Still Swinging For The Fences

And nearly hitting a triple.

Swinging For The Fences, With Protection

Back in August, I showed how a hedged portfolio created six months earlier had delivered strong returns while protecting against steep losses.

The idea was simple: swing for the fences, but do it with a safety net.

Now we’ve got a new set of results in, from portfolios created on March 6th, 2025—and they tell the same story.

The March 6th Portfolio Example

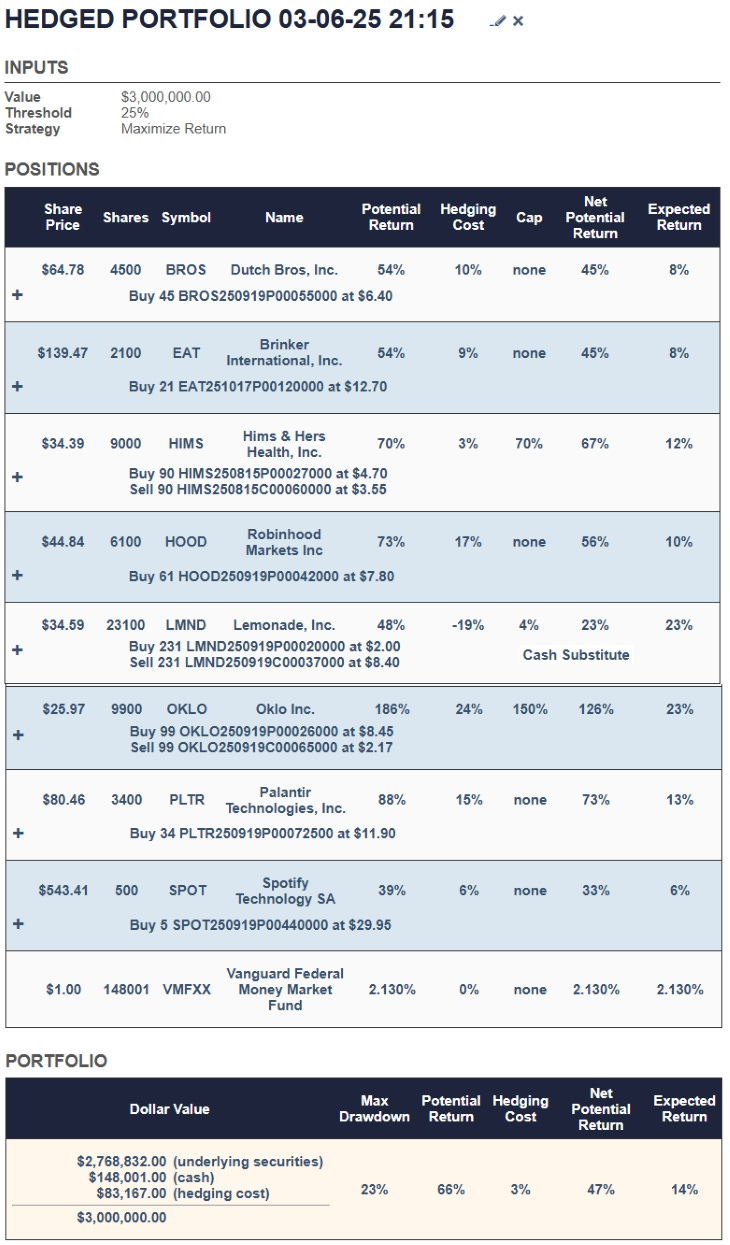

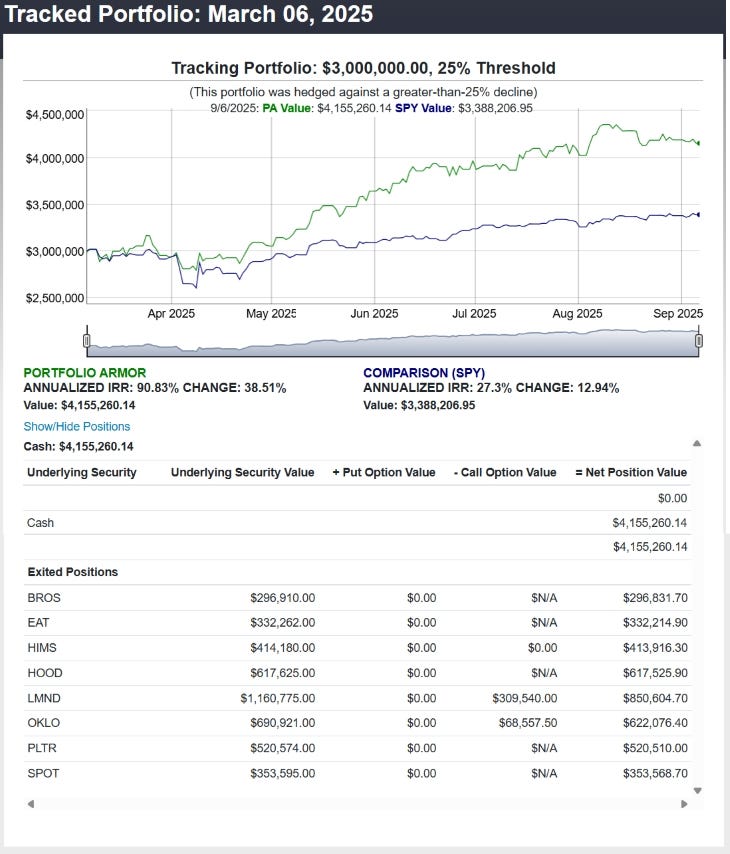

Here’s one example: a $3M portfolio built on March 6th and hedged against a >25% decline.

Six months later, this portfolio’s return nearly tripled SPY’s over the same period—while being fully hedged. The hedges capped the worst-case drawdown at 25%, but the actual outcome was massively positive.

You can see an interactive version of that chart here.

Across All March 6th Portfolios

It wasn’t just this one portfolio. Every March 6th portfolio hedged against declines of >20%, >25%, >30%, or >40% more than doubled SPY’s return over the following six months. Some did even better, tripling SPY’s performance.

That’s not luck—it’s the method at work across different risk thresholds.

The Ongoing Track Record

And stepping back further, the picture gets even clearer. Since December 2022, the average performance of hedged portfolios at those same thresholds (>20% through >40%) has consistently beaten SPY.

That means dozens of 6-month runs, across changing market conditions, all showing the same edge: defined risk, uncapped upside.

Why This Matters

In markets where leadership rotates quickly and volatility can punish the unhedged, having a disciplined way to pursue upside without leaving yourself exposed is crucial.

That’s what these portfolios offer:

A limit on downside risk (set at the threshold you choose).

The potential for large gains if the right names take off.

A consistent track record of beating the market while staying hedged.

It’s proof that you can swing for the fences without blowing yourself up.

Just Want The Top Names?

We post them every week in this Substack (usually on Thursdays), but you can get them daily on the Portfolio Armor website and iPhone app (separate subscriptions from the Substack).

We also have a couple of trades teed up on top names for later today.