Trade Alert: Rare Earth Reaction

Bullish bets on two of the less-obvious potential beneficiaries of China's new rare earth export restrictions.

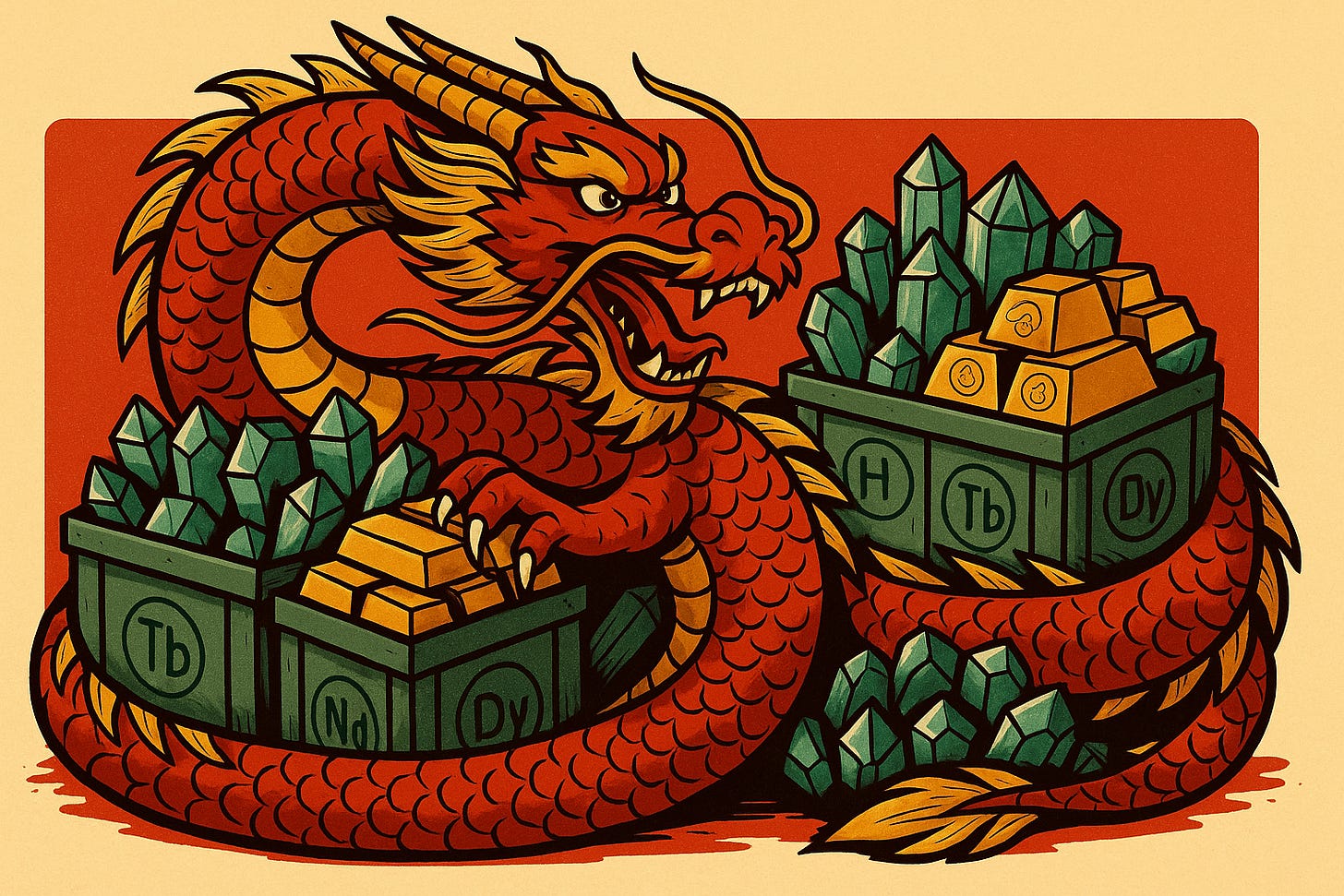

The Middle Kingdom Strikes Back

China just tightened the screws on rare-earth exports. Instead of chasing the obvious miners, we’re positioning in two second-order winners:

Materials workhorse for the AI era.

This company supplies the metal that gets more important when manufacturers dial back rare-earth magnets— and it’s exactly the metal the datacenter buildout and the U.S. power-grid expansion will devour (cables, busbars, transformers, cooling, everything). It’s a straightforward way to ride reindustrialization and AI infrastructure without single-metal risk.Factory eyes & brains.

As OEMs re-engineer drive systems to reduce rare-earth dependency, plants need more machine-vision and automation to retool, qualify, and scale new lines. This platform sells the sensors/software that make those lines run. It benefits whether the winning design is induction, SRM, or something new—because all of them require smarter inspection and control.

How we’re structuring it:

On both trades we’re harvesting elevated near-term implied volatility by selling a near-dated put spread to finance long-dated upside:

For the infrastructure name, we keep uncapped upside with long-dated calls.

For the automation name, we use a long-dated call vertical for defined risk while still leaving a wide runway.

As usual, we’re setting GTC exit orders ahead of time, so we don’t have to babysit these trades. Our goal there is cash some winners early and leave runners for further gains. Full details laid out below clearly, with zero jargon, as usual.