Trade Alert: Crypto

A pre-earnings trade and a post-earnings trade.

Waiting For The Right Setup

In our Exits post over the weekend, I wrote about using Chartmill’s Setup Rating, a measure of technical consolidation, to time entries into post-earnings trades;

In the past, I’ve placed post-earnings trades in situations like this, where a stock is down despite solid earnings (also in some cases where there was an earnings miss but I was still bullish on the stock. One difference I’m doing now is waiting for some price consolidation before placing post-earnings trades. Specifically, I set an alert on Chartmill for when the Setup Rating on the stock hits 7 (out of 10), while the overall Technical Rating is at least a 6. That increases the chance we’re not catching a falling knife. Then we can jump in and place a longer-term bullish trade. I plan to do that with COIN, as I am still bullish on it.

Today, Coinbase (COIN 0.00%↑) has a set-up rating of 7, so I placed a bullish bet on it expiring after its next earnings release.

Looking For An Upside Target

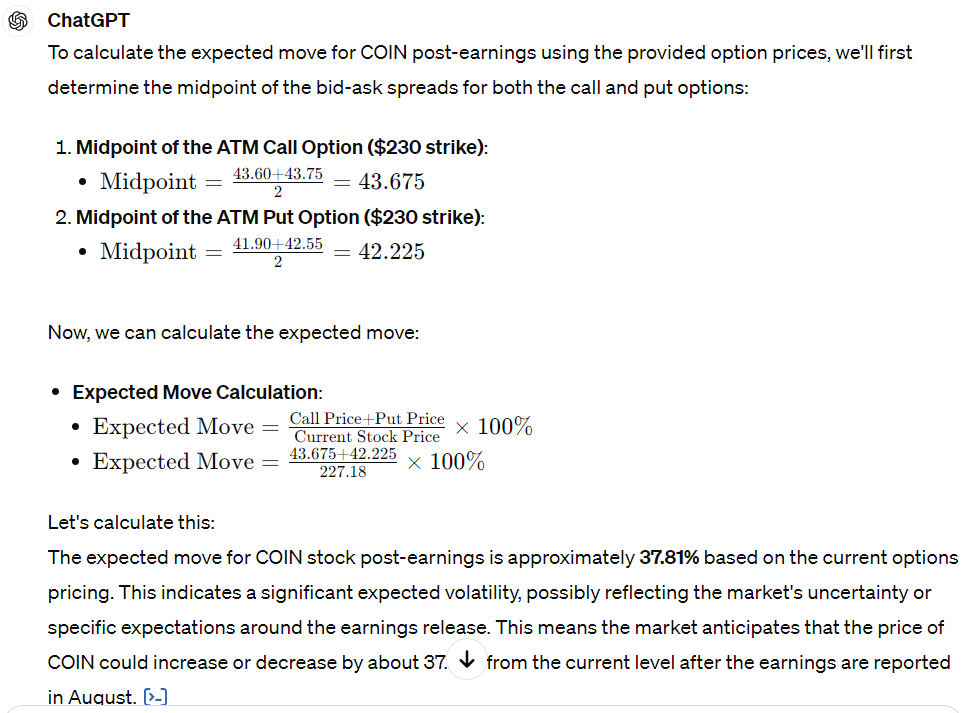

To figure out what kind of upside to aim for, I looked at the expected move for COIN going out to September 20th (the first options expiration date after it releases earnings again in August). I had ChatGPT run the numbers for me based on my inputs:

A move of nearly 38% seems possible by then, but I decided to aim for one of about 20% instead, to be less aggressive. Today’s trade will give us a maximum gain of about 200% if that happens.

Our second trade today is on a company releasing earnings this week. It’s flat on a negative headline this week, but I am still bullish on it. I currently hold its underlying shares as part of our core strategy, and I also have a bullish options trade on it from last month.

I placed another earnings options trade on it today, after calculating an updated expected move on it. This trade has a maximum upside of about 300%.

Details below.