Exits, 2/13/2026

How we did on the trades we exited this week.

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. Starting in July, 2024, I have also been tracking them in this spreadsheet. These are the trades I exited this week.

Stocks or Exchange Traded Products

None.

Options

4-leg combo on Robinhood Markets (HOOD 0.00%↑). Entered at a net credit of $0.90 on 1/26/2026; the put spread was assigned and exercised on 2/12/2026 and the call spread expired worthless on 2/13/2026. Loss: 99% on max risk.

Put spread on Palantir Technologies (PLTR 0.00%↑). Entered at a net credit of $1.97 as part of a 4-leg combo opened on 11/10/2025; the put spread was assigned and exercised on 2/12/2026. Loss: 100% on max risk.

Put spread on Sphere Entertainment (SPHR 0.00%↑). Entered for a net credit of $1.22 as part of a 4-leg combo on 2/5/2026; exited for a net debit of $0.20 on 2/12/2026. Profit: 84% on premium collected (16% on max risk).

Put spread on Zoetis (ZTS 0.00%↑). Entered for a net credit of $1.34 as part of a 4-leg combo on 12/26/2025; exited for a net debit of $0.20 on 2/13/2026. Profit: 85% on premium collected (return on max risk: 31%).

Put spread on Alamos Gold (AGI). Entered at a net credit of $1.60 as part of a 4-leg combo on 02/03/2026; exited at a net debit of $0.20 on 02/10/2026. Profit: 88% (41% on max risk).

Put spread on AXT (AXTI 0.00%↑). Entered at a net credit of $2.32, as part of a 3-leg combo, on 12/29/2025; exited it at a net debit of $0.20 on 02/09/2026. Profit: 91% (79% on max risk).

Put spread on AXT (AXTI 0.00%↑). Entered for a net credit of $2.15 as part of a 4-leg combo on 1/27/2026; exited for a net debit of $0.20 on 2/12/2026. Profit: 91% on premium collected (68% on max risk).

Calls on TIM S.A. (TIMB 0.00%↑). Bought for $0.92 on 11/19/2025 as part of a 3-leg combo; sold half at $3.00 on 02/11/2026. Profit: 226%.

Comments

Stocks or Exchange Traded Products

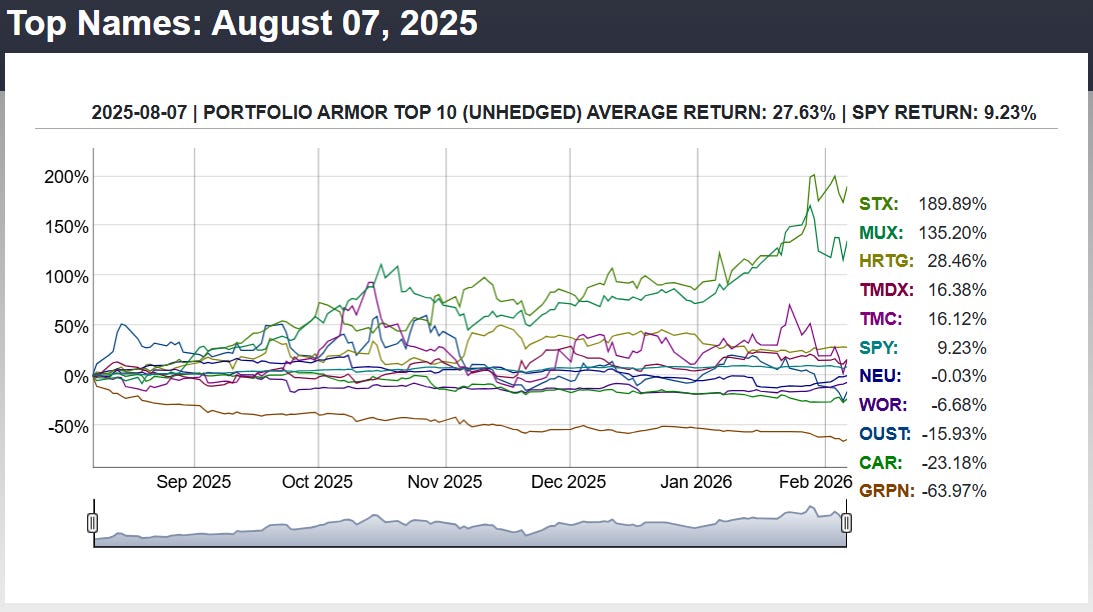

No exits this week, as I haven’t been doing our basic strategy, which involves buying stocks and ETFs, and have been focusing on options instead. Nevertheless, the performance of our system’s top names have nearly doubled that of the SPDR S&P 500 Trust (SPY 1.32%↑) since I started this Substack. Here’s the performance of our last weekly Top Names cohort to finish its 6-month run:

You can find the performance of all 137 weekly Top Names cohorts that have finished their 6-month runs here.

Options

As Michael Batnick noted recently, the market action this week has been pretty violent under the surface of the index.

So it’s encouraging that 6 of our 8 exits this week were profitable. Of the ones that weren’t, on Palantir and Robinhood, ideally, our tighter entry rules will help us avoid more falling knives going forward. The Palentir trade we entered before adding those rules, and the Robinhood trade we entered when we were screening for Chartmill setup scores of 5 and over. I subsequently tightened that to 6 and over after the market got rockier. The upside of that volatility, though, is it will give us some good trade entries we wouldn’t have had otherwise.