Top Names, 2/8/2024

Continuing our core strategy while updating our performance.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Personal Performance Update

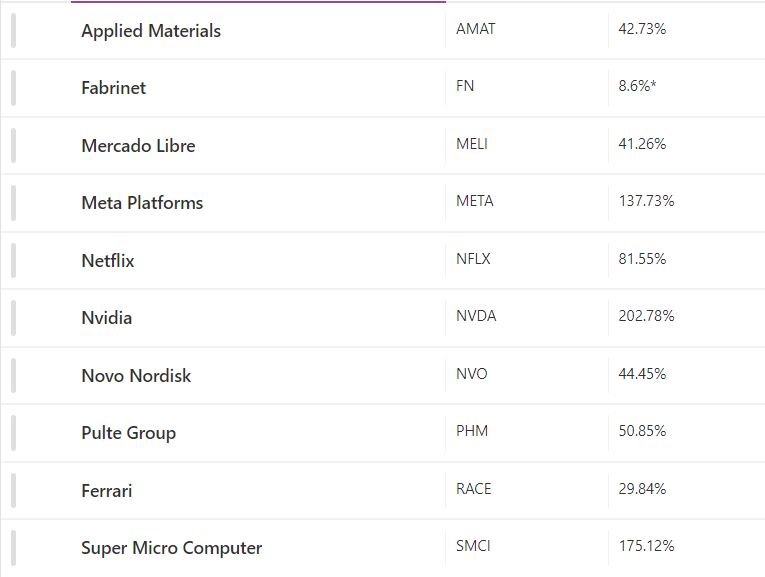

Here’s how the current names in my version of our core strategy are doing since I bought them so far (these are ranked alphabetically by stock symbol, the order they appear in my account):

*Return as of Tuesday, when I got stopped out.

A Top Names Performance Update

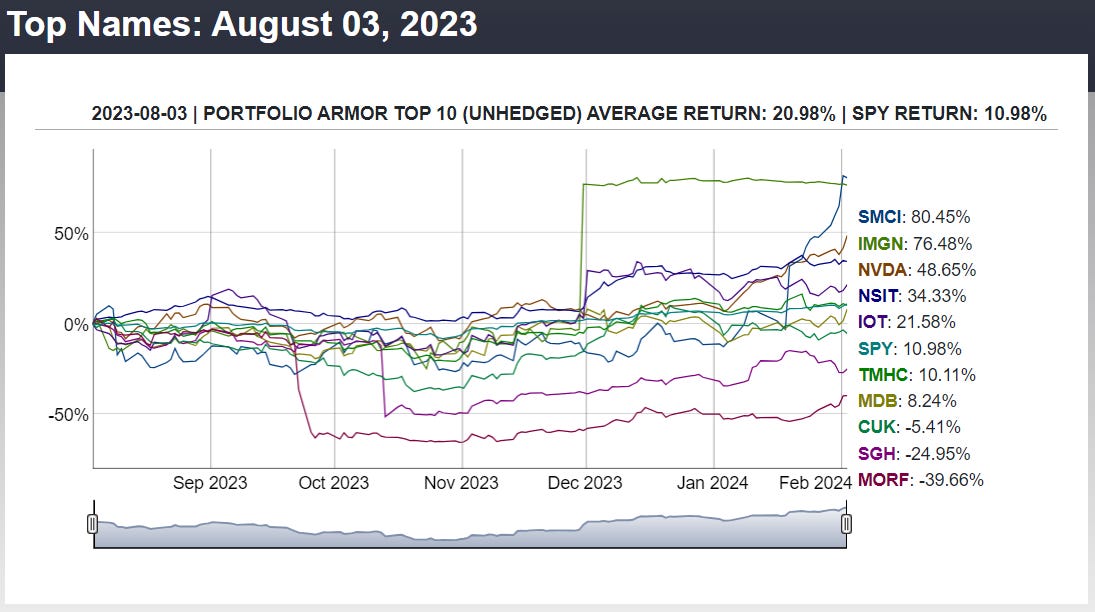

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from August 3rd.

Over the next six months, our top ten names were up 20.98% on average, versus up 10.98% for SPY.

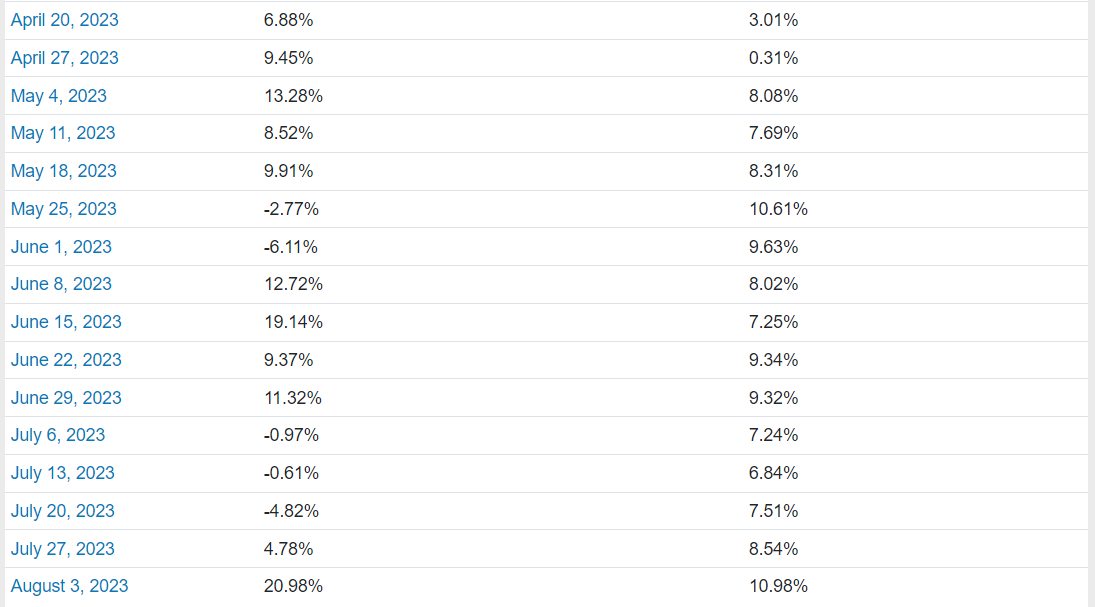

That was the 22nd top names cohort of 32 since we started this Substack that beat the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.