Top Names, 6/5/2025

Revisiting our core strategy while updating our performance.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as this one we exited this week:

Options

Call spread on Oklo (OKLO 0.00%↑ ). Entered at a net debit of $0.20 on 12/20/2024; exited at a net credit of $0.97 on 6/3/2025. Profit: 385%.

A Top Names Performance Update

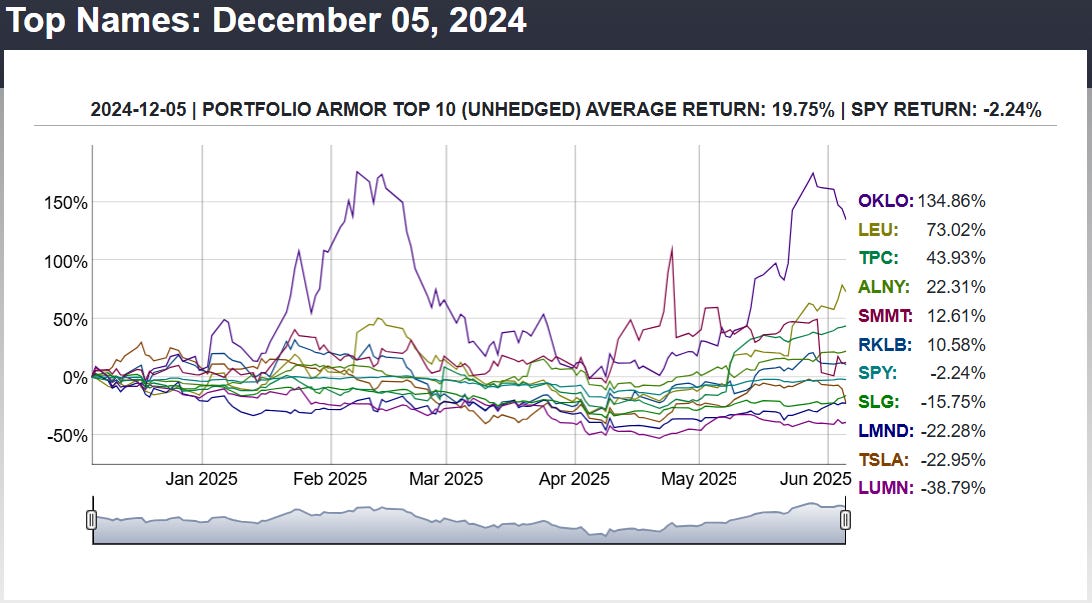

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from December 5th, 2024.

Our top names from December 5th returned +19.75%, on average, over the next six months, versus -2.24% for the SPDR S&P 500 Trust (SPY 0.00%↑).

So far, we have 6-month returns for 102 top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 16.78% over the next six months, versus SPY’s average of 9.64%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

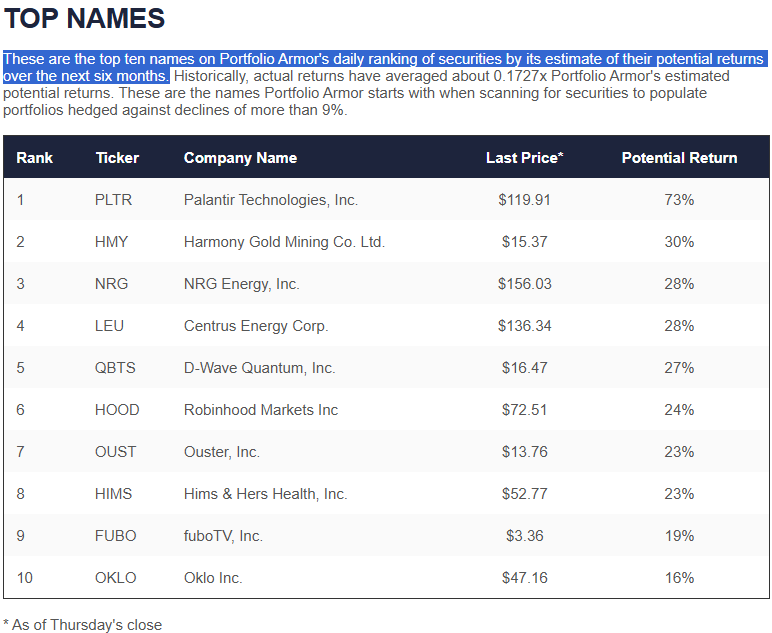

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 6/5/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.