Top Names, 3/13/2025

A brief market note, then on to continuing our core strategy while updating our top names performance.

A Brief Market Note

We ought to address the elephant in the room, the market tanking. Charlie Bilello shared this Nasdaq chart on X last week, which raises the question of whether we are headed into a steeper correction or a bear market.

The short answer is we don’t know, but Jason Goepfert shared this interesting table of previous times when the Nasdaq broke its 200-day moving average after long bull run. Over the next two weeks, if the index was down less than 3%, the bull market continued. But if it was down more than that, look out below.

So, we’ll keep an eye on that. But in the meantime, we’ll keep looking for opportunities, mostly on the long side, because we have a source of potential alpha there in our top ten names.

You might also consider taking advantage of the next market rally to hedge. You can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as these on one of our top names from earlier this week:

Calls on Spotify (SPOT 0.00%↑). Bought for $2.40 on 3/10/2025; sold (half) for $6 on 3/11/2025. Profit: 150%.

Calls on Spotify (SPOT 0.00%↑). Bought for $2.40 on 3/10/2025; sold (second half) for $6 on 3/11/2025. Profit: 150%

A Top Names Performance Update

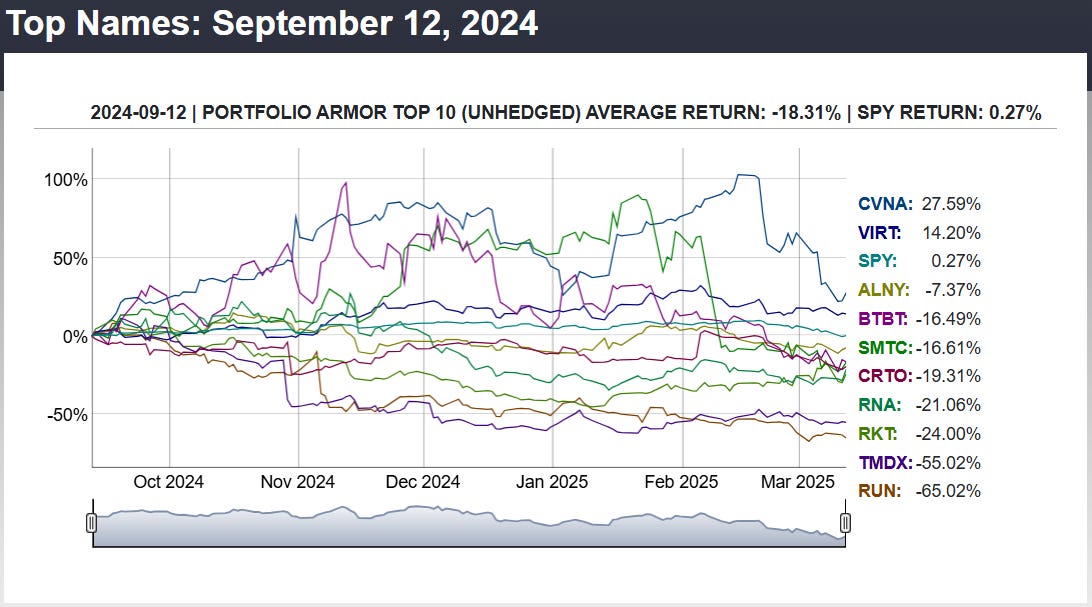

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from September 12th, 2024.

Our top names from September 12th were down 18.31%, on average, over the next six months, versus up 6.41% for the SPDR S&P 500 Trust (SPY 0.00%↑).

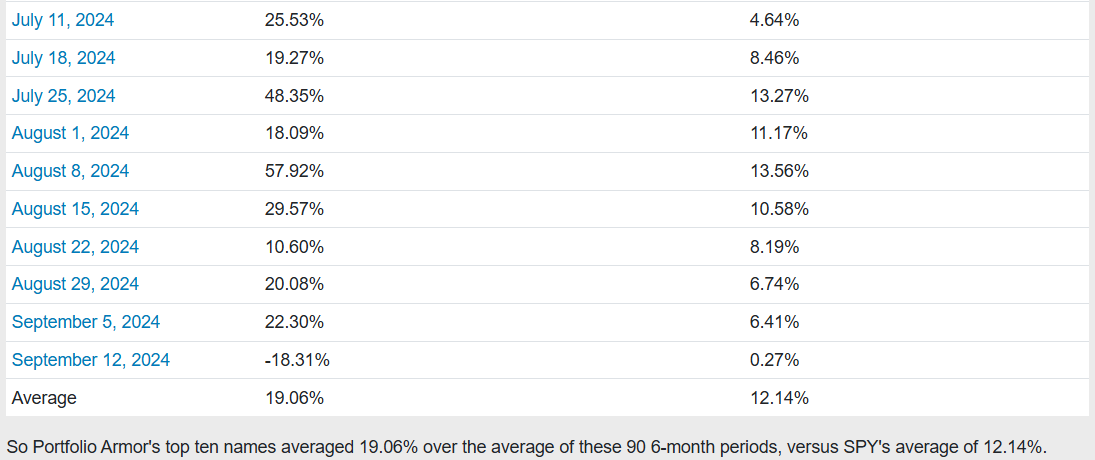

So far, we have 6-month returns for 90 top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 19.06% over the next six months, versus SPY’s average of 12.14%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

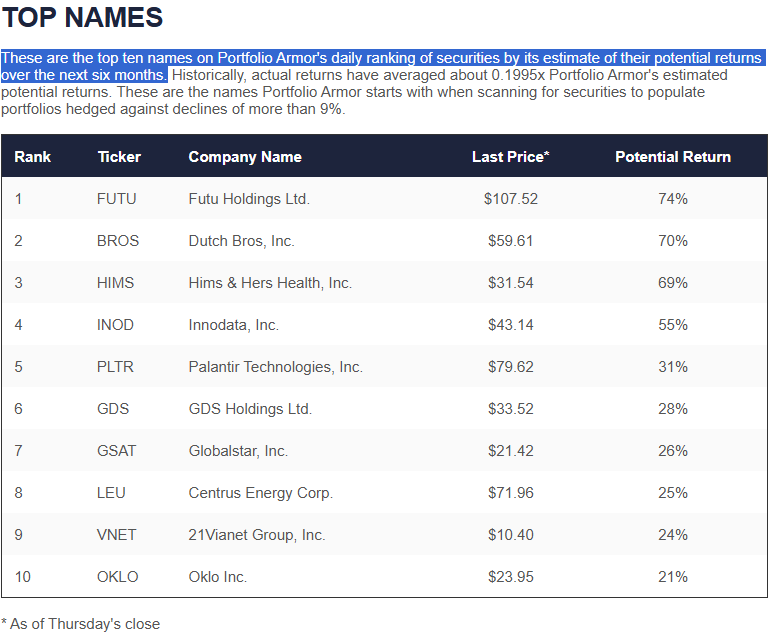

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 3/13/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.

I started the core strategy back in December using 15% stops. I stopped out, opened new positions, and repeated until now I only have 4 open positions. I see my entries have been smaller and smaller $ amounts due to a net drawdown during this period. Do I try to maintain 10 positions or should I aim for fewer positions but with similar dollar amounts?