Trade Alert: Fading Canada

Betting against five Canadian companies in tariff trouble--plus, a bonus nanocap bullish trade.

The Trump Tariffs Continue

As I’ve mentioned before, the $64 trillion question is whether Trump’s tariffs are intended to balance trade (in which case, they’re sticking around) or a negotiating tactic (in which case, they’ll be rolled back).

On Sunday, we got two more indications that they’re meant to balance trade. The first was in a WSJ op/ed by Treasury Secretary Bessent, in which he wrote, “Tariffs are an effective tool for balancing international commerce.” (counterpoint: today Bessent suggested there could be trade deals as soon as this week). The second was a new tariff announced by President Trump, a 100% tariff on foreign movies.

Angle On: Canada

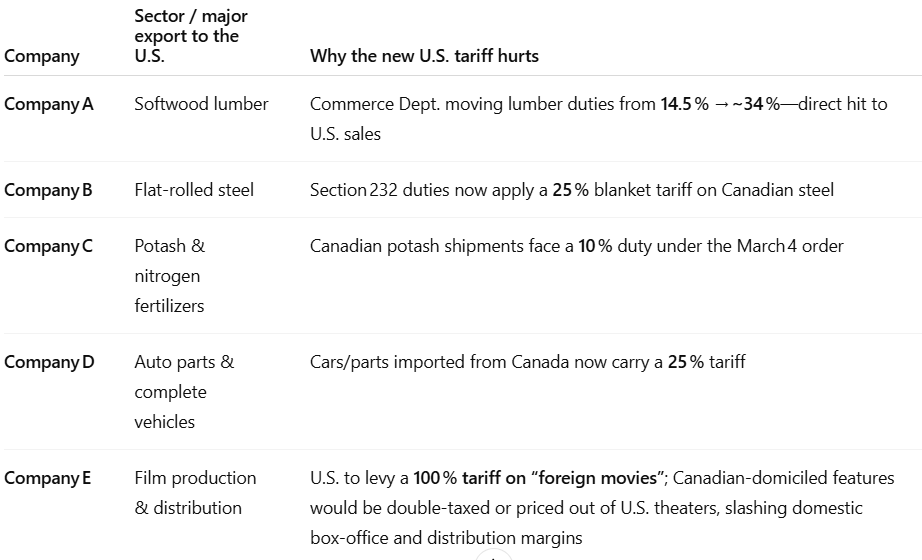

One country where a lot of movies shown in America are at least partially filmed is Canada. Coincidentally, Portfolio Armor Substack subscriber Zach asked over the weekend if we would be placing more bearish trades on Canadian names, as the prosect that the tariffs mostly won’t be rolled back doesn’t seem priced in yet. I noted that one of our trucking-related names last week was Canadian,

And said I’d do some more research on other possible Canadian stocks we could bet against. I looked for names that met these three criteria:

Have shares traded in the U.S.

Have options traded on those shares.

Are likely to be materially negatively impacted by new U.S. tariffs.

And I came up with five:

Today, we have bearish trades on all of them. The maximum risk on all of these trades are losses of 100%, and the maximum upsides vary, but are more than 100%.

In addition, we have a bonus bullish trade on a nanocap stock, surfaced on our Market Watchers X list. This is an industrial in the cogeneration/HVAC/refrigeration sector that may be about to get its first datacenter client. That would get it more attention as a picks & shovels play on AI.

Details below.

Bearish Trade A

The company is West Fraser Timber (WFG 0.00%↑), and our trade is a vertical spread expiring on June 20th, buying the $75 strike calls and selling the $70 strike calls, for a net credit of $3.25. The max gain on 2 contracts is $650, the max loss is $350, and the break even is with WFG at $73.25. This trade hasn’t filled yet. This trade filled at $3.25 on 5/7/2025.

Bearish Trade B

The stock is Algoma Steel Group (ASTL 0.00%↑), and our trade is buying the $6 strike puts expiring on August 15th, for $1. The max loss on 4 contracts is $400, and the break even is with ASTL at $5. This trade hasn’t filled yet. This trade filled at $1 on 5/8/2025.

Bearish Trade C

The stock is Nutrien (NTR 0.00%↑), and our trade is a vertical spread expiring on June 20th, buying the $57.50 strike calls and selling the $52.50 strike calls, for a net credit of $3.05. The max gain on 2 contracts is $610, the max loss is $390, and the break even is with NTR at $55.55. This trade filled at $3.05.

Bearish Trade D

The stock is Magna International (MGA 0.00%↑), and our trade is a vertical spread expiring on June 20th, buying the $35 strike calls and selling the $30 strike calls, for a net credit of $3. The max gain on 2 contracts is $600, the max loss is $400, and the break even is with MGA at $33. This trade hasn’t filled yet. This trade filled at $3 on 5/8/2025.

Bearish Trade E

The stock is Lions Gate Entertainment ($LGF/A), and our trade is buying the $8 strike puts expiring on September 19th, for $0.90. The max gain on 4 contracts is uncapped, the max loss is $360, and the break even is with LGF/A at $7.10. This trade filled at $0.90.

Bonus Bullish Trade

The company is Tecogen ( TGEN 0.00%↑), and our trade is buying the stock for $3.26. This is the Market Watchers post that prompted me to place this trade. This trade filled at $3.26.

Exiting These Trades

Assuming they all fill:

WFG: open a GTC order to exit for a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

ASTL: open a GTC order to exit half of the puts for $2, and try to sell all for whatever we can get for them before expiration.

NTR: open a GTC order to exit for a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

MGA: open a GTC order to exit for a net debit of $0.20, and raise that price, if necessary, as we approach expiration.

LGF/A: open a GTC order to exit half of the puts for $1.80, and try to sell all for whatever we can get for them before expiration.

TGEN: Let’s keep an eye on this one as the story develops. In any case, I will let you know via chat as soon as I exit.

Out of the ASTS puts yesterday at $1.34, for a gain of 34%.

Sold a quarter of my TGEN shares at $9.60 today, for a gain of 194%. May buy more shares or calls on a pullback. If I do, I will post a trade alert for it, of course.