About Portfolio Armor

System First. Real Trades. Proven Edge.

Portfolio Armor ranks thousands of securities each day by their estimated six-month return potential.

I’ve used this system since 2017, but began publishing every trade based on it here on Substack in late 2022—when I added a new selection factor that significantly improved its accuracy.

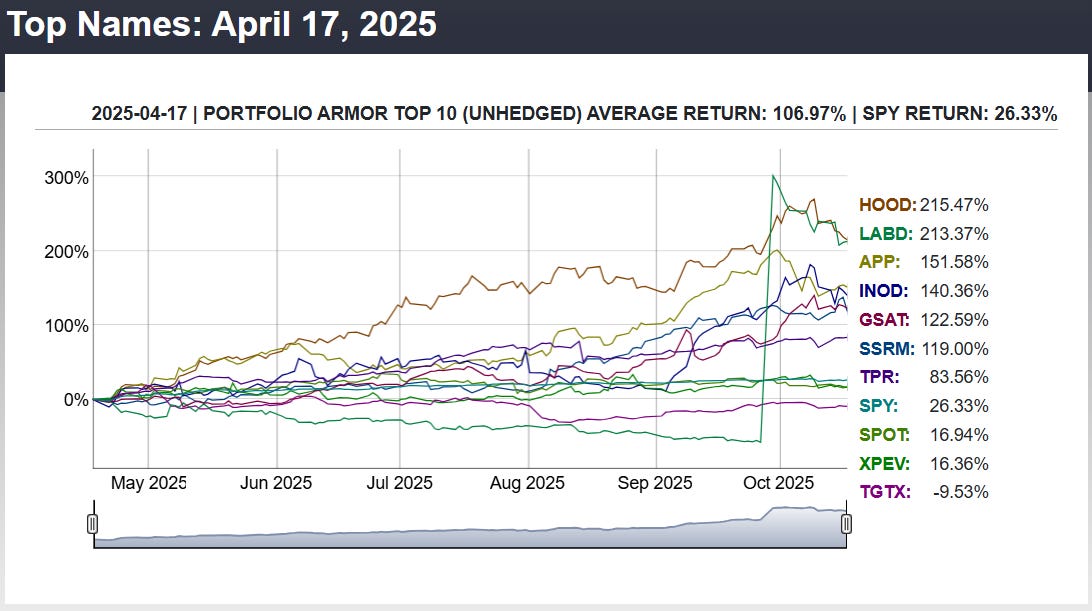

Since then, the average performance of our Top Names has been nearly double SPY’s over the same period

(see the data).

That’s the foundation of everything we do here.

What You’ll Get

Free subscribers receive:

All Exits posts with trade performance and commentary.

Access to our full trade-tracking spreadsheet, which shows ROI on premium outlay and links directly to every entry and exit.

Paid subscribers receive all of the above plus:

Weekly access to the current Top Ten names from our ranking model.

Every trade I place in real time, including structures, fills, and follow-ups.

Thematic analysis and updates on ongoing positions.

Every post arrives directly in your inbox—no dashboards to check, nothing to refresh.

The Hierarchy of Returns

Top Names performance

The unlevered performance of the highest-ranked securities in our model.

Since December 2022, this average return has significantly out-performed SPY’s.Core strategy

Buy equal-weight positions in the Top Ten names, place 15–20% trailing stops, and replace any that get stopped out.This approach historically outperforms the Top Names average, since you sell losers early and let winners run.

It’s a pure equity strategy—no options required.

Options-based trades

For those comfortable with options, we take the same signals and express them through defined-risk structures—often 3-and 4-leg combos; occasionally risk-reversals and other strategies.These aim to magnify returns through intelligent use of the inherent leverage in options and by harvesting high implied volatility before catalysts.

Full Transparency

Every exit is public.

Every fill is real.

No simulations, no cherry-picking.

Each week that a trade closes, I post an Exits article (available to everyone) showing:

Entry and exit prices

ROI on premium outlay or credit collected

ROI on maximum risk

Commentary on what went right or wrong

In our public spreadsheet, you’ll find ROI on premium outlay or credit collected for every trade.

Each entry date links to its trade alert, and each exit date links to the comment announcing the close—so you can verify every number yourself.

How We Manage Active Trades

We don’t need a running spreadsheet for open positions, because each trade comes with pre-set exit triggers.

Most profitable exits happen automatically, and as expiration dates approach, we handle the few laggards pragmatically—closing or salvaging remaining value.

Our Record

The Portfolio Armor model has been ranking stocks since 2017, but the current version—the one used here since late 2022—has produced its strongest results yet.

It has consistently identified top-performing stocks while avoiding, many of the market’s eventual losers.

All results are verifiable through our published posts and data links.

Not Investment Advice

I’m not your financial advisor, and nothing here is tailored to your personal situation.

What you’ll get are the actual trades I’m placing, executed with a disciplined, rules-based process that defines risk before targeting reward.

Refund Policy

No refunds on monthly memberships.

Prorated refunds on annual memberships are available upon request.