Trade Alert: AI Bottlenecks + Biotech

Betting on memory as an AI bottleneck again, plus second trade on another AI bottleneck and a third trade on a recently-validated biotech that looks like it's heading higher.

Betting On Bottlenecks Again

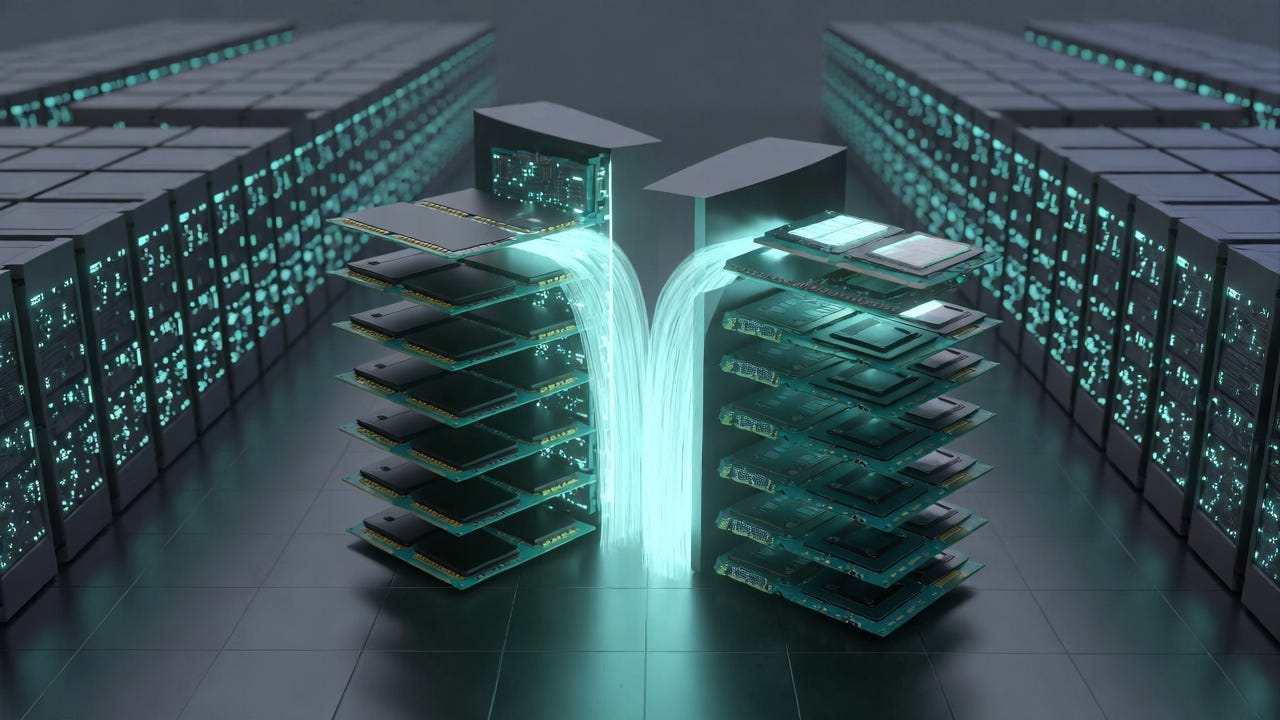

How we’re playing the “memory crunch” in the AI build-out

Over the last few months, we’ve been placing bullish bets on the bottlenecks in the AI build-out: the companies that make the equipment and materials everything else depends on. We’ve already hit some of the power and photonics bottlenecks; today we’re circling back to memory, a bottleneck we placed a trade on last month as well.

Every new wave of datacenters needs a lot more of it. When you zoom out from the day-to-day price action, you can see an industry that still looks structurally tight on supply, with demand tied not just to AI servers, but to storage and compute across the board. If you believe the AI build-out has more room to run, it’s hard to tell a story where the leading memory manufacturers don’t eventually benefit.

Among that group, one name now checks enough of our boxes to justify a new trade. Its shares have had a strong move, but not a parabolic one, and they’ve settled into what we consider an acceptable zone: the stock is trending higher, its RSI isn’t stretched, and its Chartmill setup rating suggests this is a reasonable spot to take a swing rather than to chase.

Another AI Bottleneck

And memory isn’t the only bottleneck we’re leaning into today. Further down the stack, there’s a quieter kind of AI plumbing: the photomasks that let chipmakers etch ever-smaller features into silicon. That’s where a lesser-known semiconductor tools name we’ve discussed before comes in. It doesn’t show up on the usual AI stock lists, but it sits right in the path of rising demand for advanced logic and specialty nodes. It’s now pulled back into our preferred RSI and ChartMill setup range, which gave us a chance to build a structured, option-based way to get leveraged upside there without writing a blank check on risk.

And A Validated Biotech

Alongside that, I’m also adding a new trade in a biotech my Multibaggers list has been pounding the table on. This is actually a name we tried to enter a couple of months ago, ahead of a data readout. That data came in this week, and the stock is higher on the news, but the analyst I follow on this name all say it has further to climb.

As usual, we’re not just buying calls and hoping for the best. We’ve built defined-risk structures that let us express our bullish view while harvesting some of the high near-term volatility along the way. I used the Black-Scholes model to estimate fair values for these structure and made sure we were coming in below that—so if we get filled, we’re getting convex upside exposure at a discount to what the options market considers fair.

Full details on all three trades below.

Today’s First Market Watchers Trade

Memory / AI bottleneck theme