China Has Surpassed Us

The good news is we can still get back on track.

China’s Latest Flex

On September 28th, the the Huajiang Grand Canyon Bridge in Guizhou Province, Southwestern China, officially opened to traffic. The drone videos of this bridge being uploaded to YouTube are spectacular; you can see one below.

China’s Real Economy vs. Ours

That bridge is only the latest sign of China’s advance. By the hard measures of economic output and living standards, China has already surpassed us. Neither Washington nor Beijing has much incentive to advertise that, but the evidence is clear.

Consider energy. In 2024, China generated over 10,000 terawatt hours of electricity—more than twice as much as the United States and more than the U.S. and Europe combined. Steel production tells a similar story: China produced about 1.0 billion tons last year, compared to 79.5 million in the United States. Cement? Roughly 1.8 billion tons in China versus 84 million here—a twenty-fold difference. The same pattern repeats in industry after industry. China accounts for nearly 74% of all new shipbuilding orders worldwide. It exported about 5.5 million automobiles last year, compared with fewer than 1.8 million from the U.S. These aren’t abstract GDP figures; they are concrete measures of industrial strength. By those measures, China already dwarfs America.

Chinese industry has also proved to be astonishingly adaptable and advanced in recent years. One example is Xiaomi. Remember years ago, when Apple (AAPL 0.00%↑) flirted with the idea of building cars? Up until a few years ago, Xiaomi was sort of a lower-end Chinese hybrid of Apple and Sony; now it pumps out a highly-rated electric vehicles in a giant, automated factory.

It’s not an accident, incidentally, that nearly half of the cars produced for China’s domestic market are electric—it’s strategic. In the event of a conflict with the U.S. (or a future rival), the higher the percentage of China’s cars that are electric, the less vulnerable it is to a naval blockade of the Strait of Malacca, cutting it off from Mideastern oil. In the event of war, China would be able to husband its oil piped in from Russia for military use while keeping its civilian economy humming on electricity produced from nuclear, coal, and other sources.

Infrastructure, Safety, and High Trust

Infrastructure and urban life show an equally stark contrast. China now operates about 48,000 kilometers (29,826 miles) of true high-speed rail, while the United States operates none (to be fair, high-speed rail is less practical in the U.S.). The entire U.S. has only about 1,350 kilometers (839 miles) of metro systems; China has more than 11,000 kilometers (6,835 miles), spread across forty-seven cities. And China’s cities are not just larger and better connected—they’re safer. The homicide rate in China is 0.5 per 100,000, compared to 6.3 per 100,000 in the United States.

Visitors and expatriates often remark on something that’s become increasingly alien in America: China has quietly become a high-trust society. Westerners living in Shanghai or Shenzhen describe leaving laptops unattended on café tables without fear. One even recorded even recorded an example of that, with a hidden camera.

The same ease extends to payments and logistics. Nearly 969 million Chinese—about 88% of internet users—pay with mobile apps like Alipay or WeChat. In the United States, the figure is roughly 175 million users, or 65% penetration.

From Copying to Cutting Edge

Americans once comforted themselves with the notion that China could build but not innovate, that its engineers could copy Western designs but not produce breakthroughs of their own. That too is outdated. Chinese scientists recently demonstrated a robotic hand that can decode individual finger movements from a user’s brain signals non-invasively (unlike Elon Musk’s Neurolink, which uses a brain implant), a world first.

Biomedical researchers have created an oyster-inspired bone glue that can set fractures in minutes and safely dissolve in the body, obviating the need for metal screws. China was the first and only nation to land a probe on the far side of the moon (granted, not as impressive as landing men on the moon, but we haven’t done that in more than fifty years, and it’s not clear we could do it now if we wanted to). And in artificial intelligence, DeepSeek has emerged as a competitor to the most advanced Western reasoning models. In many fields, China is as or more advanced than us.

At Least We Still Have “Our Democracy”

China’s accomplishments challenge another cherished aspect American self-image: “our democracy.” American elites often assume that a one-party state is inherently inferior to a two-party or multiparty system. But if your party’s platform is to develop your country and raise your citizens’ standard of living… what would be the point of an opposition party? What’s the point of the opposition party here?

