Exits: 9/26/2025

How we did on the trades we exited this week.

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None

Options

Four-leg combo on Worthington Enterprises (WOR 0.00%↑). Entered at a net debit of $1.58 on 9/19/2025. Assigned the short put on 9/25/2026, so sold the long put and shares. Exited at a net debit of $6.42 on 9/26/2025. Loss: 94%.

Calls on Asp Isotopes (ASPI 2.40%↑). Bought for $2.40 as part of a 3-leg combo on 9/4/2025; sold (half) at $5 on 9/23/2025. Profit: 108%

Four-leg combo on Applied Digital (APLD 21.50%↑). Entered at a net debit of $0.97 on 8/18/2025; exited the put leg at a net debit of $0.20 on 8/26/2025; exited the call leg at $4 on 9/22/2025, for a net credit of $3.80. Profit: 292%1

Risk-reversal on Intellia Therapeutics (NTLA -2.34%↓). Entered at a net debit of $1.27 on 7/18/2025; exited at a net credit of $5.64 on 9/23/2025. Profit: 344%2

On outlay; return on max risk = 144%.

On outlay; return on max risk (defined as NTLA going to $0 before expiration) = 39%.

Comments

Stocks or Exchange Traded Products

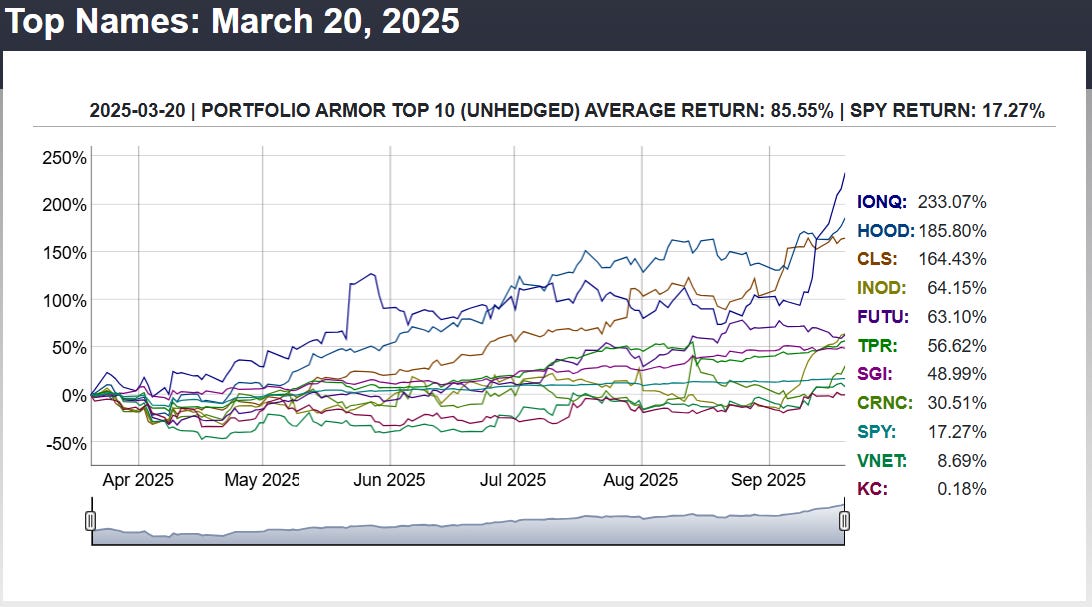

No exits this week, but our top names performance remains strong, as you can see below.

Options

Worthington Enterprises (WOR 0.00%↑) missed earnings this week, which led to our $65 strike puts getting assigned, so we exited the combo this week for a loss. We took profits on Asp Isotopes (ASPI 2.40%↑) and kept a runner. Expect the U.S. government to start buying stakes in nuclear names soon.

For Those Who Don’t Like Frequent Trading

Consider our hedged portfolio method. You can read about it and its recent performance here: