Top Names, 1/8/2025

Continuing our core strategy while updating our Top Names performance.

Programming Note

I’m posting this week’s top names as of Wednesday’s close this week, as the market will be closed on Thursday in memory of President Carter.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 15%-20% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from July 3rd, 2024.

Our top names from July 3rd were down 2.62%, on average, over the next six months, versus up 7.67% for the SPDR S&P 500 Trust (SPY 0.00%↑).

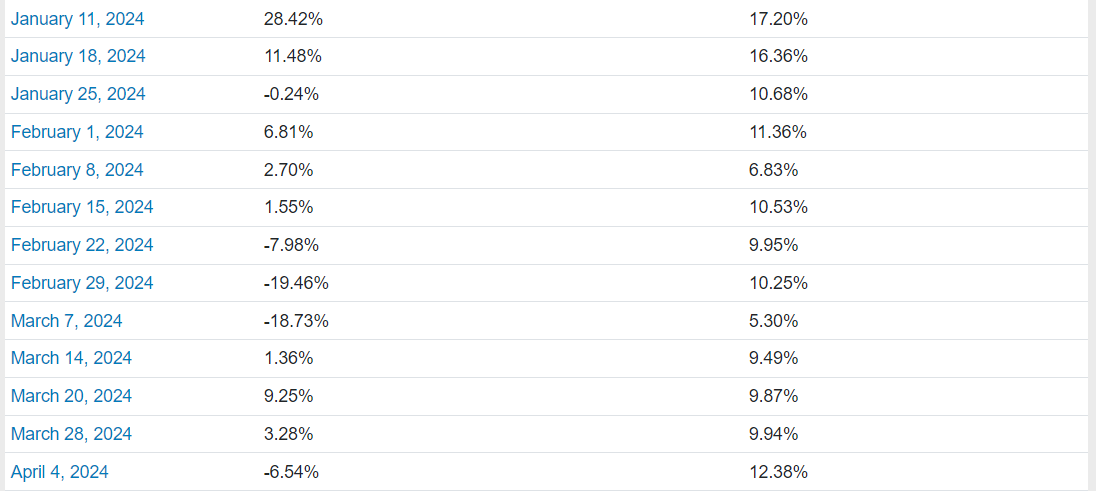

So far, we have 6-month returns for 80 weekly top names cohorts since we started this Substack at the end of December, 2022.

And as you can see above, our top names have averaged returns of 18.53% over the next six months, versus SPY’s average of 12.61%. You can see an interactive version of the table above here, where you can click on each date and see a chart showing each of the holdings that week.

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Wednesday’s close.

Screen capture via Portfolio Armor on 1/8/2025.

If you’re starting our core strategy now, you’ll want to buy equal dollar amounts of each at or near these prices, if possible, on Friday, and then enter trailing stops of 15% to 20% on each of them. As you get stopped out of positions, you’ll add new ones from the then-current top ten names.

In my case, I am already running this strategy, and didn’t get stopped out of any positions this week, so I’m not planning on buying any of these stocks on Friday. I’ll do a little research on them before then, though, and if one of the new names here looks interesting, I may post an options trade for it on Friday.