No Crying In The Casino

Where I went wrong with AirSculpt Technologies.

What I Got Wrong About AIRS

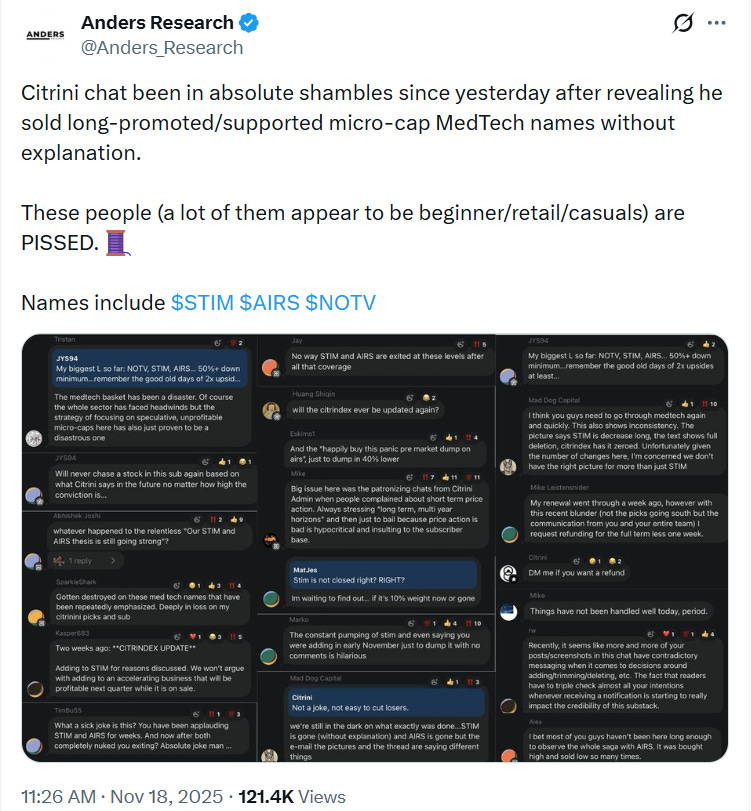

Last month, the #1 Substack in finance, Citrini Research, found itself in a bit of a controversy. As Anders Research pointed out on X,

Citrini abruptly exited several medical-tech names he had promoted, including AirSculpt Technologies (AIRS 0.00%↑), Inotiv (NOTV 0.00%↑), and Neuronetics (STIM 0.00%↑) , without explanation.

That sparked a broader discussion on X about what a newsletter author owes his subscribers: does he owe them a postmortem, or is it strictly “no crying in the casino”? Plenty of people came down on the side of caveat emptor.

I see it a little differently.

I run a smaller finance Substack than Citrini, but I think it’s healthier—for authors and subscribers—when authors critically evaluate their trades, especially the ones that don’t work out. If you’re serious about improving your process, you have to look in the mirror when something goes wrong.

In that spirit, let’s talk about what I did wrong with AirSculpt Technologies (AIRS).

Why Citrini Became #1—And Why That Matters

There’s a good reason Citrini Research climbed to the top spot in finance Substack: He has been early and excellent at identifying big macro themes. His GLP-1 coverage, for example, was ahead of the curve.

And once again, he seems to be early in recognizing the downstream demand for cosmetic and aesthetic procedures as GLP-1-driven weight loss accelerates.

Because of that, I added him to my Market Watchers X list, which tracks investing accounts whose insights are worth paying attention to.

Earlier this year, I also added him to my Multibaggers list—a curated subset of Market Watchers who’ve had multiple 100%+ winners this year. I’ve since removed him from Multibaggers—not as a knock, but because his style makes more sense in Market Watchers. Although he’s had some big winners, he’s a baskets guy, not a single-name conviction investor. He identifies a theme, then buys numerous names around it, often with < 1% weightings.

That distinction is important.

Where I Went Wrong: Treating AIRS Like a Conviction Name

I forgot that Citrini’s approach is basket-based, not single-name focused.

And as a result, I treated AIRS like a higher-conviction name than I should have.

It wasn’t a huge mistake in dollar terms, but I sized it a bit larger than I otherwise would have—and then, worse, I doubled down with a second trade as the stock went up.

Here’s how those trades have played out so far:

Calls on AirSculpt Technologies (AIRS 2.85%↑). Bought for $2.08, as part of a risk-reversal on 8/14/2025; sold (half) for $4 on 10/15/2025. Profit: 92%.

Put spread on AirSculpt Technologies (AIRS). Entered at a net credit of $0.80 as part of a 3-leg combo on 11/6/2025; effectively exited on 11/21/2025 via assignment of the $8 put and exercise of the $6 put.

Loss: 100%.

Other legs of those trades are still open, so it’s theoretically possible we’ll record some profits if AIRS turns things around over the next few months, but with AIRS trading under $4, it doesn’t look good. In any case, my mistake here was placing a second trade on a theme-basket name and treating it like a core conviction idea.

The GLP-1 “Last Mile” Aesthetic Thesis Still Makes Sense

Even though Citrini’s specific med-tech basket didn’t work out, the underlying thesis still looks directionally right:

GLP-1 drugs are causing massive weight loss.

Patients who lose a lot of weight will be more likely to seek “last-mile” aesthetic procedures—tightening skin, fixing stubborn pockets of fat, etc.

That demand doesn’t appear instantly; it builds with a lag as the patient population progressing through GLP-1 weight loss grows.

So the question becomes:

What’s the best way to express that thesis now?

In something with:

Strong profitability

Solid balance sheet

Real earnings

Attractive valuation

A bottoming technical structure

And enough liquidity to get in and out responsibly

So I spent time looking for a better expression of the GLP-1 aesthetic-procedure demand angle.

And I think I found one.

A Better Expression of the Theme

The company I’m looking at now:

Has a Chartmill profitability rating of 9, health rating of 8, valuation rating of 8

Beat on both top and bottom lines in its latest earnings release

Has an RSI that’s stabilizing near 47 and rising

Has a Chartmill set-up score of 8, suggesting the selling pressure may have exhausted itself

And unlike some former members of Citrini’s med-tech basket, it has real margins, real cash flow, and real global distribution

The stock has been beaten down a bit this year, but the fundamentals look strong, and technically it appears to be carving out a base here.

To express the thesis, I’ve created an options structure designed to give us:

Uncapped upside into early 2027, so more time for the GLP-1 aesthetic “second-order” trend to fully develop

Harvested near-term implied volatility to meaningfully offset the cost of the long-dated calls

I’ll be sending out a full trade alert later today with the details.

Stay tuned.