Top Names, 2/12/2026

A brief market comment, followed by a Top Names performance update, and this week's Top Names.

A Brief Market Comment

In last week’s Top Names post, I included a link to that day’s trade alert, where I wrote that, in light of current market conditions, I had tightened our entry rules to try to avoid falling knives.

That’s still the case, but a question some readers may have is why even enter new trades in a market environment like this. The answer is that if you pick the right names, and structure your trades well, you can make money in this market. The trade alert above offers an example of that, our trade in Sphere Entertainment (SPHR 2.51%↑). SPHR beat on top and bottom lines when reporting today and closed up 22.07%, putting our trade from last week on track for a max gain.

If You Want To Add Downside Protection Here

As a reminder, our website and iPhone app enable you to can for optimal hedges.

Our Basic Strategy

Our basic strategy to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of ~20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position—there are no options involved in this strategy.

Another Use For Our Top Names

We also use our top names in options trades, such as this one we exited last week:

4-leg combo on Littlefuse (LFUS -1.97%↓). Entered at a net credit of $0.50 on 10/13/2025; the November 21st, 2025 $250/$240 put spread was assigned and exercised at a max loss of $10.00 per spread on 11/21/2025, and we exited March 20th, 2026 $300/$320 call spread at a net credit of $16.00 on 2/4/2026, for a net value of $6.50 per contract. Profit: 1,300% of premium collected (68% of max risk).

A Top Names Performance Update

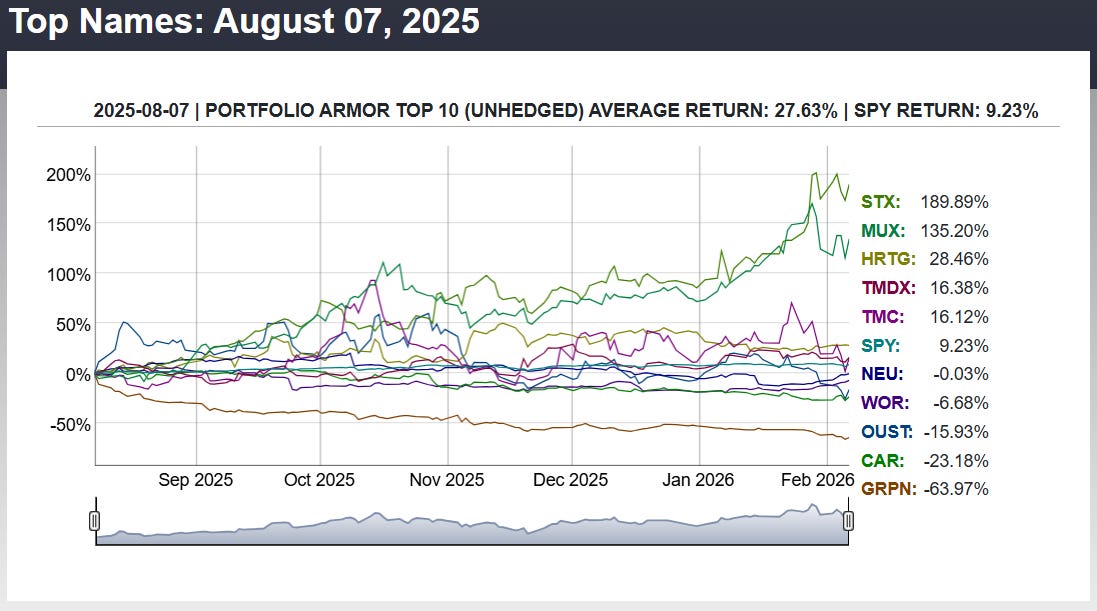

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from 8/7/2025.

Over the next 6 months, our top ten names from August 7th, 2025 returned +27.63%, versus +9.23% for the SPDR S&P 500 Trust ETF (SPY 0.23%↑).

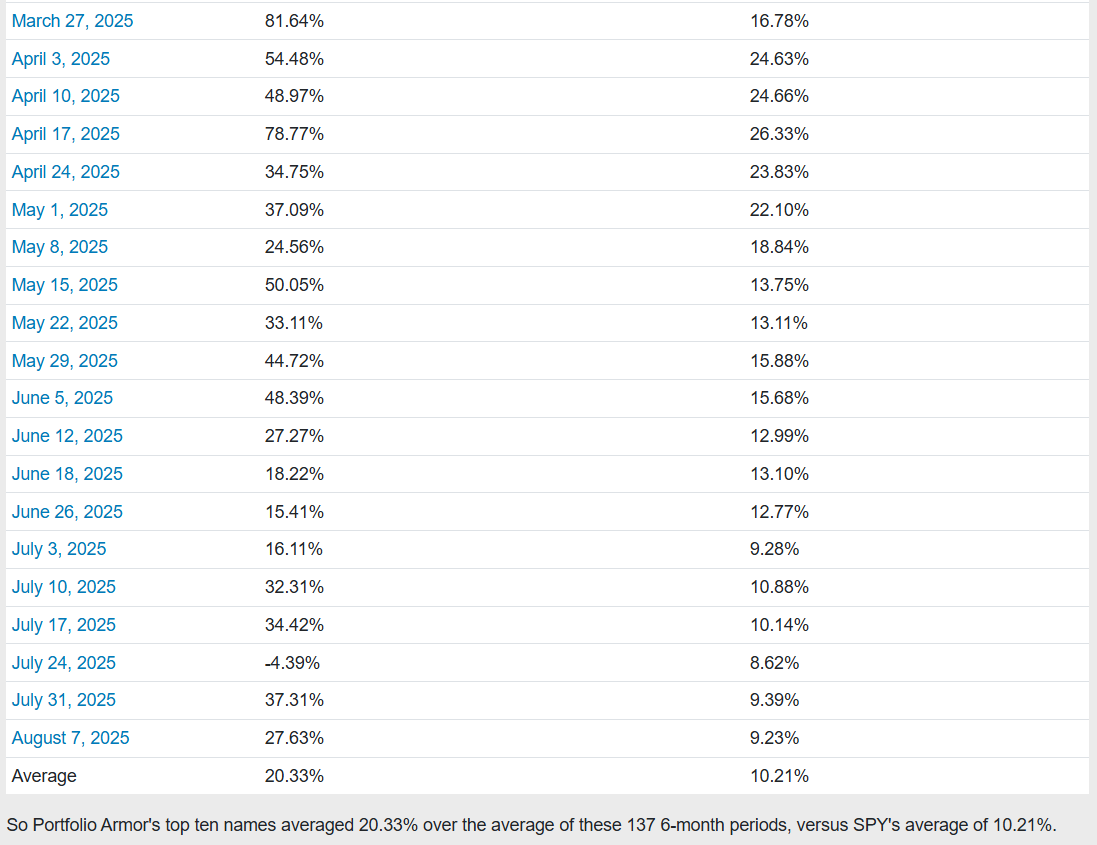

So far, we have 6-month returns for 137 weekly top names cohorts since we started this Substack at the end of December, 2022.

[Skipping ahead so this post doesn’t exceed email length—you can see the top names returns for every week here]

And as you can see above, our top names have averaged returns of 20.33% over the next six months, versus SPY’s average of 10.21%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.