Is This Still A Bear Market Rally?

Probably. Let's break down why.

Is This Still A Bear Market Rally?

That's been my view since last month. The market hasn't priced in the possibility that most of the Trump tariffs are here to stay, so we'll probably see another leg down when that reality sets in.

Why This Question Matters

We've got a source of alpha that works well during market rallies: our top ten names.

Since December of 2022, our top ten names have averaged returns of 17.03% over the next six months, versus 10.75% for the SPDR S&P 500 Trust (SPY). If this is a new bull market, it makes sense to start buying those top names again now, or placing bullish options trades on them. But if this is a bear market rally, it makes sense to wait.

With that in mind, let's review the whirlwind since "Liberation Day" and think about where we stand now.

1 | What just happened?

After selling off on Trump’s April 2 “Liberation Day” tariff announcement, the S&P 500 strung together nine straight up sessions (its longest run since 2004) and erased every penny of the tariff draw‑down before the streak finally broke on Monday. Even so, the index is still ~8 % below its February peak and has yet to clear its 200‑day moving average—a spot technicians see as first serious resistance.

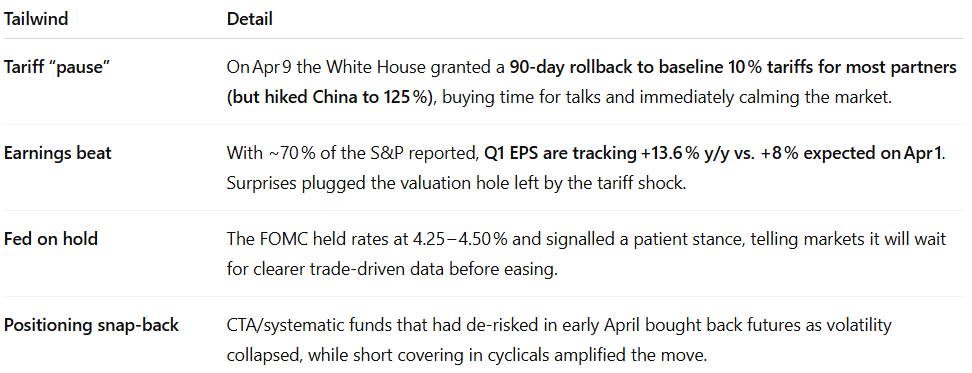

2 | Why the bounce looked so convincing

3 | …but under the hood it still looks like a bear‑market rally

Breadth only mid‑cycle: barely 41 % of S&P members traded above their 200‑day moving average at Friday’s close, far from the 50‑60 % that normally marks the start of sustainable advances.

Valuations re‑inflated fast: the forward P/E is back to ~20.6× (10‑yr avg ≈ 18.5×), identical to the level on April 2, yet consensus profit growth for the next three quarters has fallen.

Guidance skewed negative: 56 % of companies issuing outlooks have guided below Street numbers, vs. a 51 % long‑run average.

Historical context: Goldman’s playbook reminds us that sharp, 10‑15 % surges are standard fare inside bear markets; the “pain trade” erupts when positioning is light and news flow looks “less bad,” but usually fades once the next macro shock arrives.

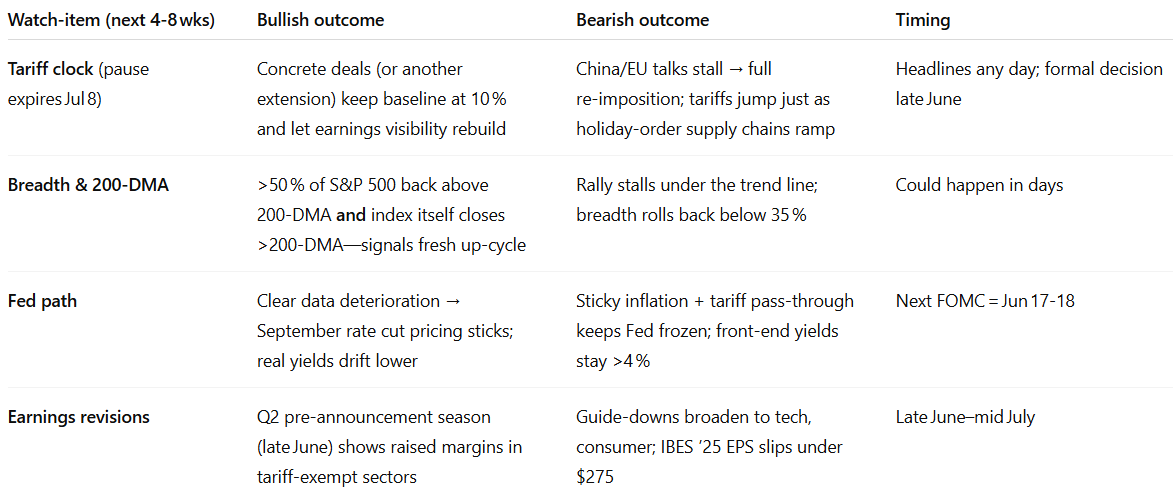

4 | What could flip the tape bullish—or bearish—from here

5 | How we can manage the recency bias/FOMO temptations

Anchor on the regime, not the rally.

We are still in an event‑driven bear market triggered by a policy shock; statistically, these don’t finish until either valuations reset or the policy shock is reversed. Neither has happened yet.Use objective triggers instead of gut feel.

Market internals: breadth >50 %, cyclicals outperforming defensives, VIX <20.

Macro: durable tariff settlement or a first Fed cut.

Until then, respect the possibility of another leg lower.

Continue to trade tactically, hedge strategically.

Add short exposure on the way up, as we did with Canadian names this week, and look for occasional longs with upcoming catalysts, as we did in the same post.

Use rallies to hedge. Remember, you can download our optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

Bottom Line: This Probably Is A Bear Market Rally

Our instinct that the April‑May surge feels like a bear‑market rally lines up with the data: light breadth, lofty valuations, negative guidance, and a catalyst (tariff expiry) still looming. Could it morph into a new bull leg? Yes, but only if breadth, policy and the Fed line up in the next few weeks. Until we see those confirmations, it's best to treat strength as tactical rather than structural and keep risk‑management front and center.