In Case A 1987-Style Crash Happens Next

How to protect yourself.

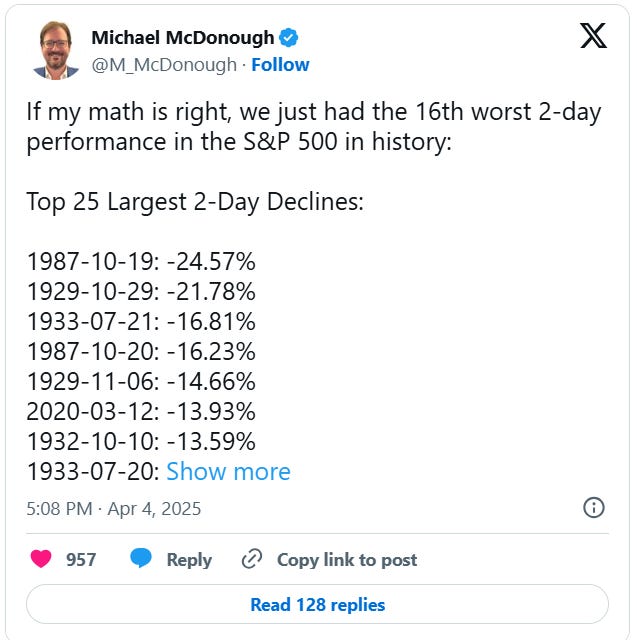

You Just Survived The 16th-Worst 2-Day Period For Stocks

According to Michael McDonough, Thursday and Friday were the 16th worst 2-day period for the S&P 500 in history.

If you're reading this, you survived. And if you followed our suggestions this week--to raise cash and hedge on Monday...

To enter binary trades on Tuesday...

And to add short exposure on Wednesday...

You thrived.

Credit put spread on Spotify (SPOT -9.90%↓). Entered at a net credit of $8 on 4/1/2025; still open, but looks like we’ll exit at a net debit of $10 on 4/4/2025. Loss: 100%.

Calls on Spotify (SPOT 0.00%↑). Bought for $1.67 on 4/1/2025; sold (second half) for $4 on 4/3/2025. Profit: 2%

Puts on Arm Holdings (ARM -4.02%↓). Bought for $1.82 on 4/2/2025; sold (half) for $4 on 4/3/2025. Profit: 120%.

Calls on Broadcom (AVGO 0.00%↑). Bought for $1.74 on 4/2/2025; sold (half) for $4 on 4/3/2025. Profit: 130%.

Calls on Spotify (SPOT 0.00%↑). Bought for $1.67 on 4/1/2025; sold (half) for $4 on 4/2/2025. Profit: 140%.

Credit call spread on Tesla (TSLA -9.96%↓). Entered at a net credit of $7.50 on 4/1/2025; exited at a net debit of $0.20 on 4/4/2025. Profit: 292%.

Puts on Nvidia ( NVDA -8.02%↓). Bought for $1.17 on 4/2/2025; sold (half) for $5.80 on 4/4/2025. Profit: 396%.

You took a bath on our bullish binary trade, the credit put spread on Spotify, but you made money on everything else.

But What If The Worst Two-Day Period Is Ahead Of Us?

The worst two-day period for the S&P 500 happened in 1987. What if something that bad--or worse--happens again? In the guest post below, our friend David Janello, PhD, CFA, has a suggestion for how you can protect against that.

Dr. Janello is the founder of SpreadHunter, and the author of The Nuclear Option: Trading To Win With Options Momentum Strategies.

Authored by David Janello, PhD, CFA at Nuclear Options Trading.

Protecting Against A 1987-Style Crash

With the market continuing its relentless drive lower, there are a few outcomes that can unfold over the next week or two. Here are option trades (with fill prices) to capture extreme profits in one or more of these scenarios. Equally important, we look at trades to avoid because of poor pricing.

The most likely possibilities for the market in the near future are:

A sharp move higher, from extreme oversold conditions (no news)

A violent move higher, based on a truce in the ongoing trade war

A continuous move straight down for 30-90 days, like 2022

A violent move lower, on either no news or an acceleration in the trade war

In our opinion, Scenarios 1 and 2 are the most likely to occur. Unfortunately, the options pricing to capture these moves is extremely poor, which generates mediocre profits even if the forecast comes true.

The 2022 Scenario was discussed in an earlier Nuclear Option Substack post, with an example bearish trade in TSLA that was profitable. Because of the potential for a violent move up (on tariff / trade war truce) we would avoid re-initiating this trade because of the extremely high risk.

The final scenario, a violent move lower, perhaps Monday at the open (like 1987) is the only scenario with decently priced spread trades.

Our favorite trade from this morning was this:

Long VIX Index 70-90 Call Vertical Spread Expiring April 16 at 0.20.

This trade risks 20- for a 2000- potential gain. Although it is a low probability trade, the potential profits more than make up for it. If we get a 1987 type crash on Monday morning, this is the trade have.

NOTE: You can only trade VIX Index Options and Complex Spreads on the CBOE Exchange.

Algorithmic Trades:

Visa (V) 255 Put 255 Strike Put Calendar Apr 17-Apr25 day traded for a 142% profit earlier. If you want to try to get more, set the max price at 0.07.

Exxon Mobil (XOM) 95 Strike Put Calendar Apr 17-25 day traded for 333% profit at the close

DISCLAIMER: All Content on the Nuclear Option Substack is for Education and Information Purposes only. It does not constitute a solicitation or recommendation to buy or sell any security. Before trading, consult with your Professional Financial Advisor and read the booklet Characteristics and Risks of Standardized Options Contracts, available from the Options Clearing Corporation.

If You Just Want To Hedge

As a reminder, you can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone). Our app can help you find the least expensive hedges given your risk tolerance and time frame.

Test: https://www.zerohedge.com/news/2025-04-12/it-all-fake