Trade Alert: Top Names Bounce

Bullish bets on a PA top name that plummeted yesterday.

Taking Our Top Names To The Next Level

A few years ago, I was looking for a way to improve Portfolio Armor’s security selection system. At the time, in addition to gauging options market sentiment, it was looking at historical returns over 6-month periods. So we started looking at 1-week, 1-month, and 1-quarter returns as well. As I wrote in an X thread about that in August of 2022:

In late June, we added a new factor to the process we use to pick our top names. Those are the names we estimate will do best over the next six months. We post them on our website and app for subscribers daily. A quick thread about that.

The new factor was based on historical data we've been tracking which shows that, all else equal, securities that underperformed over the last week and month relative to their historic averages, outperform ones that did well over the most recent week and month.

The Result: Market-Beating Returns, On Average

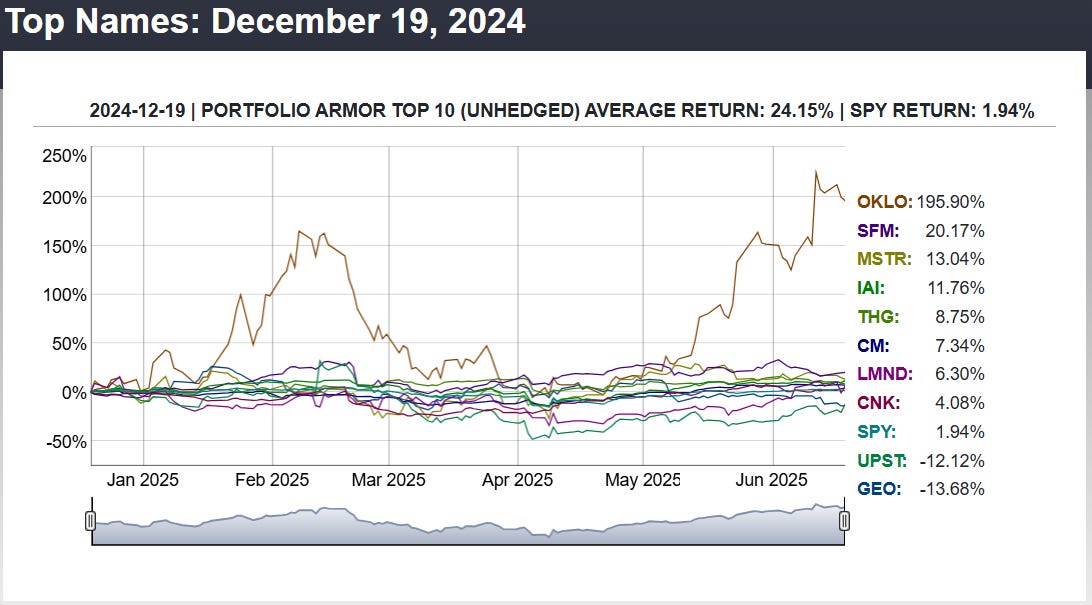

Adding that factor boosted our returns by getting us better entries into volatile names. I started this Substack a few months later, at the end of 2022, and since then, Portfolio Armor’s top ten names have averaged returns of 16.7% over the next six months, versus 9.47% for SPY 0.00%↑. As you can see from our most recent top names cohort to finish its 6-month run, sometimes most of the returns in a top ten batch come from one name.

Today’s top names trades are on a stock that ended up in our top ten names on Monday night in part because of that factor we added back in 2022. The stock plummeted yesterday, on a bad news headline (one that, in my opinion, doesn’t invalidate its bullish case).

We have one short-term options trade on it, and another that expires after its next earnings release in August. The worst case scenario in both trades is a loss of 100%, and the best case scenario might be gains of 200% or 300%.

Details below.

Today’s Short-Term Top Names Trade

The stock is Hims & Hers Health (HIMS 0.00%↑), and it plummeted by a third yesterday, after Novo Nordisk (NVO 0.00%↑) ended a GLP-1 agonist partnership with it. Our short-term trade is buying the $44 strike calls expiring on June 27th for $1.50. The max gain on 2 contracts is uncapped, the max loss is $300, and the break even is with HIMS at $45.50. This trade filled at $1.50.

Today’s Top Names Earnings Trade

Our earnings trade is opening a vertical spread on HIMS expiring on August 15th, buying the $45 strike calls, and selling the $60 strike calls, for a net debit of $3.50. The max gain on 1 contract is $1,150, the max loss is $350, and the break even is with HIMS at $48.50. This trade filled at $3.50.

Exiting These Trades

For the short-term trade, I’m going to open a GTC order to sell one contract at $4.50, and aim to be out of both before noon on Friday for whatever I can get for them. For the earnings trade, I’m going to open a GTC order to exit the spread for a net credit of $14.50, and lower that price, if necessary, as we approach expiration.

Out of the HIMS call spread for a net credit of $10, for a gain of 186%.

Out of the HIMS call expiring Friday at $1.74, for a gain of 16%.