Trade Alert: Top Names

A bullish options trade on one of our top ten names from last night.

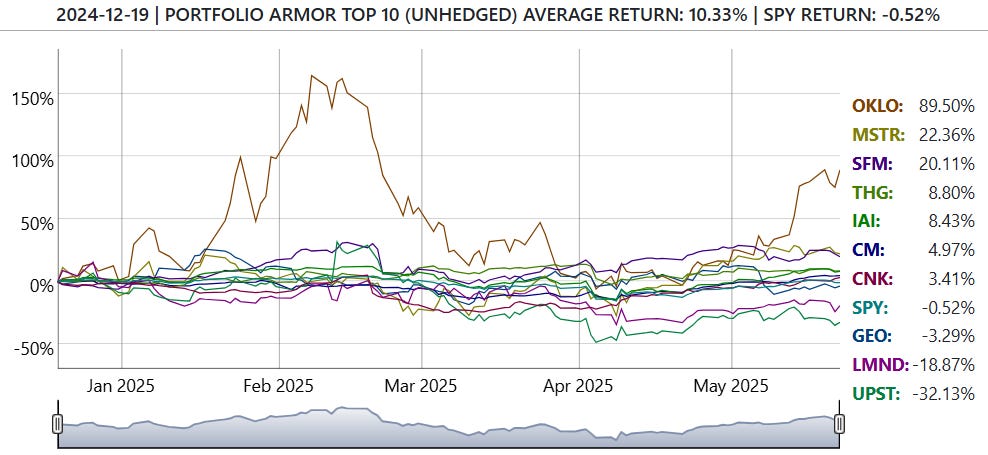

Our Top Ten Names Hit 100

As I mentioned in last night’s top names post, we now have 6-month return data from 100 weekly top names cohorts since I launched this Substack in December of 2022.

The average return of Portfolio Armor’s top ten names over the next six months was 16.68%, versus 9.88% for S&P 500-tracking ETF SPY 0.00%↑. So it’s been a good source of alpha for us.

A Bullish Bet Amid Market Uncertainty

“Market uncertainty” is, in one sense, a meaningless cliché: the market’s always uncertain. But in a more specific sense, it applies here. Amid the 90-day tariff truce, we have the bond market giving Washington a vote of non-confidence. So far, Treasury bond yields ticking higher haven’t caused another leg down in the stock market, but that seems like a real possibility here. So why place a bullish bet on one of our top names now? One reason is this one has real operating leverage, and an AI tailwind.

Time Enough To Absorb A Correction

But another is that, over a 6-month time frame, we can make money on a top name even if there’s a correction within those 6 months. The chart of the performance so far of our top ten names from December 19th illustrates this well. We opened an options trade on Oklo (OKLO 0.00%↑) on December 20th, the day after it hit our top ten names. That trade required a ~44% gain in the stock to generate a ~400% gain on our options. By early February, OKLO was up more than 150%; by early April, it was down more than 5%; as of Thursday’s close, it was up 89.5%.

So my plan here is to enter a trade going out about 6-months on today’s top name, and then if we have a correction in the near term, we can take advantage of that to enter a shorter-term bullish earnings trade on it.

The max upside on today’s trade is about 300%, with a max downside of 100%.

Details below.

Today’s Top Names Trade

The stock is Palantir (PLTR 0.00%↑), and our trade is a vertical spread expiring on October 17th, buying the $145 strike calls and selling the $165 strike calls, for a net debit of $4.80. The max gain on 1 contract is $1,520, the max loss is $480, and the break even is with PLTR at $149.80.

Exiting This Trade

I’m going to open a GTC order to exit this one at a net credit of $19.75, and lower that price if necessary, as we approach expiration.

Out of the PLTR call spread today at a net credit of $16, for a gain of 233%.

PLTR is trading at $172 now, after crushing earnings yesterday.