Exits, 2/6/2026

How we did on the trades we exited this week.

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options

Put spread on Amazon.com (AMZN 0.00%↑). Entered at a net credit of $1.21 on 2/4/2026 as part of a 4-leg combo; had the spread assigned and exercised at max loss on 2/6/2026. Loss: 100% on max risk (313% on premium collected).

Put spread on Coinbase Global (COIN 0.00%↑). Entered at a net credit of $3.90 on 11/7/2025 as part of a 4-leg combo; spread was assigned and exercised on 2/5/2026. Loss: 100% of max risk (156% of premium collected).

Short call on Cipher Mining (CIFR 0.00%↑). Sold to open for $3.25 on 11/28/2025 as part of a 4-leg hybrid combo; bought to close for $0.20 on 2/4/2026. Profit: 94%.

Short call on Symbotic (SYM 0.00%↑). Sold to open for $5.07 on 12/5/2025 as part of a 4-leg hybrid combo; bought to close for $0.20 on 2/5/2026. Profit: 96%.

Put spread on Lumentum Holdings (LITE 0.00%↑). Entered at a net credit of $2.72 on 1/14/2026 as part of a 4-leg combo; exited at a net debit of $0.10 on c. Profit: 96% of premium collected (115% of max risk).

Short call on Iris Energy (IREN 0.00%↑). Sold to open for $6.50 on 11/13/2025 as part of a 4-leg combo; bought to close for $0.20 on 2/5/2026. Profit: 97%.

Calls on Twist Bioscience (TWST 0.00%↑). Bought for $5.14 on 10/3/2025 as part of a 3-leg combo; sold half for $11.00 on 2/4/2026. Profit: 114%.

3-leg combo on Coterra Energy (CTRA 0.00%↑). Entered at a net debit of $1.55 on 10/21/2025; exited the November 7th, 2025 $22/$20 put spread at a net debit of $0.05 on 11/4/2025, and sold the June 18th, 2026 $25 calls at $5.30 on 2/4/2026, for a net value of $5.25 per contract. Profit: 239% of premium collected (104% of max risk).

4-leg combo on Littlefuse (LFUS 0.00%↑). Entered at a net credit of $0.50 on 10/13/2025; the November 21st, 2025 $250/$240 put spread was assigned and exercised at a max loss of $10.00 per spread on 11/21/2025, and we exited March 20th, 2026 $300/$320 call spread at a net credit of $16.00 on 2/4/2026, for a net value of $6.50 per contract. Profit: 1,300% of premium collected (68% of max risk).

Comments

Stocks or Exchange Traded Products

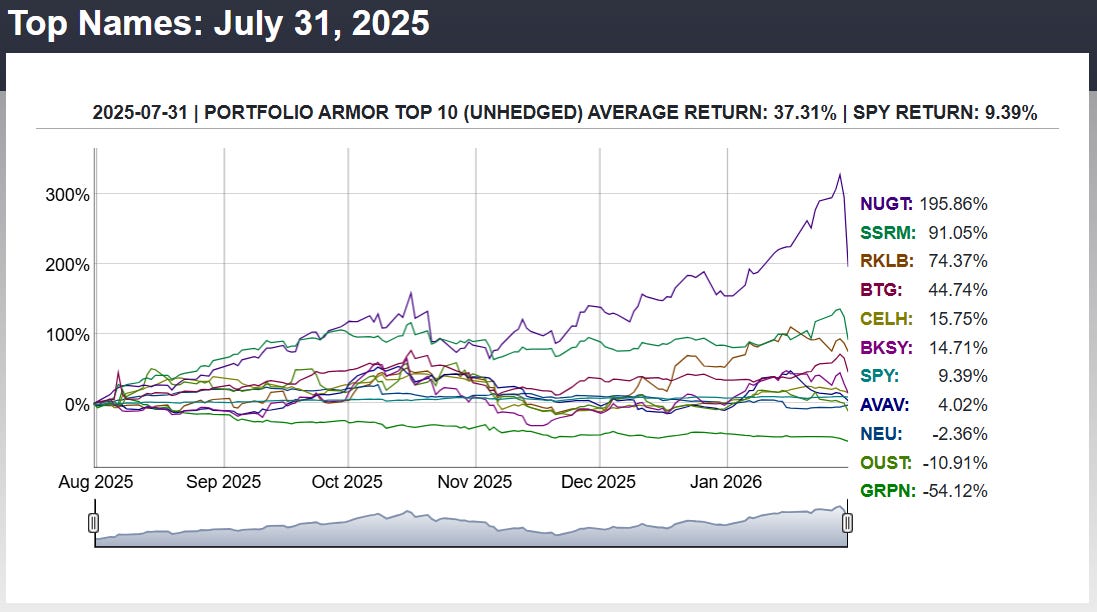

No exits this week, as I haven’t been doing our basic strategy, which involves buying stocks and ETFs, and have been focusing on options instead. Nevertheless, the performance of our system’s top names have nearly doubled that of the SPDR S&P 500 Trust (SPY 1.32%↑) since I started this Substack. Here’s the performance of our last weekly Top Names cohort to finish its 6-month run:

You can find the performance of all 136 weekly Top Names cohorts that have finished their 6-month runs here.

Options

Some violent moves in markets this week, so it’s encouraging that 7 out of our 9 partial or full exits this week were profitable ones. Regarding the losers:

Amazon.com (AMZN 0.00%↑). I think our thesis that Amazon will be one of the biggest beneficiaries of AI/robots remains true, but it looks like it’s going to take longer for that to play out. Their eye-watering capex estimates this week sank the stock.

Coinbase Global (COIN 0.00%↑). Obviously, crypto got clobbered, but I think I’m going to avoid this stock in the future. We’re currently underwater on a Robinhood Hood Markets (HOOD 0.00%↑) trade, but HOOD seems like a better choice overall than COIN, as it benefits from both crypto and stock market upside.

Regarding the winners, Littlefuse (LFUS 0.00%↑) is interesting here in that we lost money on the put spread but still made a nice profit on the overall trade. If we’re lucky, the same will be true of Amazon. We’ll see.

Also of interest are our partial trade exits on short calls this week. Those are components of options trade structures were we give up potential short-term gains in order to finance a bet on potentially higher longer term gains. With those trade structures, a short term market drop can work to our advantage, by giving us some initial gains and removing our upside caps.

Taking Advantage Of The Market Rebound

If today’s market rally continues on Monday, and you’d like to take that opportunity to add some downside protection, remember that you can use the Portfolio Armor web app or iPhone app to scan for optimal hedges.