One might respond that the point is to debate which policies best achieve those goals. But these are really empirical questions, that can be settled by observation and experimentation, rather than debate. You can look at what policies have worked in successful countries, or you can try out different policies in different states and examine the results. But that’s not really how American democracy has worked in recent decades is it? To see what’s happened here more clearly, consider what it would have looked like in China.

Imagine that China had something similar to America’s current demographic composition. Suppose it were only 54% Han rather than 91%, and that a second party existed to advocate for non-Han Chinese at the expense of the Han majority, while simultaneously pushing for mass immigration to displace them further. Would China be better off today for having that kind of “democracy”? Or would it look more like our own fractured, gridlocked society?

Strategic Implications for U.S. Policy

When you realize that China has already surpassed us, the Trump administration’s moves to reassert the Monroe Doctrine makes sense.

If America can no longer outproduce China globally, it makes sense to focus on securing our own hemisphere rather than scattering resources abroad. And if you consider that China has automated factories like that Xiaomi one above producing antiship missiles instead of cars, it’s probably best to concede Taiwan to them while we can still get some diplomatic consideration for that.

The White Pill for America

There’s a natural human tendency to extrapolate from the present, and if you do that with respect to China and the U.S., our relative trajectory looks grim. But China’s own example should offer us hope. In less than fifty years, China transformed itself from a nation of starving peasants on bicycles to one of automated EV factories and lunar landings. It did so by abandoning disastrous Maoist policies—the Cultural Revolution that persecuted its intellectuals, the backyard blast furnaces that wasted scarce resources—in favor of rational, technocratic development.

America has been held back by its own elite follies. They opened our borders to mass third world immigration that has diluted the ~85% European population responsible for America’s 20th Century accomplishments, from building the Empire State Building, to inventing the 747, to putting a man on the moon, to creating Silicon Valley.

They implemented DEI policies that meant if you looked anything like one of those Fairchild Semiconductor founders, someone less qualified got accepted or hired over you. They embraced unilateral free trade that hollowed out our industrial base and helped build up China’s. If China could rebound from Maoism, America can rebound from its own version of it.

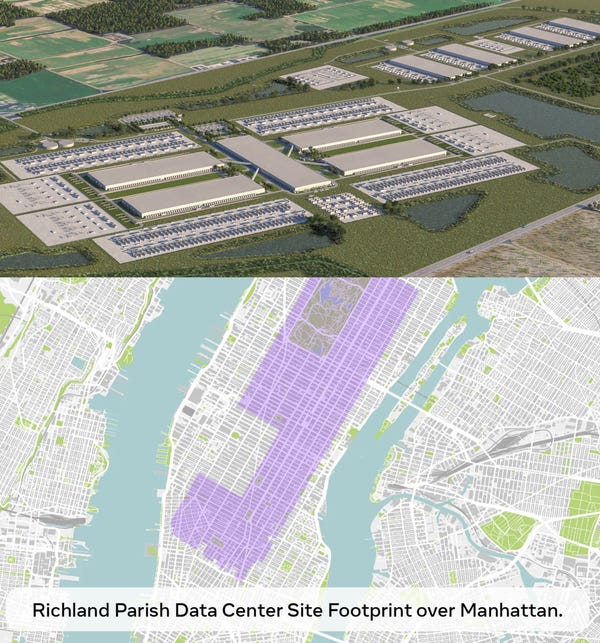

In fact, there are already signs that we can still build fast when incentives align. The rapid buildout of AI datacenters across the U.S., as documented by Citrini Research’s recent post, shows what happens when capital and policy point in the same direction.

Investment Implications

Before you dump everything U.S. and buy everything China, consider that the largest U.S.-listed China ETF buying the biggest China stocks, the iShares China Large-Cap ETF (FXI 0.00%↑), is essentially flat over the last ten years. Despite China’s growth, foreign index investors haven’t been rewarded.

Success in China has required selectivity and timing. We had some of both in the past, fortunately, and have a couple of open positions now, Futu Holdings (FUTU 0.00%↑) and Up Fintech Holding (TIGR 0.00%↑) . But you’d probably have better odds now betting on reindustrialization here. The U.S. is finally abandoning unilateral free trade, pushing reshoring and energy buildout, and channeling capital into AI infrastructure and robotics. Those are all themes we’ve been focusing on this year.