Trade Alert: Short Term, Speculative

Betting that Trump will throw crypto and/or stock markets a bone tonight.

Hopefully, we’re not catching falling knives now.

Does Trump 2.0 Care About The Stock Market?

Probably not as much as Trump 1.0 did. This is not a typical presidency, where stock market and short term economic performance are top of mind for the administration. And this is not a “conservative” administration either. It’s aiming to be a revolutionary one, rolling back decades of left-establishment policy on immigration, trade, deficit expansion, race preferences, war, etc.

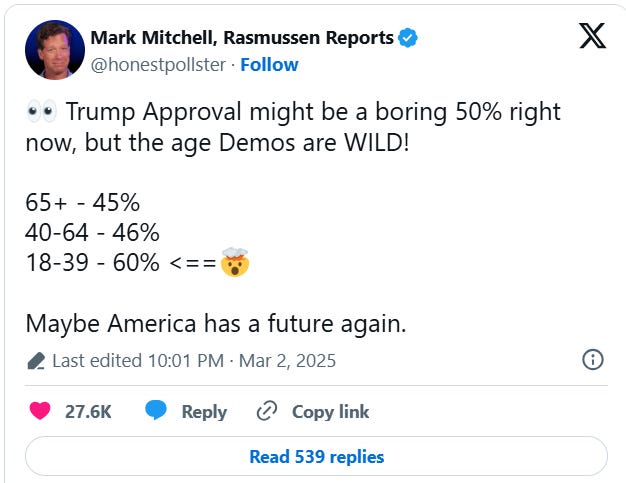

Also, in a reversal of typical Republican administrations, President Trump’s strongest support today comes from America’s youngest demographic—the one that owns the least amount of stocks and real estate.

So, stocks are probably not #1 in Trump 2.0. That said, I don’t think President Trump is completely insensitive to movements in stock or crypto. While real estate prices and interest rates coming down would help his biggest and youngest supporters, many of those young supporters still like to trade stocks and crypto. Today’s trade is a bet that the President will throw them a bone in his speech before a joint session of Congress tonight.

How We’re Approaching This

We’re going to use the approach that’s been successful for us recently: betting on a Portfolio Armor top name after a market drop. In addition to having been a Portfolio Armor top name last night, this stock is also positioned to benefit from a bounce in crypto.

To make this more exciting, we’re going to be buying options on it that expire this Friday. We’ll either make some money on these, or they will expire worthless on Friday and we’ll lose 100%.

Details below.

Today’s Short Term, Speculative Trade

The stock is Robinhood Markets (HOOD 0.00%↑), and our trade is buying the $45 strike calls expiring on March 7th for $1.50. The max gain on 2 contracts is uncapped, the max loss is $300, and the break even is with HOOD at $46.50. This trade filled at $1.46.

Exiting This Trade

If we get a bounce tomorrow, I’ll probably sell at least half of these contracts. I’ll try to sell all for whatever I can get before expiration on Friday.

I saw this post when it was trading at $1.65 so decided I had missed out. It's now trading at $3.80, more than twice what I could have bought it for.

Sold these calls today for $3, a gain of 105%.