How We Re-Enter Winners

A real-world example using Robinhood Markets.

Re-Entering Winners

One of the hardest things in trading is re-entering a name that’s already run. Our answer is to let the Portfolio Armor system give us the “license.” When a stock graduates into our Top Names again, that’s our objective signal that—regardless of how far it’s come—its six-month expected return still scores high enough to merit fresh risk.

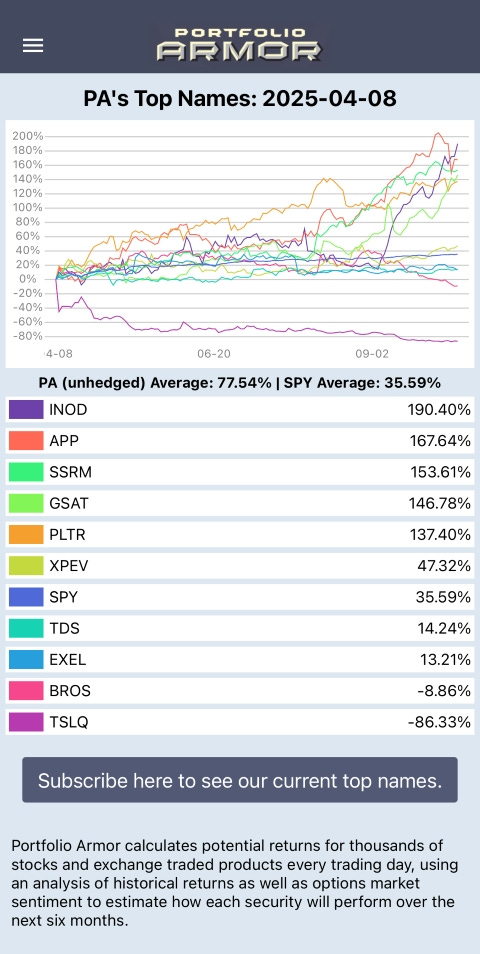

For an idea of the alpha our top names have generated recently, below is the 6-month performance of our top ten names from April 8th.

Robinhood as a Case Study

When it appeared in our top ten last month, Robinhood Markets (HOOD 0.00%↑) had already appreciated dramatically since we first started trading it in 2024. We had had several successful trades on it before, including this exit for a >1,000% gain back in February.

Calls on Robinhood Markets (HOOD -1.91%↓). Bought for $2.30 on 10/31/2024; sold (half) for $33.50 on 2/13/2025. Profit: 1,443%

By summer, it was too expensive to trade HOOD with straight calls, so when it appeared in our top ten in June, we used a call spread.

Call spread on Robinhood Markets (HOOD 0.56%↑). Entered at a net debit of $3 on 6/9/2025; exited at a net credit of $9.50 on 7/28/2025. Profit: 217%.

When it reappeared on our Top Ten in early September, we treated it like a new idea—then used a four-leg structure to make the risk/reward compelling despite rich options.

Why Four Legs?

Because expensive options are a feature, not a bug, if you harvest the richness correctly. Our 4-leg template combines:

a bull call spread (defined upside)

a bull put spread (defined downside, near-dated decay)

This lets us harvest near-term implied volatility, reduce net cost, and drag breakevens lower—while keeping risk capped on both sides.

The Trade & Timeline

The HOOD trade we placed on September 5th was a combo expiring on November 21st, consisting of these four legs:

Buying the $115 strike call,

Selling the $130 strike call,

Selling the $95 strike put, and

Buying the $90 strike put,

For a net debit of $1.70.

We set GTC (Good ‘Till Cancel) orders to exit as soon as that trade filled:

Exiting These Trades

My plan:

HOOD Call Spread (legs 1 & 2): open a GTC order to exit at a net credit of $12, and lower that price, if necessary, as we approach expiration.

HOOD Put Spread (legs 3 & 4): open a GTC order to exit at a net debit of $0.25, and raise that price, if necessary, as we approach expiration.

Both of those exit orders filled automatically, this week and last, respectively:

Four-leg combo on Robinhood Markets (HOOD 2.10%↑). Entered at a net debit of $1.70 on 9/5/2025; exited the put spread at a net debit of $0.25 on 10/2/2025; exited the call spread at a net credit of $12 on 10/6/2025. Profit: 591%.1

On premium paid; profit on max risk = 150%.

What This Illustrates

System first, opinions second. A re-appearance on our Top Ten is our green light to re-engage, even after a big move.

Harvest the rich stuff. When options are pricey, don’t complain—sell some of that IV (in a defined-risk way) to finance the upside.

Pre-planned exits. We enter as a single package, set GTCs day one, and let the market pay us:

Downside put spread: buy-to-close near $0.20–$0.25

Upside spread: sell to close at around 80% of spread width (adjust higher if deep ITM late). The idea here is to increase our win percentage, rather than squeezing every possible cent out of each trade.

The Playbook, in One Box

Find: Names that surface in our Top Ten.

Structure: Default to uncapped calls when IV is sane; move to 4-leg when IV is rich and we want lower cost & lower break evens.

Size and risk: Target $500-$1,000 per contract, so traders with smaller accounts can participate.

We’ll keep using this framework: let the system tell us which names deserve fresh risk, and let structure decide how to trade them efficiently.