that with AST SpaceMobile (ASTS 3.54%↑) in August. As I wrote back then, the main attraction for us was that the stock had appeared in our system’s top names:

For the benefit of new readers: we have 6-month return data for 113 weekly top ten names cohorts, and, on average, they’ve outperformed the market-tracking SPDR S&P 500 Trust (SPY 0.29%↑), +16.10% versus +9.09%, over the next 6 months. Returns can be lumpy, but there’s real alpha here.

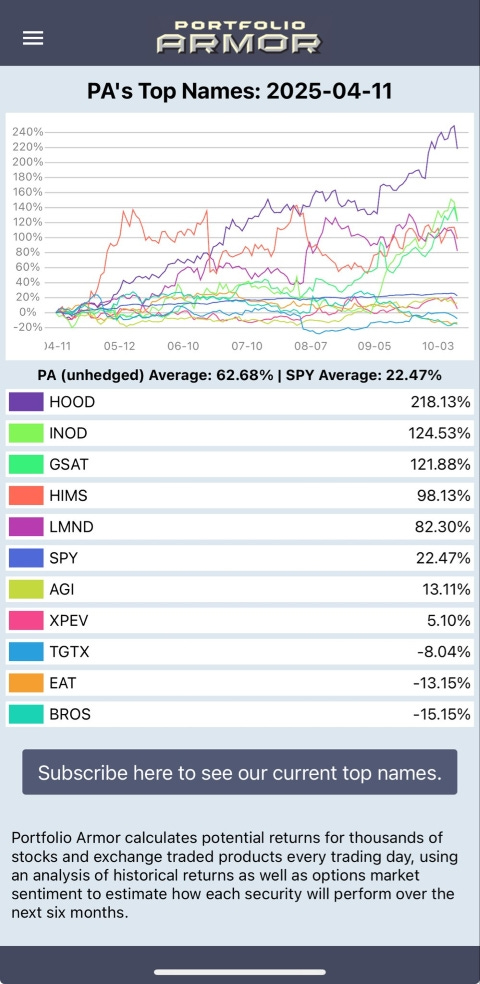

The average outperformance of our top ten names has widened in the seven weeks since, to +18.56% versus 9.61% for SPY 0.00%↑ over the next 6 months. You can see the 6-month performance of our top ten names from April 11th below.

The other reason ASTS looked promising to us is it was in a hot industry—space—but more on the commercial side. At the time we placed this trade, defense space names had cooled off a bit in the wake of President Trump’s summit with President Putin in Alaska.

Step Two: Find A Promising Trade Setup

Since options were expensive on ASTS, we used that to our advantage by harvesting high implied volatility on the way in. Our trade was a combo expiring on November 21st, consisting of these four legs:

Buying the $50 strike call,

Selling the $65 strike call,

Selling the $50 strike put, and

Buying the $47 strike put,

For a net debit of $2.80 or less. The max gain per contract on that structure was $1,220, the max loss loss $580, and the break even was with ASTS at $52.80. That trade filled for us at $2.70, so our prospects were a little better than that going in.

Step Three: Set Exit Orders

One of Stephen Covey’s famous seven habits of highly successful people was “Begin with the end in mind”. We do that with all of our options trades, setting GTC (Good ‘till Cancelled) exit orders immediately after we enter. These were our exit orders on our ASTS trade:

ASTS Call spread (legs 1 & 2): open a GTC order to exit at a net credit of $12.

ASTS Put spread (legs 3 & 4): open a GTC order to exit at a net debit of $0.20.

Step Four: Profit

Those exit orders filled automatically last week and this week:

4-leg combo on AST SpaceMobile (ASTS 5.04%↑). Entered at a net debit of $2.70 on 8/27/2025; exited the call spread at a net credit of $12 on 10/8/2025; exited the put spread at a net debit of $0.20 on 10/13/2025. Profit: 337%.1

On premium outlay; return on max risk = 160%.

Had they not filled automatically by expiration next month, we would have adjusted our prices on them.

These sorts of trades don’t always work, of course, but when they don’t work, your downside is strictly limited (in this case, to less than $600 per contract). We document all of our exits in an “Exits” post at the end of the week, and in this spreadsheet.