Top Names, 5/30/2024

Plus a brief market comment.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

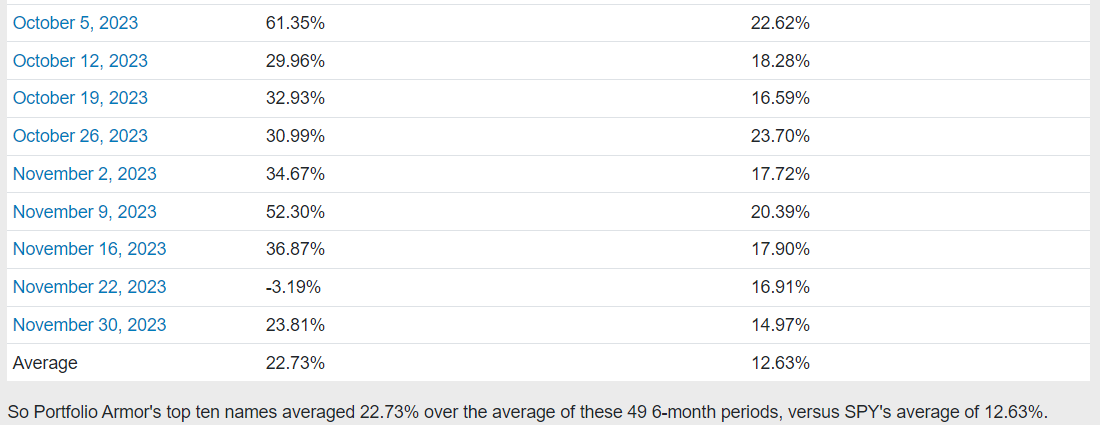

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from November 30th, 2023.

Over the next six months, our top ten names from November 30th were up 23.81%, on average, versus up 14.97% for the SPDR S&P 500 Trust (SPY 0.00%↑).

Below is how all of our weekly top names cohorts have done since we started this Substack.

You can click here to see an interactive version of that table, where you can click on a date and see what are top names were then and how each of them did.

A Brief Market Comment

Our system runs its top names every day the market is open, not just on Thursdays when I post them here. Checking the top names from Wednesday last night, I noticed something odd. We use two options market sentiment factors in generating these top names, one that looks for upside risk, and one that looks for downside risk. None of our top names last night included the upside risk factor, suggesting options market participants were unusually bearish on Wednesday. Today, however, the top five names in our top ten exhibit that upside risk factor.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.