Exits, 9/8/2023

How we did on the trades we exited this week.

Dids/Pexels

This Week’s Trade Exits

As soon as I exit a trade, I note that in the comments of the post where I first mentioned the trade; at the end of the week, I try to track them all in one post. These are the trades I exited this week:

Stocks or Exchange Traded Products

None

Options Trades

Puts on Kirklands (KIRK -0.46%↓). Bought at $0.65 on 9/5; sold at $0.80 on 9/8. Profit: 23%

Calls on BioLineRx (BLRX 1.84%↑). Bought at $0.10 on 8/18; exited half of those calls at $0.35 on 9/5. Profit: 350%

Comments

On the stock side, no exits is always good news, as it means we didn’t get stopped out of any positions. The performance of Portfolio Armor’s top ten names this year continues to be strong, with 8 of our last 10 top names cohorts out performing the market.

On the options side, we had a nice gain on half of our biotech bet.

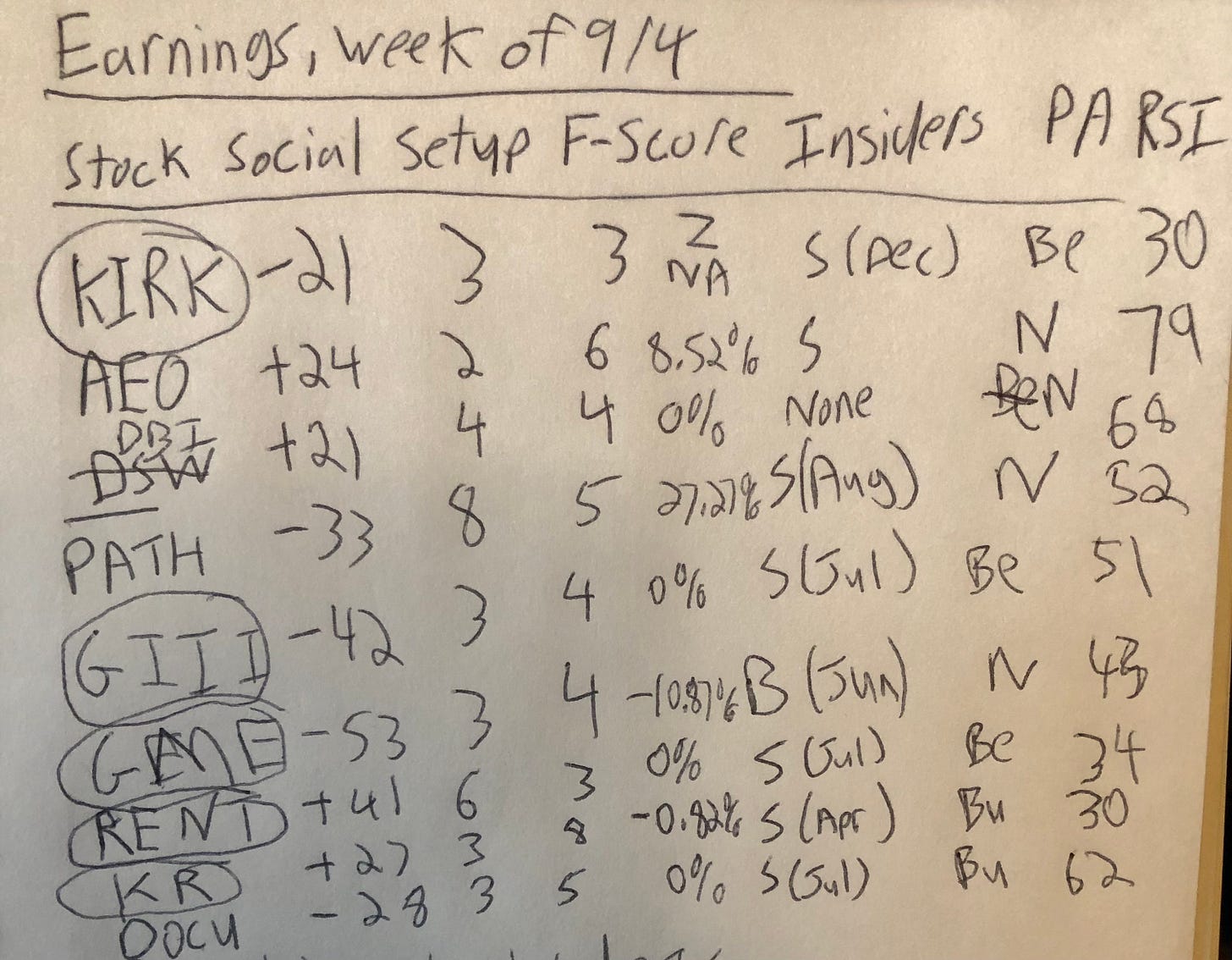

As far as this week’s earnings trades, here were our notes heading into this week.

The Kroger (KR 0.00%↑) trade would have worked if it had filled. I probably should have bid $0.49 for that call spread. The GameStop ( GME 0.00%↑ ) trades would have worked too, but that’s been a hard stock to get decently-priced options on. Rent the Runway (RENT 0.00%↑) was a coin flip that went against us. Weak fundamentals heading into this quarter’s earnings (including a Piotroski F-Score of 3), but lots of short interest and the potential for a big upward move had the company guided higher today. G-III Apparel Group (GIII -0.59%↓) went against us too. One of the talented traders I follow on Twitter has a thesis that there will be continued demand for luxury products from the top 3 quintiles of American earners; maybe this was an example of that. The RENT and GIII options don’t expire this week, so we didn’t exit those positions.

We did get a fill today on our 2nd post-earnings trade that we placed a limit order for in this post a couple of weeks ago.