Top Names, 4/24/2025

Revisiting our core strategy while updating our performance.

A Bear Market Note

A reminder about what our system does in a bear market: Portfolio Armor’s security selection algorithm is agnostic about market direction—it’s just trying to find securities that it estimates will do well over the next several months. And those securities don’t have to be stocks. They can also be inverse ETFs. In a bear market, I would expect to see more of those in our top names.

If you are worried about further downside, as a reminder, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as this one on Spotify earlier this month:

Calls on Spotify (SPOT 0.00%↑). Bought for $1.67 on 4/1/2025; sold (half) for $4 on 4/2/2025. Profit: 140%.

A Top Names Performance Update

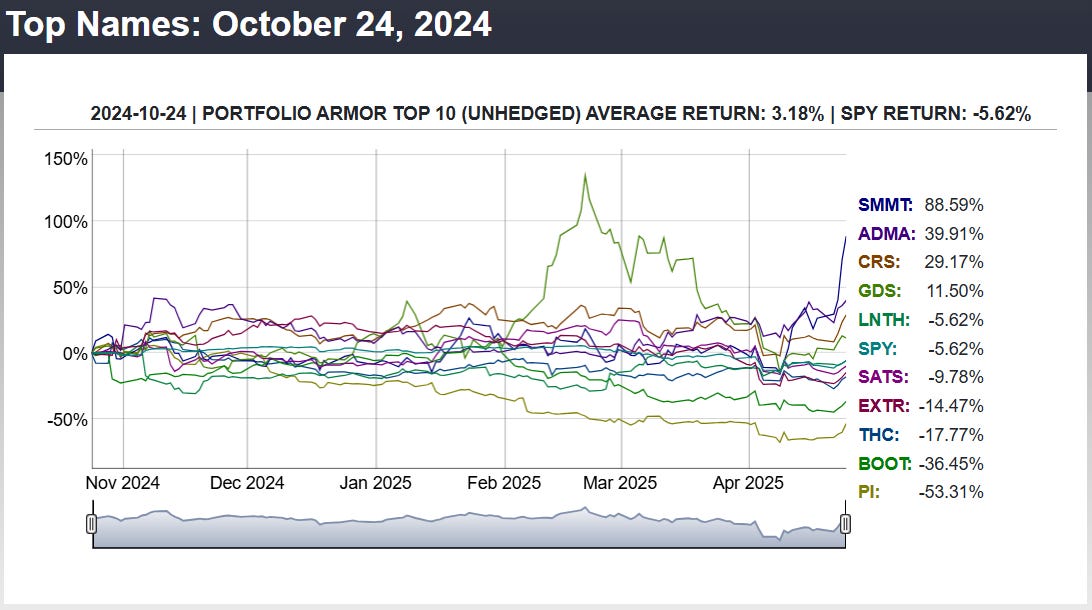

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from October 24th, 2024.

Our top names from October 24th were up 3.18%, on average, over the next six months, versus down 5.62% for the SPDR S&P 500 Trust (SPY 0.00%↑).

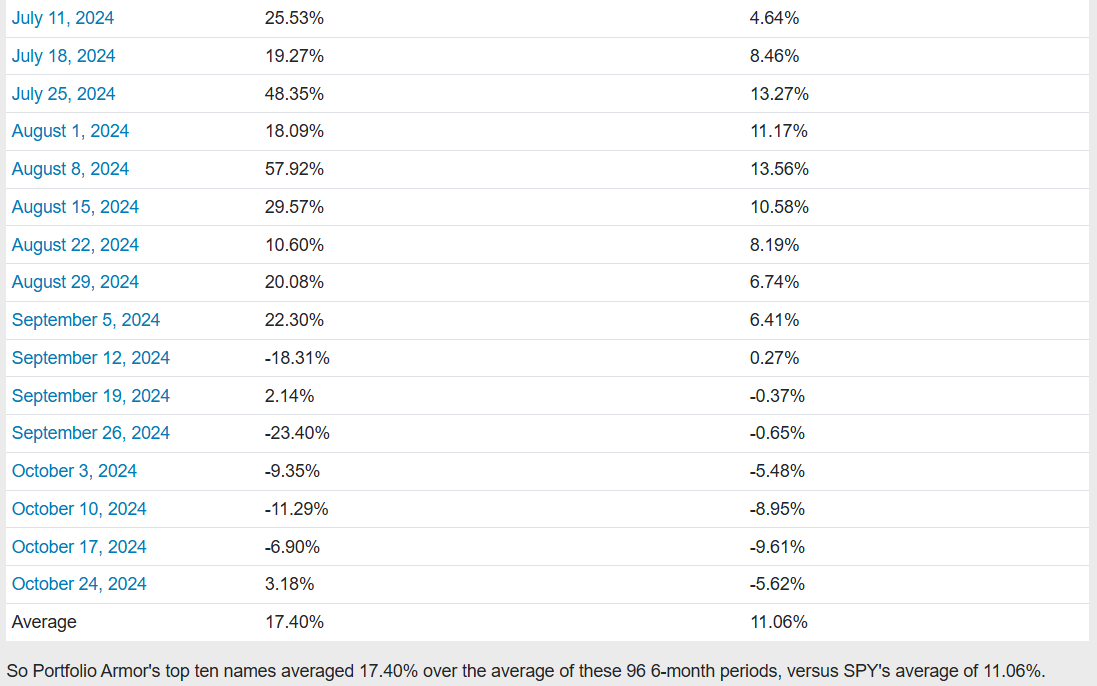

So far, we have 6-month returns for 96 top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 17.40% over the next six months, versus SPY’s average of 11.06%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

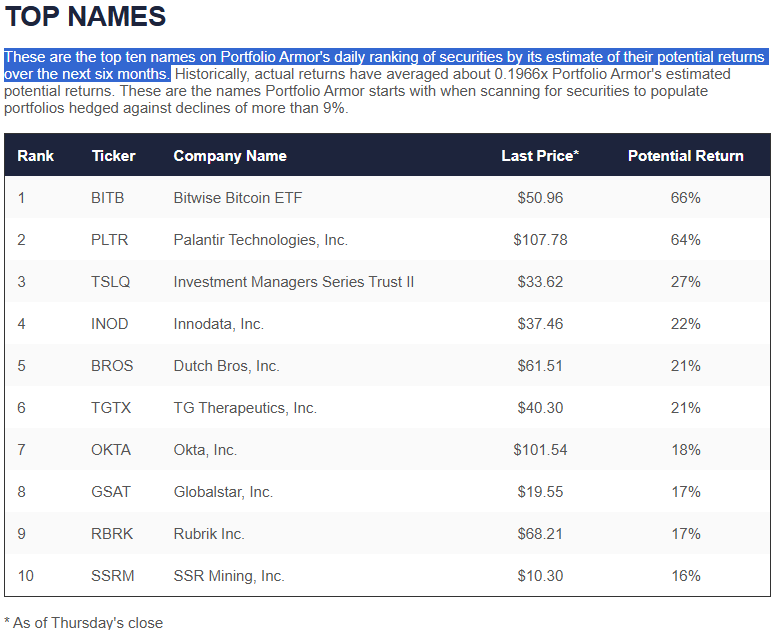

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 4/24/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Monday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.

I have a couple of open spots, but I’m probably going to hold off buying a new stock on Friday. I research these and see if any look interesting for short term options trades.