Top Names, 7/11/2024

Plus, a quick Tesla trade update.

A Quick Tesla Update

Before we get to tonight’s Top Names post, a quick update on our Tesla (TSLA 0.00%↑ ) trade from this morning. In that post, I mentioned that although I remained bullish long term on Tesla, I was betting on a modest (~3%) pullback over the next several trading days.

As it happened, we got an 8.44% drop in Tesla today, putting our trade on track for a 150% gain next Friday if Tesla stays below $255 by then. I’ve removed the paywall on this morning’s trade alert, so you can read it below, but let me quickly explain why I placed this trade. No, I didn’t know Tesla would postpone the development of its robotaxi, but I knew this:

Tesla’s RSI (Relative Strength Index) of 87 indicated the stock was overbought.

After closing in the green for 11 or 12 straight sessions, the stock seemed like it was ready for a pullback.

The net credit available on this call spread so close to the money was too good to pass up.

Now on to tonight’s Top Names post.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

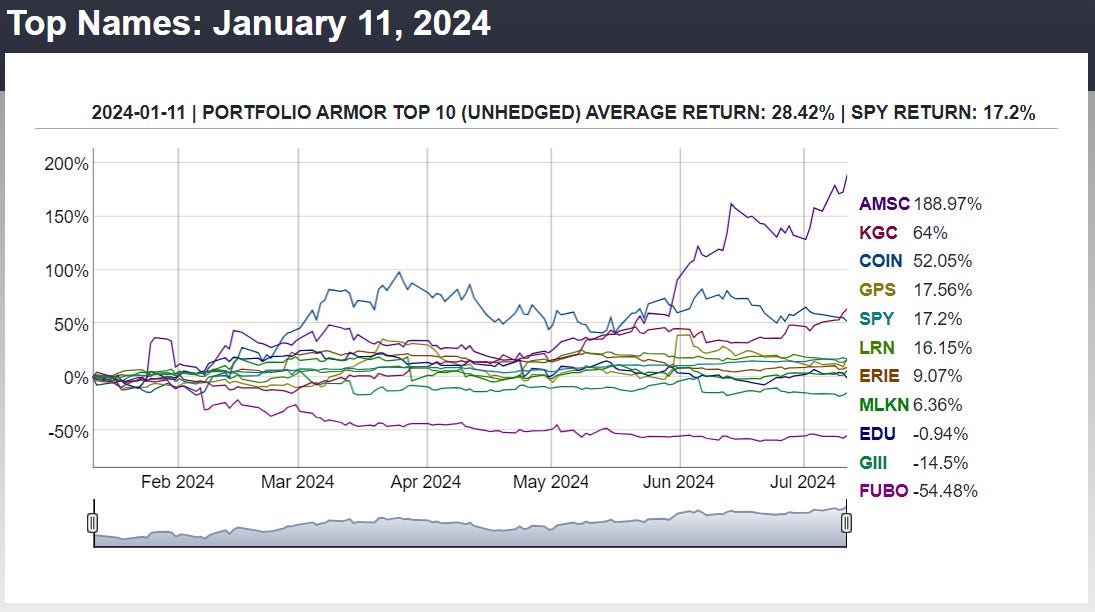

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from January 11th.

Over the next six months, our top ten names from January 11th were up 28.42%, on average, versus up 17.2% for the SPDR S&P 500 Trust (SPY 0.00%↑).

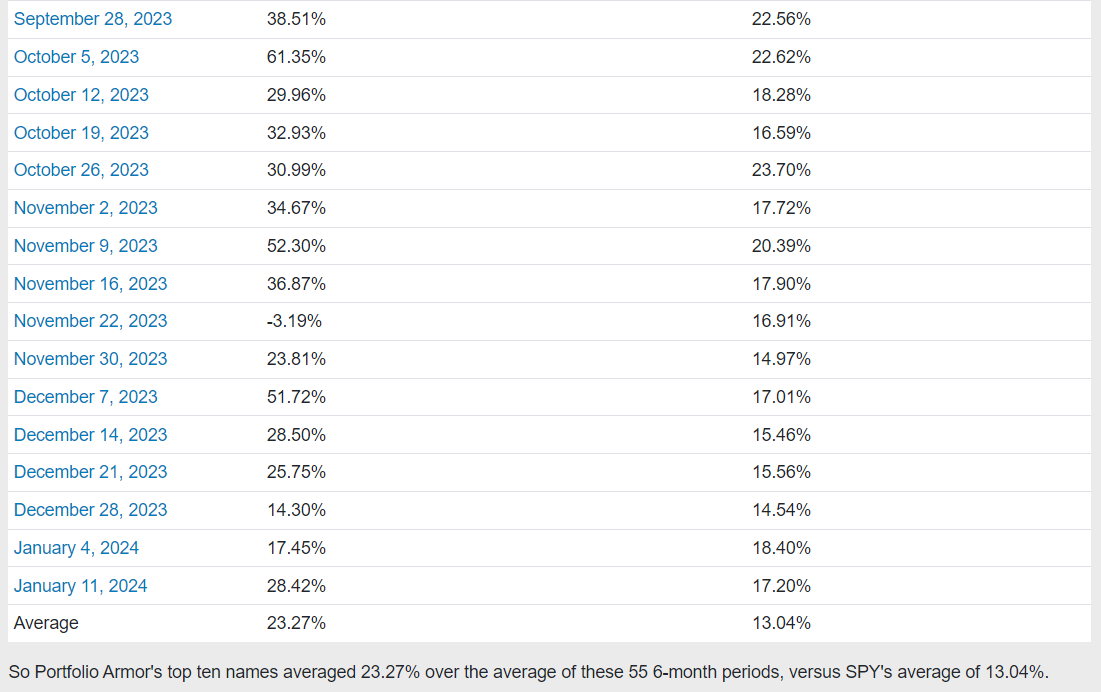

So far, we have 6-month returns for 55 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 23.27% over the next six months, versus SPY’s average of 13.04%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.