Exits, 7/18/2025

How we did on the trades we exited this week.

Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None

Options

Calls on Grab Holdings, Ltd. (GRAB 0.00%↑). Bought for $0.52 on 12/31/2024; expired worthless on 7/18/2025. Loss: 100%.

Calls on XPeng (XPEV -0.43%↓). Bought for $1.72 on 3/20/2025; expired worthless on 7/18/2025. Loss: 100%.

Calls on Lineage Cell Therapeutics (LCTX -1.99%↓). Bought for $0.20 on 6/20/2025; expired worthless on 7/18/2025.

Calls on Maximus (MMS -0.52%↓). Bought for $2.57 on 2/25/2025; expired worthless on 7/18/2025. Loss: 100%.

Puts on Invesco QQQ Trust ETF (QQQ -0.31%↓). Bought for $1.63 on 6/16/2025; expired worthless on 7/18/2025. Loss: 100%.

Calls on Grindr (GRND -0.55%↓). Bought for $0.50 on 6/13/2025; expired worthless on 7/18/2025. Loss: 100%.

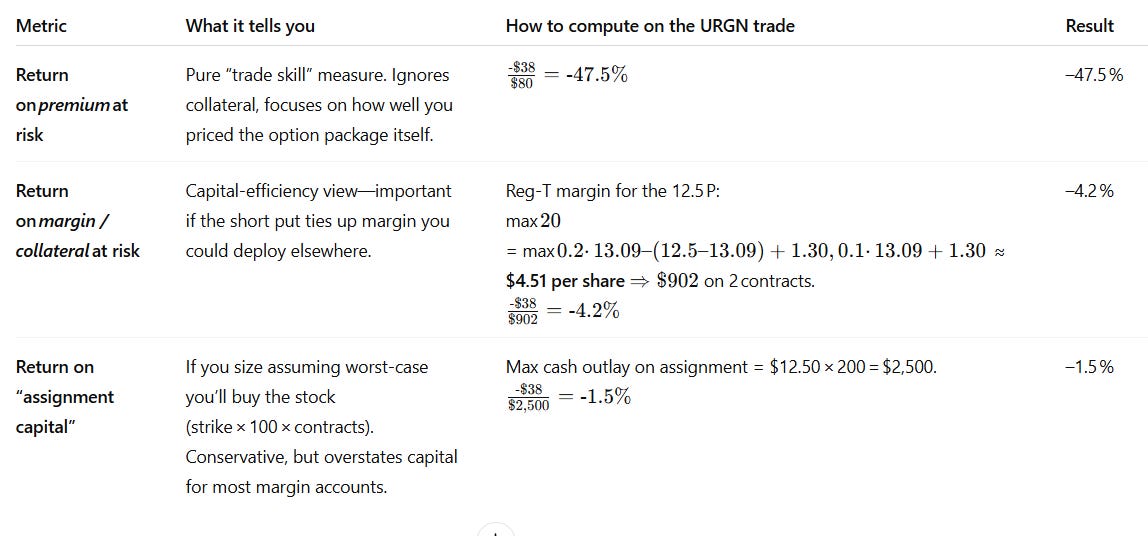

Risk-Reversal on Urogen Pharma ( URGN -3.40%↓ ). Bought calls for $1.70 and sold puts for $1.30 on 6/13/2025; sold the calls for $0.21 and the puts expired worthless on 7/18/2025. Loss: 48%.*

Calls on Anavex Life Sciences (AVXL -2.41%↓). Bought for $1.55 on 3/27/2025; sold for $0.90 on 7/18/2025. Loss: 42%.

Puts on KKR Real Estate Finance Trust (KREF -1.00%↓). Bought for $1.25 on 4/17/2025; sold for $1.06 on 7/18/2025. Loss: 15%.

Call spread on Super Micro Computer (SMCI 0.90%↑ ). Entered at a net debit of $0.48 on 7/3/2025; exited a net credit of $7.50 on 7/18/2025. Profit: 122%.

Calls on Sana Biotechnology ( SANA -2.19%↓). Bought for $0.70 on 6/10/2025; sold for $1.92 on 7/18/2025. Profit: 174%.

Comments

Stocks or Exchange Traded Products

No exits this week, as I haven’t gotten back into our core strategy directly yet (instead, I have sold puts on a couple of top names as part of risk-reversals, which ties up an similar amount of money), but since I started this Substack in December of 2022, our top names have averaged returns of 16.46% over the next six months, versus SPY’s average of 9.29%.

Options

Today was the big options expiration date for the month, so as usual, our losses collect on big OpEx days (since we usually exit winners before expiration). This OpeX included losers from as far back as last December. A few notes on these trades:

Grab Holdings, Ltd. (GRAB 0.00%↑) and XPeng (XPEV -0.43%↓): two Greater China names in our top names several months ago. GRAB is sort of a Southeast Asian DoorDash but XPeng is doing some cutting edge stuff with robotics, flying cars, etc. May be worth another look in the near future.

Lineage Cell Therapeutics (LCTX -1.99%↓) is another stock we may get back into in the future. We bought calls on this one ahead of a catalyst, and the data came in great, but the stock barely moved. I could have sold this shortly afterwards for a 25% loss, but was hoping we’d get more news that would move it before expiration.

Maximus (MMS -0.52%↓). The interesting thing about the trade alert for this post was it included short term bullish trades on two PA top names at the time, Robinhoood Markets (HOOD -0.67%↓) and Oklo, Inc. (OKLO 1.73%↑) that we’d be up huge on now, had I used further-out expirations.

Invesco QQQ Trust ETF (QQQ -0.31%↓). The optimal puts we bought on this were a hedge, which expired worthless, as hedges usually do. Nevertheless, hedging is worth doing when it’s cheap to do so. We used the Portfolio Armor iPhone app to scan for new optimal puts on QQQ earlier this week.

Sana Biotechnology ( SANA -2.19%↓). I took profits on these calls that were expiring today, but will probably reinvest those gains in this stock. One thing I have been trying to do recently is put more money in higher potential names.

*There are three different ways of calculating returns on risk-reversal trades. I have used return on premium at risk here. You can see how the returns would look with the other two methods below.