Trade Alert: Top Names +

Both our top names and our Market Watchers are aligned on this one.

A Brief Note About Posting Frequency

Before getting into this post, a quick note about my posting frequency here, since we’ve got a bunch of new subscribers this week. I don’t write posts here for the sake of writing them. The only regularly scheduled post here is the weekly Top Names post, which usually appears on Thursday. If I have any trade exits, I note those in an Exits post on Friday.

Other than that, I post a trade alert when I enter trades. Some weeks I may not enter any; I try not to force anything. And occasionally I’ll post something here I think may be of general interest, such as yesterday’s debt post.

The Two Big Gains We Missed Out On Yesterday

Two of my main sources for trade ideas are Portfolio Armor’s top ten names (which you can access daily for the low price of $30 per month on the Portfolio Armor iPhone app), and my Market Watchers list on X (which you can access daily for the even lower price of $0). On Wednesday, one name from each source posted monster gains.

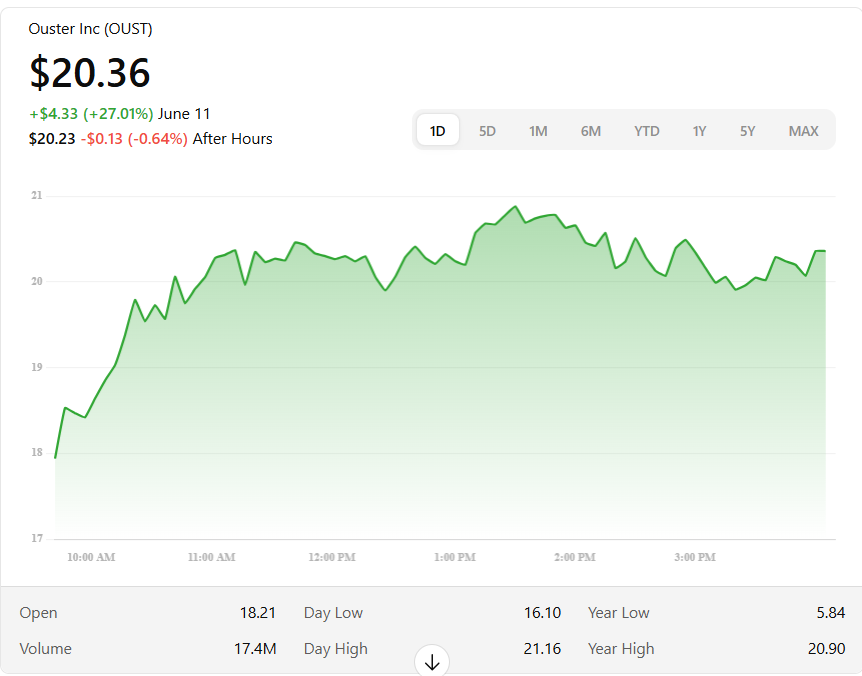

Ouster (OUST 0.00%↑), which had been discussed on my Market Watchers list, was up more than 27% on the day.

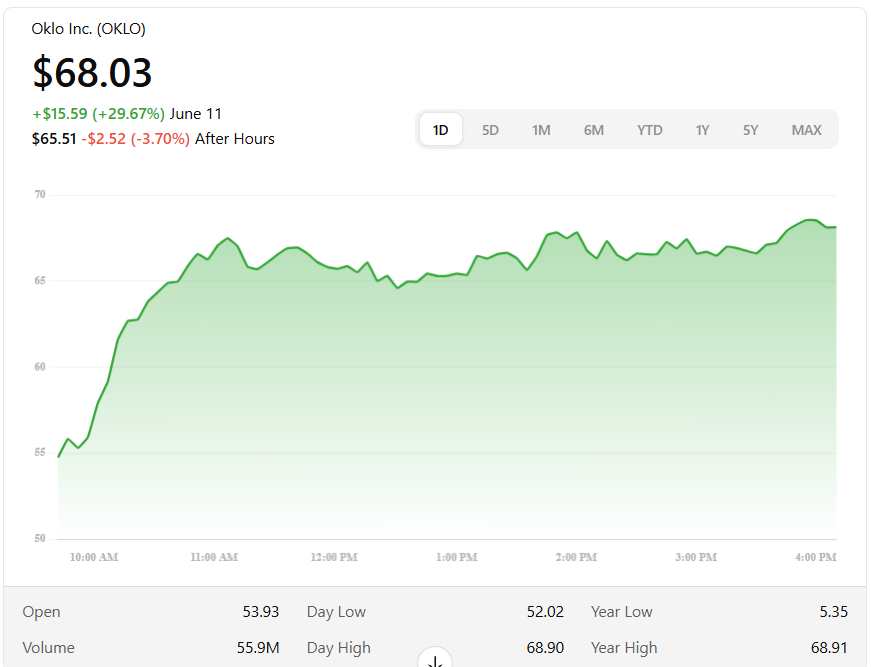

And Oklo (OKLO 0.00%↑), which was Portfolio Armor’s #6 name as of Tuesday’s close, was up more than 29%.

Coincidentally, both rose on Department of Defense news. Looks like OUST is getting a contract for its LIDAR and OKLO was selected to provide a modular nuclear reactor for an Air Force base in Alaska.

Bear in mind, that double-digit gains like these can translate to triple digit gains on an options trade. So why did I miss out on these?

In the case of OUST, I had been looking into it, but not with a sense of urgency; in the case of OKLO, I had just exited a trade on it for a 385% gain last week and thought it was a bit extended. My mistake.

A Triple Alignment On Wednesday Night

On Wednesday night, one of the names that’s been mentioned on my Market Watchers list appeared in the #2 spot on Portfolio Armor’s top ten names. On top of that, Nancy Pelosi, one of Congress’s top investors, owns it (I am not being ironic here; I think she is genuinely a good investor. Being tapped in to elites in San Francisco and Silicon Valley certainly doesn’t hurt in that regard).

We’re going to place a bullish options trade on that name today, before there’s a big move in it.

In addition, we have a bonus volatility trade today, in things pop off with Iran in the near future.

Details below.