Top Names, 7/17/2025

Revisiting our core strategy and updating our top names performance. Plus, a note for Substack investors.

Substack Raises A $100 million Series C Round

A couple of years ago, Substack raised $7.8 million in a Series B community round. I mentioned it here at the time, and noted that I would be investing. Those of use who invested then are now up about 80% based on Substack’s new $1.1 billion post-money valuation after its Series C Preferred round.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as this one we entered on Super Micro Computer (SMCI 0.00%↑) earlier this month.

A Top Names Performance Update

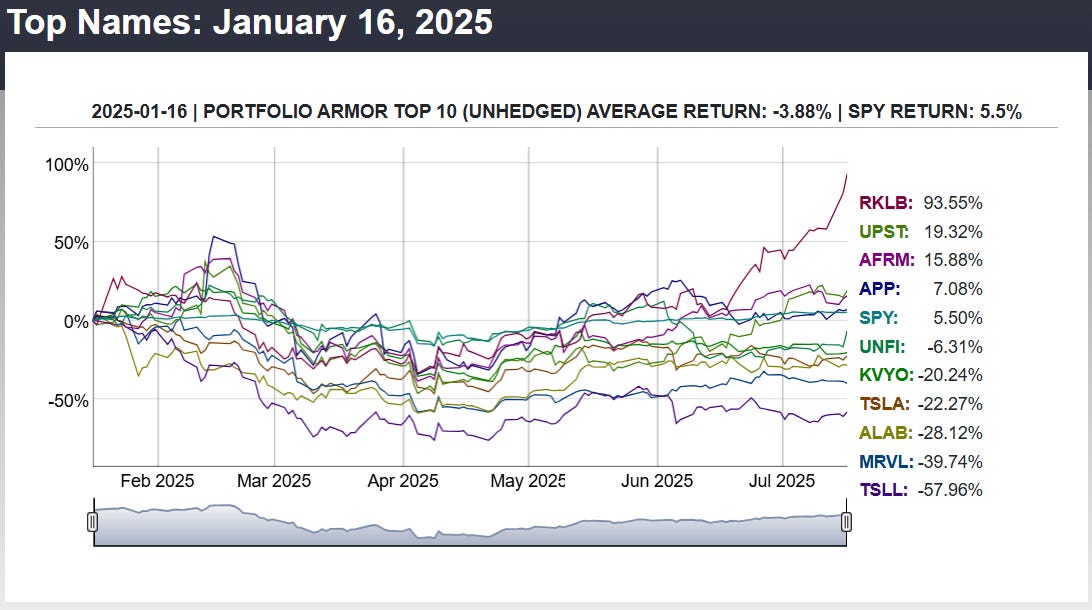

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from January 16th, 2025.

Our top names from January 16th returned -3.88%, on average, over the next six months, versus +5.5% for the SPDR S&P 500 Trust (SPY 0.00%↑).

So far, we have 6-month returns for 108 weekly top names cohorts since we started this Substack at the end of December, 2022.

[Skipping ahead so this post doesn’t exceed email length—you can see the top names returns for every week here]

And as you can see above, our top names have averaged returns of 16.46% over the next six months, versus SPY’s average of 9.29%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

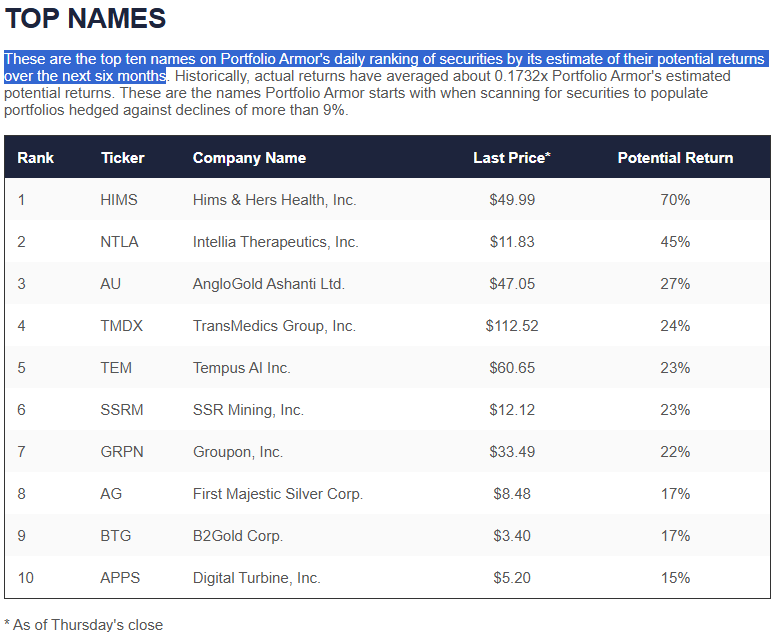

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 7/17/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.