Top Names, 11/30/2023

Continuing our core strategy.

Our Core Strategy

Our core strategy is to buy equal dollar amounts of the Portfolio Armor web app’s top ten names, put trailing stops of 10%-15% on them, and replace them with names from the current week’s top ten when we get stopped out of a position.

A Top Names Performance Update

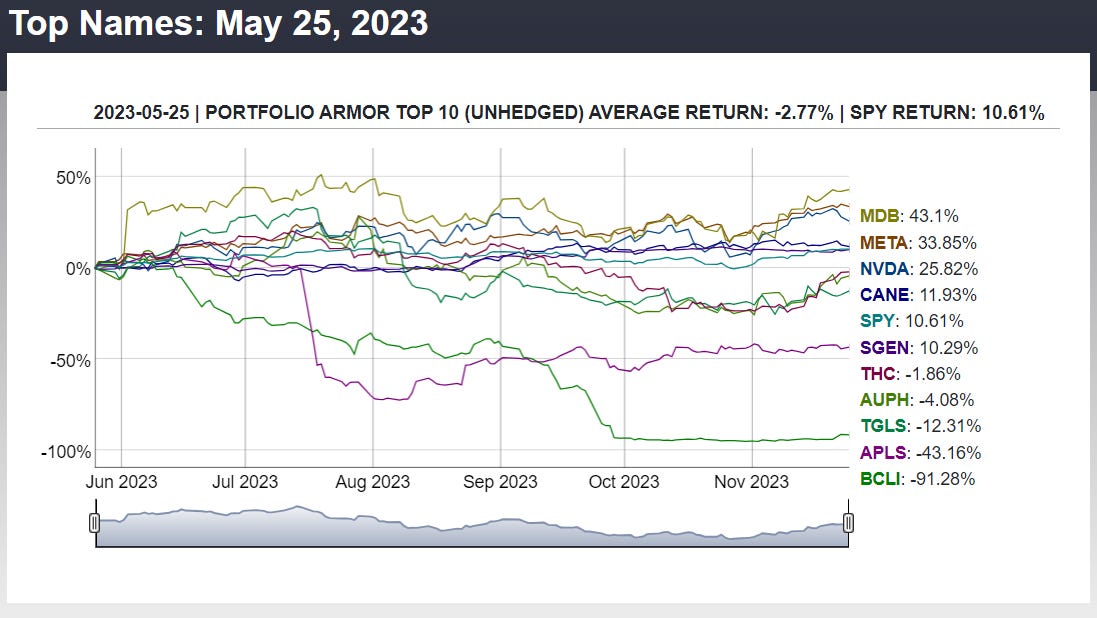

Before we get to this week’s top ten names, let’s look at the final, 6-month performance of our top ten names from May 25th.

Over the next six months, our top ten names from May 25th were down 2.77%, on average, while the SPDR S&P 500 Trust ETF (SPY 0.00) was up 10.61%.

Of course, if you were following our core strategy, you would have exited BCLI after it dropped 10%-20%.

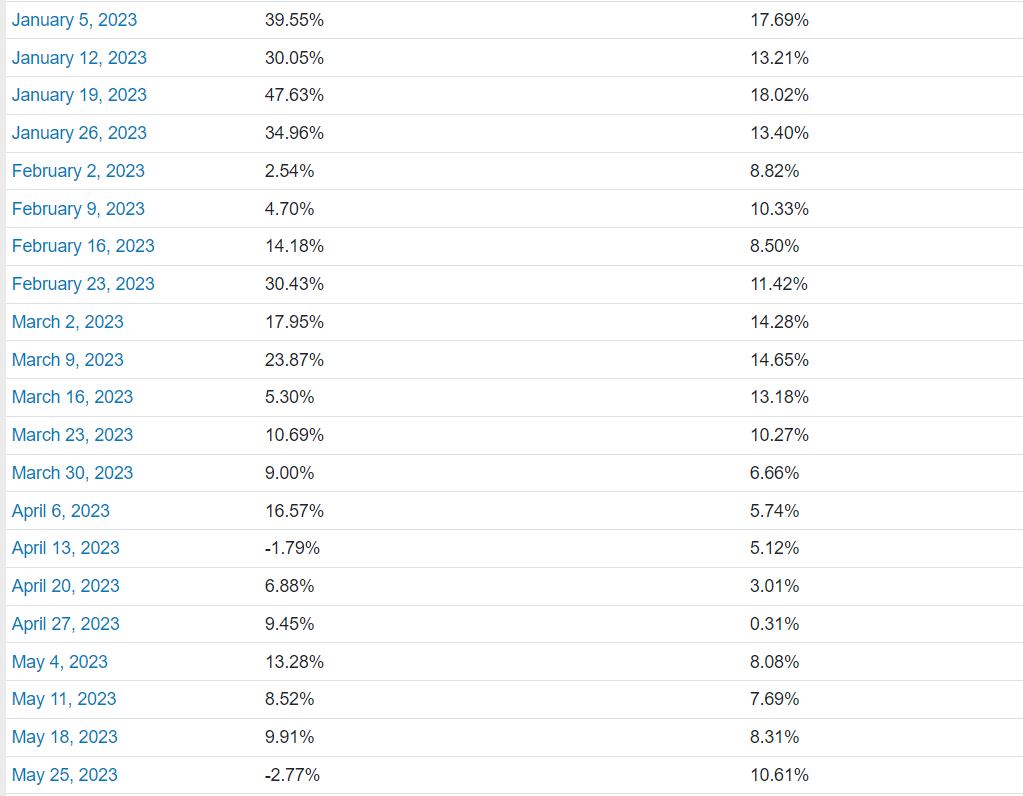

That was the 5th top names cohort of 21 so far this year that underperformed the market (PA top ten returns are on the left below; SPY returns on the right).

This Week’s Top Names

Below are Portfolio Armor’s current top ten names as of Thursday’s close.