Swinging For The Fences—Without Blowing Up

How a $30,000, 6-month hedged portfolio beat the market while capping risk at ~13%

Note: This post is about the Portfolio Armor website’s hedged portfolio construction tool. The overlap with this Substack is that both draw from Portfolio Armor’s top names, but what the website offers is for investors who want to strictly limit their risk.

Swinging For The Fences—Without Blowing Up

How a $30,000, 6-month hedged portfolio beat the market while capping risk at ~13%

TL;DR: You don’t have to hide in “defensive” names to manage risk. If you hedge intelligently, you can own volatile, high-beta stuff, keep worst-case drawdown bounded, and still capture upside. A $30k portfolio we built on Feb 6 with a −13% max-drawdown limit just finished its six-month run—outperforming the market through the spring selloff—while never exposing the investor to anything like SPY’s drawdown.

The Setup

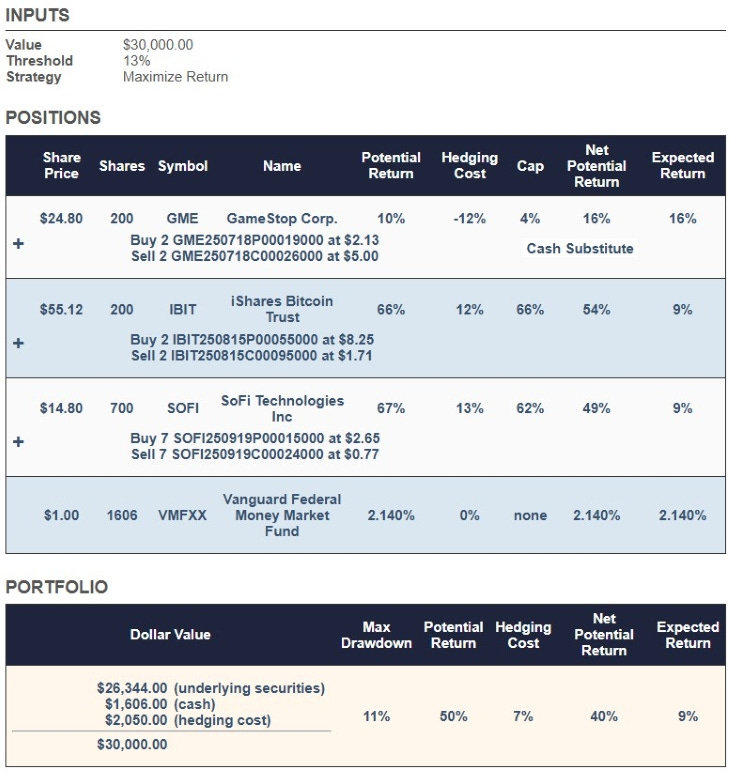

Portfolio size: $30,000 (the smallest level we construct)

Risk guardrail: Do not lose more than ~13% over the next ~6 months

Construction date: Feb 6

Environment: Included the spring correction/“mini-bear” that dinged most unhedged portfolios

The build looked nothing like a traditional low-vol sleeve. It held a meme-ish single name, a crypto proxy ETF, and a high-beta fintech. The point wasn’t to make the holdings look safe; it was to make the portfolio safe via optimal hedges.

What “Cash Substitute” Means Here

In this portfolio the cash substitute is GME 0.00%↑ , not the money-market fund.

Portfolio Armor selects a stock or ETF as a “cash substitute” when—after applying an optimal collar—

its max downside is ≤ the investor’s risk threshold (13% in this case),

the cap on upside is set to the greater of 1% or the current 7-day MMF yield,

the net hedging cost is low or negative, and

its net potential return over the hedge horizon is greater than the MMF yield.

Why GME qualified on 2/6: the collar on GME produced a net credit (–12% hedging cost), with a 4% cap, and an estimated net potential return of 16%, comfortably above the ~2.14% yield of VMFXX at the time.

Result: GME served as a capital-efficient “cash substitute,” boosting expected return while still respecting the portfolio’s drawdown limit.(Note: the portfolio also carried a small VMFXX line for residual cash, but the “Cash Substitute” label refers to the hedged GME position.)

Key idea: Because each position is paired with the least-cost, best-fit hedge (put/collar) that enforces your loss threshold, the selection engine is free to choose return-rich, cost-effective-to-hedge names instead of “stodgy” low-beta names. Risk is controlled at the portfolio level, not by sandbagging the upside.

What Happened

It outpaced SPY over the full six months despite the spring drawdown.

Max drawdown stayed inside the ~13% guardrail by design.

The mix’s surprise to most readers isn’t the outperformance—it’s that the holdings many would call “risky” didn’t translate into scary portfolio risk. The hedges did their job.

You can see an interactive version of that chart here.

Why This Works

Security selection starts with upside and hedgeability.

We look for names with attractive potential return that are also inexpensive to insure. (If a name is too costly to hedge, it’s out—no matter how exciting the story.)Position caps + optimal hedges translate to a hard portfolio loss limit.

That’s how you can “swing for the fences” and still play small-ball on risk.Collar math turns IV to your advantage.

In many cases, call premium subsidizes put cost, keeping hedging costs low (or even net-credit).

But What About Now?

If you worry about today’s mix of tech concentration, retail froth, rich skew, and shrinking cash cushions (all themes making the rounds this week), this is a timely moment to think in guardrails, not guesses. A hedged portfolio lets you stay long and opportunistic while pre-defining your worst-case.

The Numbers We Show Upfront (when building)

Max Drawdown (your chosen guardrail)

Potential Return (bullish but adjusted to hedge duration)

Hedging Cost (net of call income, priced conservatively)

Net Potential Return (potential return minus hedging cost)

Expected Return (net potential return adjusted by past actual returns)

For that Feb 6 build, the construction screen showed an ~11% max drawdown (within the 13% mandate), modest expected return, and plenty of upside if the names ran—which is exactly what you want: bounded risk, unbounded opportunity.

Why Readers May Find This Counter-Intuitive

Most “risk-managed” portfolios look like a museum of low-beta staples. Ours didn’t. It didn’t need to—because the hedge is the risk control. That’s the whole edge: separate the risk control from the return engine.

Where To Go From Here

If you’ve been hiding in “safe” names and watching the leaders run, consider flipping the script: own better upside and insure it.

See your own build: You can generate a hedged portfolio with your account size and risk cap on Portfolio Armor (paid tool; month-to-month, cancel anytime).

Just want to watch results? You can follow the public performance/track record page without subscribing and revisit later if you want your own build. We should have the performance for February 13th portfolios up this weekend.

Want to construct your own portfolio using our top names? Consider downloading our iPhone app for a less expensive, DIY approach.