Top Names, 12/28/2023

Continuing our core strategy.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

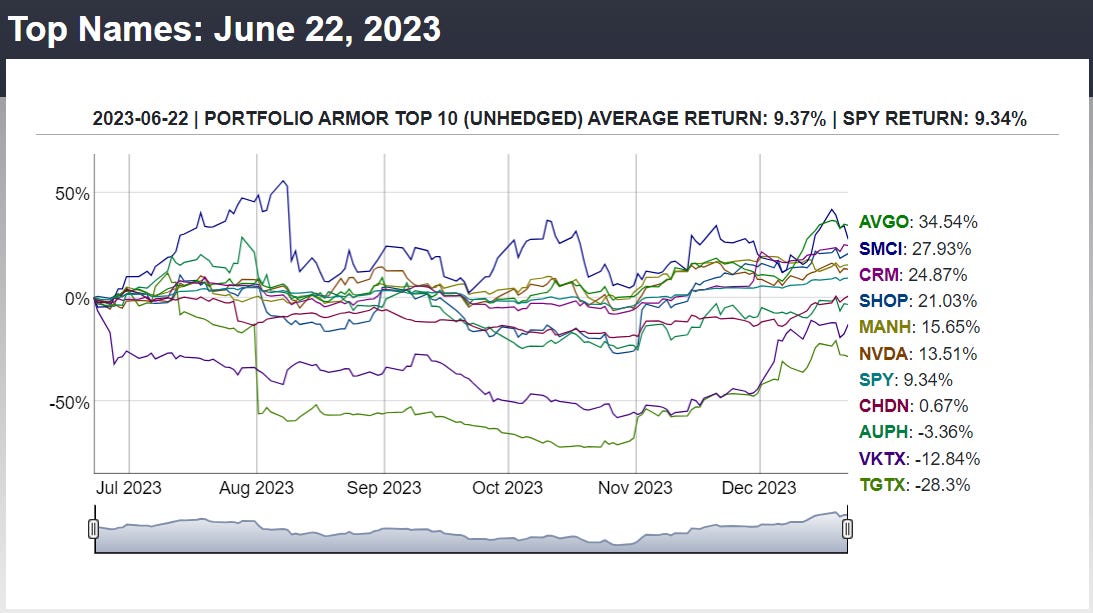

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from June 22nd.

Over the next six months, our top ten names were up 9.37% on average, versus 9.34% for SPY.

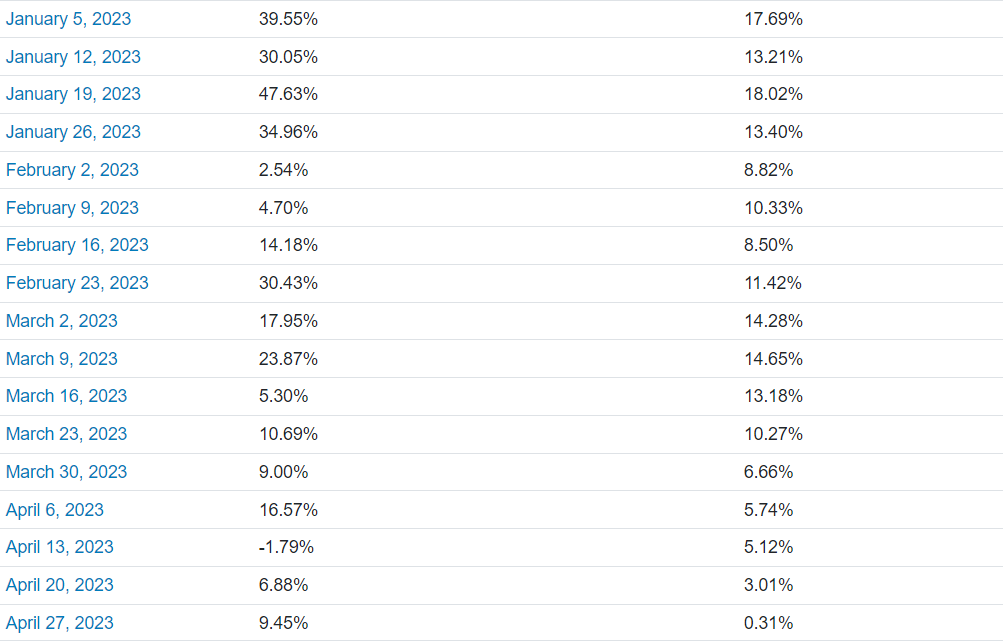

That was the 19th top names cohort of 25 so far this year that outperformed the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.