Trade Alert: Top Names + Chips

Why we do this.

Why We Do This

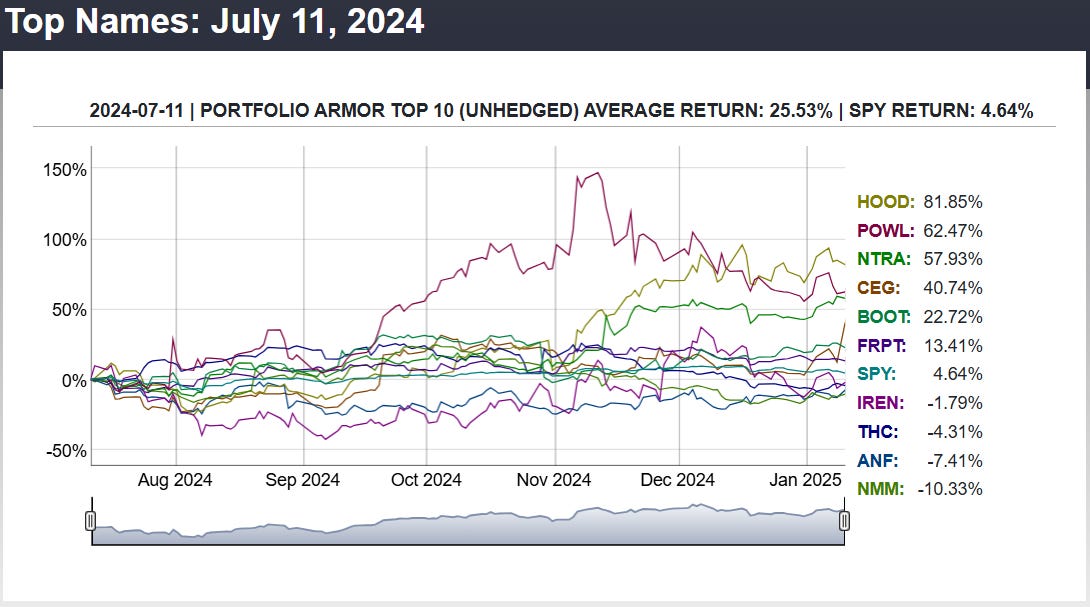

Before we get to today’s top names trade, let’s look again at how our top names from six months ago have performed since.

Screen capture via the Portfolio Armor website.

A rule of thumb looking at those stock returns is that a double digit return in an underlying stock can lead to a triple digit return in options. For example, we have an open trade on Robinhood (HOOD 0.00%↑) that is up about 626% so far. That’s why we place options trades on our top names.

Today’s Top Name Trade

Today’s top names trade is on our #2 name from last night, a chip stock. Taiwan Semiconductor’s (TSM 0.00%↑) earnings yesterday suggested the chip sector still has some big tailwinds from AI, and our chip stock should be positioned to benefit from it. Before we get to it, a warning.

Stocks Might Fall 30% to 40% This Year

That warning was from volatility trader Cem Karsan yesterday. Ordinarily, I’d take these sorts of warnings with a grain of salt, but Karsan recently predicted to the day when the post-election gap up in the market would get filled (on January 13th).

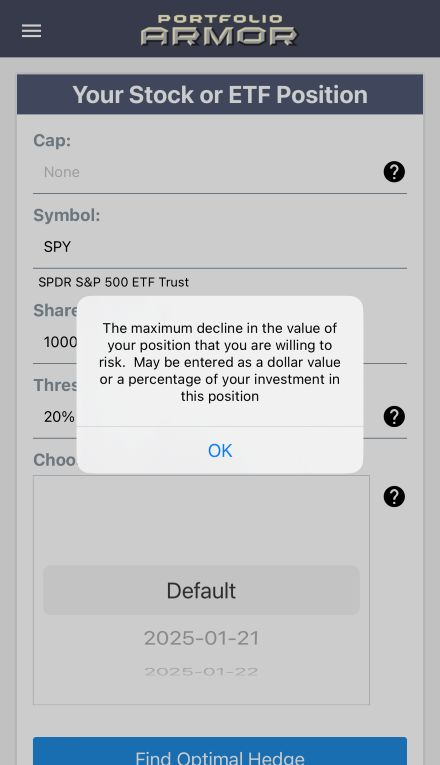

In light of Karsan’s warning, it may be prudent to add some downside protection here. A simple way to do that is to take the dollar amount of your stock portfolio, divide it by the current price of SPY 0.00%↑, round that number up to the nearest hundred, and enter that number in the “shares owned” field on the Portfolio Armor hedging app. Then you can enter the maximum drawdown you’re willing to risk, tap “Find Optimal Hedge”, and you’re on your way.

You can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

Back To Our Chip Stock Trade

If we’re right on this one, our maximum upside will be about 245%; if we’re wrong, we could lose up to 100%.

Details below.