Top Names, 2/13/2025

Continuing our core strategy while updating our Top Names performance.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

Another Use For Our Top Names

We also use our top ten names as a source of ideas for options trades, such as this one on our then-current top name, Robinhood Markets (HOOD -0.06%↓), which we exited today for a 1,443% gain.

A Top Names Performance Update

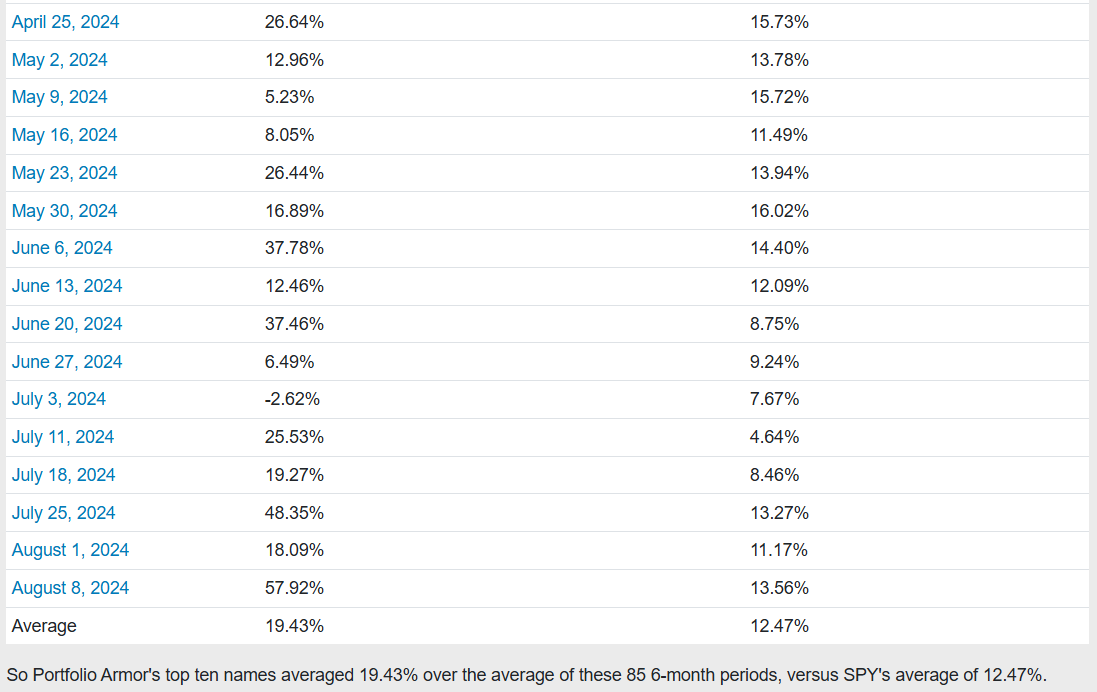

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from August 8th, 2024.

Our top names from August 8th were up 57.92%, on average, over the next six months, versus up 13.56% for the SPDR S&P 500 Trust (SPY 0.00%↑).

So far, we have 6-month returns for 85 top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 19.43% over the next six months, versus SPY’s average of 12.47%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

Limiting Your Downside Risk

If you want to add some downside protection here, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

Our Top Names Every Day

Although I post Portfolio Armor’s once per week here, they’re available daily on the Portfolio Armor website and iPhone app.

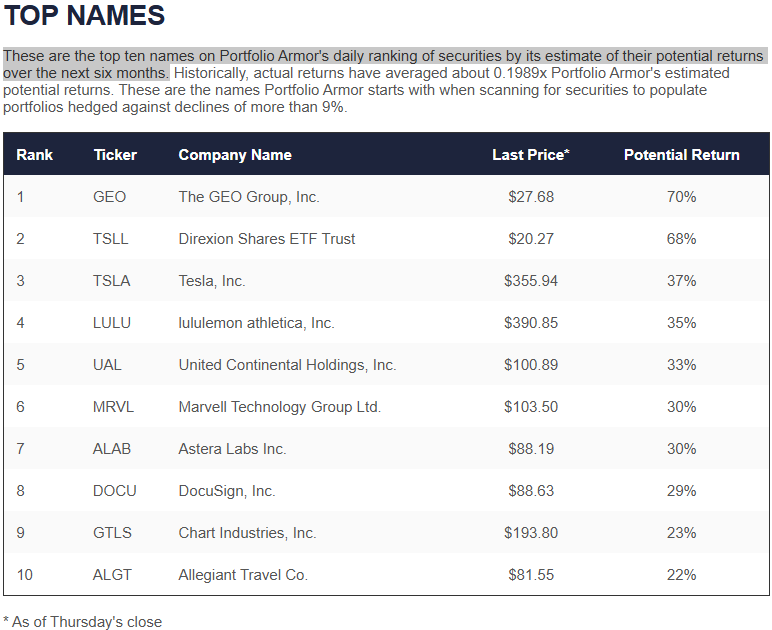

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.

Screen capture via Portfolio Armor on 2/13/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.

I just noticed on the Portfolio Armor Substack Trade Exits spreadsheet a successful TSLA call trade that wasn't posted on Substack, just on X.

I am not receiving the options recommendations. Is that a separate feed from

the Top Names feed? If not, how do I get the option alert in real time?